Is title insurance Boring? Yes. Unless you are a title nerd like us at FTIC. If so, would you like a job?

But will FTIC make my experience Super Awesome?!? Oh yeah! FTIC will prepare the documents that make the transaction happen, disburse all the payments, record the deeds and mortgages, and treat you like a princess, or prince, duke, duchess, whatever your royal preference! Just wait till you come to our office penthouse downtown.

UGGGGG!!! Why do I need or even want title insurance? Duh!!! Investing in property is a major financial step! To do so without Title Insurance is risky and foolhardy. Title Insurance usually costs as little as one half (½) of one percent (1.00%) of your Purchase Price. Exposing yourself to possible title challenges and losses, legal fees, mountains of paperwork, and days spent in litigation and a courtroom only to find you don’t actually own the property you moved into and believe you purchased. This is a no brainer right?

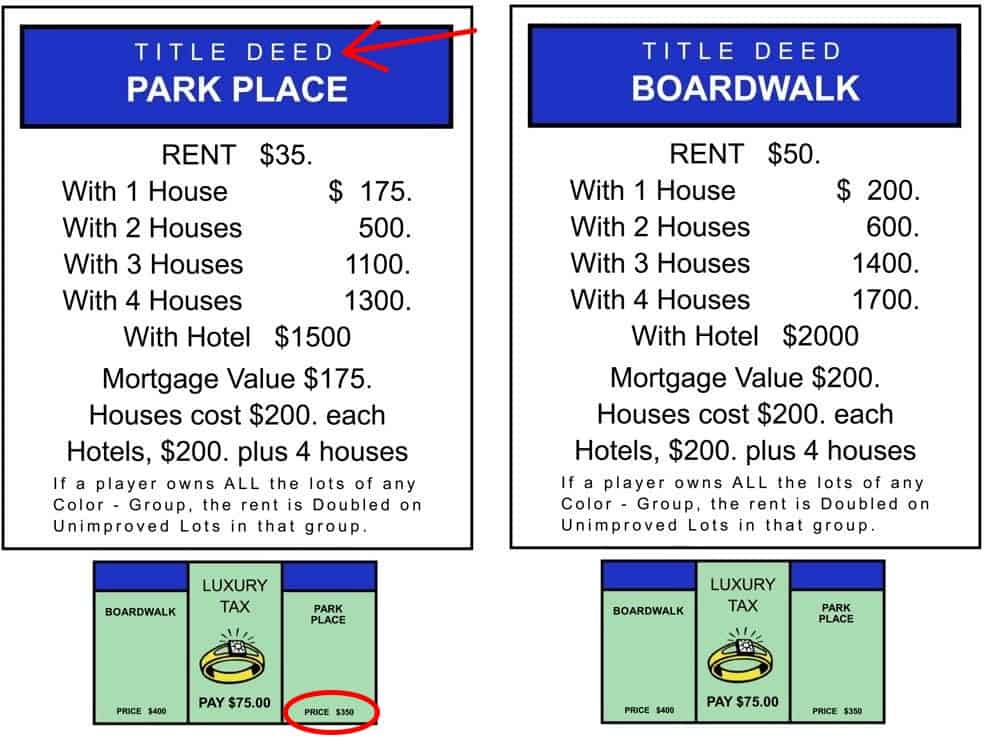

OKAY I’m Listening, so DUMB IT DOWN FOR ME – What Is Title Insurance? When I was 10 years old I played a game called Monopoly™. I would thimble around the board, collect $200 (C’mon Big Money!!!) and pretend I was a real estate tycoon buying up properties I landed on. In return, I would get a little card showing that I now own properties. That little card showing property ownership is called the Title (a/k/a the Deed). Well what if I later found out that the person who I just bought the property from (which granted, only cost me $350 for Park Place in NY) didn’t actually own the property that they sold me??? Or what if the property had unpaid utilities (remember landing on that costly spot?), unpaid judgments, liens, mortgages, Home Equity Lines (HELOC), etc… With the existence of title insurance, buyers are able to enjoy peace of mind knowing they are protected against title claims and losses for the most expensive purchase they are about to make. Of course deeds have much more formalities and FTIC prepares those documents for you, but I’m trying to make a point people so work with me here…

What is a “Title Search” looking for? FTIC scours all available public records for prior ownership making sure the title has passed correctly to each new owner, liens, utility assessments, taxes, judgments, mortgages, HELOCs, and anything else recorded about the property that may affect the new buyer’s superior and exclusive ownership of the property. The title search will reveal problems that might arise so they may be dealt with immediately, title defects cured, and the title cleared and cleaned before you purchase.

What does Title Insurance cover? A fraudulent or forged prior deed, unpaid taxes, an angry contractor filed a construction lien against the property, someone’s name is incorrect, a past notary forgot to sign, a mortgage was never paid off, the prior owners took out a Home Equity Line (HELOC) which was unpaid, a judgment lien against the seller was never paid, assessments were not paid, or any other such innumerable flaws that could impact your ownership—unless you are protected by Title Insurance. For a one (1) time payment, not only are you covered, legally and financially, from any flaws in your superior ownership of the Property arising from the time before the property was yours, but you are also covered for as long as you own the property, be that 1 year or 100 years.

Lender’s Title Insurance Policy? Doesn’t my bank have enough of their own money? Your bank is about to lend a boat load of their money to you so that you can buy your dream property. But before they do, they want to make sure whomever sells you the property actually owns the property, that there aren’t any superior claims, outstanding judgments, liens, or other title defects that could cause the property to be ripped away. So as a condition of giving you that loan, Lenders will require a Lender’s Title Insurance Policy to protect themselves.

Owner’s Title Insurance Policy, that’s for me right? The Owner’s Title Insurance Policy covers the buyer both legally and financially and insures you will not be liable for any title flaw that arose from the property’s history before you purchased it. The Owner’s Title Insurance Policy will stay in effect as long as you or your heirs own the property. FTIC will be there to pay valid claims and cover the costs of defending any attack on your title, now or in the future.

What is a Title Commitment and how do I read it? After a title search (see above) is done looking for defects in the property’s chain of history that might lead to future problems, a “Title Commitment” is issued informing that the title company has committed to insuring the property. The buyer has several days to talk to their title company or their agent if they have questions or they find anything unacceptable on the title commitment. The Title Commitment is divided into two (2) sections:

Schedule A is like the cover page. It lists the lists the: (1) Effective date of the insurance policy; (2a) Dollar Amount of the Policy; (2b) Names of the insureds (e.g. New Owner and/or Lender); (3) Name of the Seller of the Property; and (4) identification of the land being insured.

Schedule B-1 includes the Requirements. The Requirements are what must be done before the title insurance can be issued and property can close. If any of the Requirements can’t be met, there may be a delay or cancellation of the sale. Some of the Requirements may be recording of a new deed, releases of various liens, tax payments, copy of trust paperwork, or proof of identify, payoff of mortgages, liens, judgments, Home Equity Lines (HELOC).

Schedule B-2 includes the Exceptions. Exceptions are what the title company will not cover against (including certain exceptions that are standard, like water or mineral rights.) If the problem is listed in Schedule B, the title insurance policy will not cover against it (nor pay attorney or court fees regarding the problem.) If the buyer protests some Exception, the title company may be convinced to insure over it (with an endorsement) or obtain a release, or other document to eliminate the exception. Some examples of Exceptions are interests in the land that can only be found at inspection, easements, and tax assessments for new construction. The buyer, however, should read the Exceptions section carefully as there may be a limited time to make any objections before the title insurance is issued and the closing is completed.

After the Closing, the title insurance policy is issued.

How to Read a Title Commitment

As King and Queen of the Castle, how should my title as owner appear on the Deed? A question that doesn’t even occur to buyers until asked. There are options and your choice can have far-reaching consequences. It may even control where you want your property to go after you die and pyramids and libraries are erected in your honor. Here are the basic types:

Sole ownership title is held solely in one person’s name, thus no one else is shown as sharing an ownership interest except for the named titleholder.

Tenants by the Entireties: For spouses who are currently married, the property can be titled in both of their names and held as a tenants by the entireties. This is one of Florida’s best forms of asset protection from outside creditors because the property is not divisible by creditors to satisfy the obligation of only one debtor spouse.

Joint Tenancy With Rights Of Survivorship (JTWROS) means you hold title with someone else equally (i.e. 50%/50% for two people, 1/3, 1/3, 1/3 for three people etc…) and when one of you dies the entire interest passes to the remaining surviving joint tenant(s) rather than to the heirs of the one who died. Note however, that if a co-owner conveys their interest to a 3rd party, the property loses its survivorship status as to that portion and defaults to being held as tenancy in common.

Tenancy In Common Several parties can own the property in whatever different percentages they want. Any party can sell their interest to anyone without notice to the other. And upon the death of one of the people on the title, their interest goes to their own estate to be distributed according to their will or to their heirs through probate.