Buying a property can be overwhelming. You will deal with realtors, banks, mortgage brokers, loan apps, closing disclosures, credit reports, contracts, appraisals, inspections, warranties, walk-throughs, escrows, earnest money, insurance, taxes… and the list goes on. Undoubtedly you will hear words you have never heard before. Therefore, FTIC has a glossary to help you better understand commonly used terminology in the real estate industry.

1 A B C D E F G H I J K L M N O P Q R S T U V W

1

1031 Exchange: Whenever you sell business or investment property and you have a gain, you generally have to pay tax on the gain at the time of sale. IRC Section 1031 provides an exception and allows you to postpone paying tax on the gain if you reinvest the proceeds in similar property as part of a qualifying like-kind exchange. Gain deferred in a like-kind exchange under IRC §1031 is tax-deferred, but it is not tax-free. Both the relinquished property you sell and the replacement property you buy must meet certain requirements. Both properties must be held for use in a trade or business or for investment. Property used primarily for personal use, like a primary residence or a second home or vacation home, does not qualify for like-kind exchange treatment. The first limit is that you have 45 days from the date you sell the relinquished property to identify potential replacement properties. The identification must be in writing, signed by you and delivered to a person involved in the exchange like the seller of the replacement property or the qualified intermediary. Notice to your attorney, real estate agent, accountant or similar persons acting as your agent is not sufficient. The second limit is that the replacement property must be received and the exchange completed no later than 180 days after the sale of the exchanged property or the due date (with extensions) of the income tax return for the tax year in which the relinquished property was sold, whichever is earlier. The replacement property received must be substantially the same as property identified within the 45-day limit described above. See, IRS FORM 8824 Like-Kind Exchanges (PDF), Sales and Other Dispositions of Assets PUBLICATION 544.

A

Abstract: Before the use of photo static copying, public records were kept by abstracts of recorded documents.

Abstract of Title: A set of documents which record the ownership through time of a property. A compilation of the recorded documents relating to a parcel of land, from which an opinion as to the condition of title may be given. Still in use in some states, but giving way to the use of title insurance.

Ad Valorem: “According to value.” A method of taxation using the value of the thing taxed to determine the amount of tax. Taxes can be either “Ad Valorem” or “Specific.” Example: A tax of $5.00 per $1000.00 of value per house is “Ad Valorem,” A tax of $5.00 per house (irrespective of value) is “Specific.”

Aggregate Adjustment: is a calculation to prevent lenders collecting more money for your escrow account than allowed under the Real Estate Settlement Procedures Act (RESPA). Under RESPA, lenders can’t keep more than one sixth (1/6) of your annual property tax and insurance payment amount in your escrow account at any one time and will credit money to prevent your escrow account from holding more funds than allowed.

Annual Percentage Rate (APR): The cost of a loan or other financing as an annual rate. The APR includes the interest rate, points, broker fees and certain other credit charges a borrower is required to pay.

Annuity: An amount paid yearly or at other regular intervals, often at a guaranteed minimum amount. Also, a type of insurance policy in which the policy holder makes payments for a fixed period or until a stated age, and then receives annuity payments from the insurance company.

Application Fee: The fee that a mortgage lender or broker charges to apply for a mortgage to cover processing costs.

Appraisal: A professional analysis used to estimate the value of the property. This includes examples of sales of similar properties.

Appraiser: A professional who conducts an analysis of the property, including examples of sales of similar properties in order to develop an estimate of the value of the property. The analysis is called an “appraisal.”

Appreciation: An increase in the market value of a home due to changing market conditions and/or home improvements.

Arbitration: A process where disputes are settled by referring them to a fair and neutral third party (arbitrator). The disputing parties agree in advance to agree with the decision of the arbitrator. There is a hearing where both parties have an opportunity to be heard, after which the arbitrator makes a decision.

Asbestos: A toxic material that was once used in housing insulation and fireproofing. Because some forms of asbestos have been linked to certain lung diseases, it is no longer used in new homes. However, some older homes may still have asbestos in these materials.

Assessed Value: Typically the value placed on property for the purpose of taxation.

Assessor: A public official who establishes the value of a property for taxation purposes.

Asset: Anything of monetary value that is owned by a person or company. Assets include real property, personal property, stocks, mutual funds, etc.

Assignment of Mortgage: A document evidencing the transfer of ownership of a mortgage from one person to another.

Assumable Mortgage: A mortgage loan that can be taken over (assumed) by the buyer when a home is sold. An assumption of a mortgage is a transaction in which the buyer of real property takes over the seller’s existing mortgage; the seller remains liable unless released by the lender from the obligation. If the mortgage contains a due on sale clause, the loan may not be assumed without the lender’s consent.

Assumption: A homebuyer’s agreement to take on the primary responsibility for paying an existing mortgage from a home seller.

Assumption Fee: A fee a lender charges a buyer who will assume the seller’s existing mortgage.

Automated Underwriting: An automated process performed by a technology application that streamlines the processing of loan applications and provides a recommendation to the lender to approve the loan or refer it for manual underwriting.

B

Balance Sheet: A financial statement that shows assets, liabilities, and net worth as of a specific date.

Balloon Mortgage: A mortgage with monthly payments often based on a 30 year amortization schedule, with the unpaid balance due in a lump sum payment at the end of a specific period of time (usually 5 or 7 years). The mortgage may contain an option to “reset” the interest rate to the current market rate and to extend the due date if certain conditions are met.

Balloon Payment: A final lump sum payment that is due, often at the maturity date of a balloon mortgage.

Bankruptcy: Legally declared unable to pay your debts. Bankruptcy can severely impact your credit and your ability to borrow money.

Before tax Income: Income before taxes are deducted. Also known as “gross income.”

Bill of Sale: An instrument conveying title to personal property.

Biweekly Payment Mortgage: A mortgage with payments due every two weeks (instead of monthly).

Bona fide: In good faith, without fraud.

Bona Fide Purchaser (BFP): A purchaser in good faith. for valuable consideration, without notice or knowledge of adverse claims of others. Sometimes abbreviated B.F.P.

Bridge Loan: A short term loan secured by the borrower’s current home (which is usually for sale) that allows the proceeds to be used for building or closing on a new house before the current home is sold. Also known as a “swing loan.”

Broker, Mortgage: An individual or firm that acts as an agent between providers and users of products or services, such as a mortgage broker or real estate broker. See also, “Mortgage Broker.”

Broker, Real Estate: One who is licensed by the state to carry on the business of dealing in real estate. A broker may receive a commission for his or her part in bringing together a buyer and seller, landlord and tenant, or parties to an exchange.

Building Code: Local regulations that set forth the standards and requirements for the construction, maintenance and occupancy of buildings. The codes are designed to provide for the safety, health and welfare of the public.

Buydown: An arrangement whereby the property developer or another third party provides an interest subsidy to reduce the borrower’s monthly payments typically in the early years of the loan.

Buydown Account: An account in which funds are held so that they can be applied as part of the monthly mortgage payment as each payment comes due during the period that an interest rate buydown plan is in effect.

C

Call: In a metes and bounds description, the angle and distance of a given line or arc. Each call is usually preceded by the word then or thence. Example: N 220 E 100 (1st. call), thence N 800 E 1W (2nd call).

Cap: For an adjustable rate mortgage (ARM), a limitation on the amount the interest rate or mortgage payments may increase or decrease. See also, “Lifetime Payment Cap,” “Lifetime Rate Cap,” “Periodic Payment Cap,” and “Periodic Rate Cap.”

Capacity: Your ability to make your mortgage payments on time. This depends on your income and income stability (job history and security), your assets and savings, and the amount of your income each month that is left over after you’ve paid for your housing costs, debts and other obligations.

Capital Gains: Gains realized from the sale of capital assets. Generally, the difference between cost and selling price, less certain deductible expenses. Used mainly for income tax purposes.

Cash out Refinance: A refinance transaction in which the borrower receives additional funds over and above the amount needed to repay the existing mortgage, closing costs, points, and any subordinate liens.

Certificate of Deposit: A document issued by a bank or other financial institution that is evidence of a deposit, with the issuer’s promise to return the deposit plus earnings at a specified interest rate within a specified time period.

Certificate of Eligibility: A document issued by the U.S. Department of Veterans Affairs (VA) certifying a veteran’s eligibility for a VA guaranteed mortgage loan.

Chain of Title: The history of all of the documents that have transferred title to a parcel of real property, starting with the earliest existing document and ending with the most recent.

Change Orders: A change in the original construction plans ordered by the property owner or general contractor.

Clear Title: Ownership that is free of liens, defects, or other legal encumbrances.

Closing: The process of completing a financial transaction. For mortgage loans, the process of signing mortgage documents, disbursing funds, and, if applicable, transferring ownership of the property. In some jurisdictions, closing is referred to as “escrow,” a process by which a buyer and seller deliver legal documents to a third party who completes the transaction in accordance with their instructions. See also, “Settlement.”

Closing Agent: The person or entity that coordinates the various closing activities, including the preparation and recordation of closing documents and the disbursement of funds. (May be referred to as an escrow agent or settlement agent in some jurisdictions.) Typically, the closing is conducted by title companies, escrow companies or attorneys.

Closing Costs: The upfront fees charged in connection with a mortgage loan transaction. Money paid by a buyer (and/or seller or other third party, if applicable) to effect the closing of a mortgage loan, generally including, but not limited to a loan origination fee, title examination and insurance, survey, attorney’s fee, and prepaid items, such as escrow deposits for taxes and insurance.

Closing Date: The date on which the sale of a property is to be finalized and a loan transaction completed. Often, a real estate sales professional coordinates the setting of this date with the buyer, the seller, the closing agent, and the lender.

Closing Disclosure: A five (5) page form that provides final details about the mortgage loan you have selected. It includes the loan terms, your projected monthly payments, and how much you will pay in fees and other costs to get your mortgage (closing costs). The lender is required to give you the Closing Disclosure at least three business days before you close on the mortgage loan. This three-day window allows you time to compare your final terms and costs to those estimated in the Loan Estimate that you previously received from the lender. The three days also gives you time to ask your lender any questions before you go to the closing table.

Closing Statement: See, “HUD-1 Settlement Statement.”

Co-borrower: Any borrower other than the first borrower whose name appears on the application and mortgage note, even when that person owns the property jointly with the first borrower and shares liability for the note.

Collateral: An asset that is pledged as security for a loan. The borrower risks losing the asset if the loan is not repaid according to the terms of the loan agreement. In the case of a mortgage, the collateral would be the house and real property.

Commission: The fee charged for services performed, usually based on a percentage of the price of the items sold (such as the fee a real estate agent earns on the sale of a house).

Commitment Letter: A binding offer from your lender that includes the amount of the mortgage, the interest rate, and repayment terms.

Common Areas: Those portions of a building, land, or improvements and amenities owned by a planned unit development (PUD) or condominium project’s homeowners’ association (or a cooperative project’s cooperative corporation) that are used by all of the unit owners, who share in the common expenses of their operation and maintenance. Common areas include swimming pools, tennis courts, and other recreational facilities, as well as common corridors of buildings, parking areas, means of ingress and egress, etc.

Comparable: An abbreviation for “comparable properties,” which are used as a comparison in determining the current value of a property that is being appraised.

Concession: Something given up or agreed to in negotiating the sale of a house. For example, the sellers may agree to help pay for closing costs.

Condominium: A unit in a multiunit building. The owner of a condominium unit owns the unit itself and has the right, along with other owners, to use the common areas but does not own the common elements such as the exterior walls, floors and ceilings or the structural systems outside of the unit; these are owned by the condominium association. There are usually condominium association fees for building maintenance, property upkeep, taxes and insurance on the common areas and reserves for improvements.

Construction Loan: A loan for financing the cost of construction or improvements to a property; the lender disburses payments to the builder at periodic intervals during construction.

Contingency: A condition that must be met before a contract is legally binding. For example, home purchasers often include a home inspection contingency; the sales contract is not binding unless and until the purchaser has the home inspected.

Conventional Mortgage: A mortgage loan that is not insured or guaranteed by the federal government or one of its agencies, such as the Federal Housing Administration (FHA), the U.S. Department of Veterans Affairs (VA), or the Rural Housing Service (RHS). Contrast with “Government Mortgage.”

Conversion Option: A provision of some adjustable rate mortgage (ARM) loans that allows the borrower to change the ARM to a fixed rate mortgage at specified times after loan origination.

Convertible ARM: An adjustable rate mortgage (ARM) that allows the borrower to convert the loan to a fixed rate mortgage under specified conditions.

Cooperative (Co-op) Project: A project in which a corporation holds title to a residential property and sells shares to individual buyers, who then receive a proprietary lease as their title.

Cost of Funds Index (COFI): An index that is used to determine interest rate changes for certain adjustable rate mortgage (ARM) loans. It is based on the weighted monthly average cost of deposits, advances, and other borrowings of members of the Federal Home Loan Bank of San Francisco.

Counteroffer: An offer made in response to a previous offer. For example, after the buyer presents their first offer, the seller may make a counteroffer with a slightly higher sale price.

Covenants, Conditions and Restrictions (CC and Rs): Limitations placed on the use and enjoyment of real property. These are found most often in condominiums and planned unit developments.

Credit: The ability of a person to borrow money, or buy goods by paying over time.

Credit is extended based on a lender’s opinion of the person’s financial situation and reliability, among other factors.

Credit Bureau: A company that gathers information on consumers who use credit. These companies sell that information to lenders and other businesses in the form of a credit report.

Credit History: Information in the files of a credit bureau, primarily comprised of a list of individual consumer debts and a record of whether or not these debts were paid back on time or “as agreed.” Your credit history is called a credit report when provided by a credit bureau to a lender or other business.

Credit Life Insurance: A type of insurance that pays off a specific amount of debt or a specified credit account if the borrower dies while the policy is in force.

Credit Report: Information provided by a credit bureau that allows a lender or other business to examine your use of credit. It provides information on money that you’ve borrowed from credit institutions and your payment history.

Credit Score: A numerical value that ranks a borrower’s credit risk at a given point in time based on a statistical evaluation of information in the individual’s credit history that has been proven to be predictive of loan performance.

Creditor: A person who extends credit to whom you owe money.

Creditworthy: Your ability to qualify for credit and repay debts.

D

Debt: Money owed from one person or institution to another person or institution.

Debt-to-Income Ratio: The percentage of gross monthly income that goes toward paying for your monthly housing expense, alimony, child support, car payments and other installment debts, and payments on revolving or open-ended accounts, such as credit cards.

Deed: The legal document transferring ownership or title to a property.

Deed-in-Lieu of Foreclosure: The transfer of title from a borrower to the lender to satisfy the mortgage debt and avoid foreclosure. Also called a “voluntary conveyance.”

Deed of Trust: A legal document in which the borrower transfers the title to a third party (trustee) to hold as security for the lender. When the loan is paid in full, the trustee transfers title back to the borrower. If the borrower defaults on the loan the trustee will sell the property and pay the lender the mortgage debt.

Default: Failure to fulfill a legal obligation. A default includes failure to pay on a financial obligation, but also may be a failure to perform some action or service that is nonmonetary. For example, when leasing a car, the lessee is usually required to properly maintain the car.

Deferred Interest Loan: A deferred interest loan, also known as a negative amortization loan, is a loan that lets you pay less than the entire interest owed for that month. The unpaid interest is then added to your loan amount to be paid off later, increasing the overall loan amount.

Delinquency: Failure to make a payment when it is due. The condition of a loan when a scheduled payment has not been received by the due date, but generally used to refer to a loan for which payment is 30 or more days past due.

Depreciation: A decline in the value of a house due to changing market conditions or lack of upkeep on a home.

Discount Point: A fee paid by the borrower at closing to reduce the interest rate. A point equals one percent of the loan amount.

Down Payment: A portion of the price of a home, usually between 3-20%, not borrowed and paid up front in cash. Some loans are offered with zero down payment.

Duck: A dethpicable screwbally waterfowl with a bad temper, notable for a lateral lisp due to an extended mandible which makes it hard for them to pronounce the letter s. The mallard turns gloryhound, over-emotional, and jealous around rabbits. Interestingly, the origin of the word duck comes from the verb meaning to bend down low as if to get under something, or “dive,” because of the way many species in the duck group feed by up-ending.

Duck: A dethpicable screwbally waterfowl with a bad temper, notable for a lateral lisp due to an extended mandible which makes it hard for them to pronounce the letter s. The mallard turns gloryhound, over-emotional, and jealous around rabbits. Interestingly, the origin of the word duck comes from the verb meaning to bend down low as if to get under something, or “dive,” because of the way many species in the duck group feed by up-ending.

Due-on-Sale Clause: A provision in a mortgage that allows the lender to demand repayment in full of the outstanding balance if the property securing the mortgage is sold.

E

Earnest Money Deposit: The deposit to show that you’re committed to buying the home. The deposit usually will not be refunded to you after the seller accepts your offer, unless one of the sales contract contingencies is not fulfilled.

Easement: A right to the use of, or access to, land owned by another.

Employer Assisted Housing: A program in which companies assist their employees in purchasing homes by providing assistance with the down payment, closing costs, or monthly payments.

Encroachment: The intrusion onto another’s property without right or permission.

Encumbrance: Any claim on a property, such as a lien, mortgage or easement.

Equal Credit Opportunity Act (ECOA): A federal law that requires lenders to make credit equally available without regard to the applicant’s race, color, religion, national origin, age, sex, or marital status; the fact that all or part of the applicant’s income is derived from a public assistance program; or the fact that the applicant has in good faith exercised any right under the Consumer Credit Protection Act. It also requires various notices to consumers.

Equity: The value in your home above the total amount of the liens against your home. If you owe $100,000 on your house but it is worth $130,000, you have $30,000 of equity.

Escrow: An item of value, money, or documents deposited with a third party to be delivered upon the fulfillment of a condition. For example, the deposit by a borrower with the lender of funds to pay taxes and insurance premiums when they become due, or the deposit of funds or documents with an attorney or escrow agent to be disbursed upon the closing of a sale of real estate.

Escrow Account: An account that a mortgage servicer establishes on behalf of a borrower to pay taxes, insurance premiums, or other charges when they are due. Sometimes referred to as an “impound” or “reserve” account.

Escrow Analysis: The accounting that a mortgage servicer performs to determine the appropriate balances for the escrow account, compute the borrower’s monthly escrow payments, and determine whether any shortages, surpluses or deficiencies exist in the account.

Eviction: The legal act of removing someone from real property.

Exclusive Right to Sell Listing: The traditional kind of listing agreement under which the property owner appoints a real estate broker (known as the listing broker) as exclusive agent to sell the property on the owner’s stated terms, and agrees to pay the listing broker a commission when the property is sold, regardless of whether the buyer is found by the broker, the owner or another broker. This is the kind of listing agreement that is commonly used by a listing broker to provide the traditional full range of real estate brokerage services. If a second real estate broker (known as a selling broker) finds the buyer for the property, then some commission will be paid to the selling broker.

Exclusive Agency Listing: A listing agreement under which a real estate broker (known as the listing broker) acts as an exclusive agent to sell the property for the property owner, but may be paid a reduced or no commission when the property is sold if, for example, the property owner rather than the listing broker finds the buyer. This kind of listing agreement can be used to provide the owner a limited range of real estate brokerage services rather than the traditional full range. As with other kinds of listing agreements, if a second real estate broker (known as a selling broker) finds the buyer for the property, then some commission will be paid to the selling broker.

Executor: A person named in a will and approved by a probate court to administer the deposition of an estate in accordance with the instructions of the will.

F

Fair Credit Reporting Act (FCRA): A consumer protection law that imposes obligations on (1) credit bureaus (and similar agencies) that maintain consumer credit histories, (2) lenders and other businesses that buy reports from credit bureaus, and (3) parties who furnish consumer information to credit bureaus. Among other provisions, the FCRA limits the sale of credit reports by credit bureaus by requiring the purchaser to have a legitimate business need for the data, allows consumers to learn the information on them in credit bureau files (including one annual free credit report), and specifies procedure for challenging errors in that data.

Fair Market Value (FMV): The price at which property would be transferred between a willing buyer and willing seller, each of whom has a reasonable knowledge of all pertinent facts and is not under any compulsion to buy or sell.

Fannie Mae: A New York stock exchange company. It is a public company that operates under a federal charter and is the nation’s largest source of financing for home mortgages. Fannie Mae does not lend money directly to consumers, but instead works to ensure that mortgage funds are available and affordable, by purchasing mortgage loans from institutions that lend directly to consumers.

Fannie Mae Seller/Servicer: A lender that Fannie Mae has approved to sell loans to it and to service loans on Fannie Mae’s behalf.

Fannie Mae/Freddie Mac Loan Limit: The Fannie Mae/Freddie Mac loan limit is subject to change. In 2018, for a single family home is $453,100, with a maximum of $679,650 for high cost areas (e.g. Monroe County, Key West is $529,000). The Fannie Mae / Freddie Mac loan limit is $870,225 for a two unit home; $1,051,875 for a three unit home; and $1,307,175 for a four unit home. Also referred to as the “conventional loan limit.”

Federal Housing Administration (FHA): An agency within the U.S. Department of Housing and Urban Development (HUD) that insures mortgages and loans made by private lenders.

FHA Insured Loan: A loan that is insured by the Federal Housing Administration (FHA) of the U.S. Department of Housing and Urban Development (HUD).

First Mortgage: A mortgage that is the primary lien against a property.

First Time Home Buyer: A person with no ownership interest in a principal residence during the 3 year period preceding the purchase of the security property.

Fixed Period Adjustable Rate Mortgage: An adjustable rate mortgage (ARM) that offers a fixed rate for an initial period, typically three to ten years, and then adjusts every six months, annually, or at another specified period, for the remainder of the term. Also known as a “hybrid loan.”

Fixed Rate Mortgage: A mortgage with an interest rate that does not change during the entire term of the loan.

Flood Certification Fee: A fee charged by independent mapping firms to identify properties located in areas designated as flood zones.

Flood Insurance: Insurance that compensates for physical property damage resulting from flooding. It is required for properties located in federally designated flood hazard zones.

Foreclosure: A legal action that ends all ownership rights in a home when the homebuyer fails to make the mortgage payments or is otherwise in default under the terms of the mortgage.

Foreign Investment in Real Property Tax Act of 1980 (FIRPTA): Persons purchasing U.S. real property interests (transferees) from foreign persons, certain purchasers’ agents, and settlement officers are required to withhold 15% of the amount realized on the disposition (special rules for foreign corporations). In most cases, the transferee/buyer is the withholding agent. If you are the transferee/buyer you must find out if the transferor is a foreign person. If the transferor is a foreign person and you fail to withhold, you may be held liable for the tax. For cases in which a U.S. business entity such as a corporation or partnership disposes of a U.S. real property interest, the business entity itself is the withholding agent. Certain exceptions apply one of which example is: (1) You (the transferee) acquire the property for use as a residence and the amount realized (sales price) is not more than $300,000. You or a member of your family must have definite plans to reside at the property for at least 50% of the number of days the property is used by any person during each of the first two 12-month periods following the date of transfer. When counting the number of days the property is used, do not count the days the property will be vacant. For this exception, the transferee must be an individual.

Forfeiture: The loss of money, property, rights, or privileges due to a breach of a legal obligation.

Fully Amortized Mortgage: A mortgage in which the monthly payments are designed to retire the obligation at the end of the mortgage term.

G

General Contractor: A person who oversees a home improvement or construction project and handles various aspects such as scheduling workers and ordering supplies. See, Fla. Stat. Chapter 489.

Gift Letter: A letter that a family member writes verifying that s/he has given you a certain amount of money as a gift and that you don’t have to repay it. You can use this money towards a portion of your down payment with some mortgages.

Good Faith Estimate: A form required by the Real Estate Settlement Procedures Act (RESPA) that discloses an estimate of the amount or range of charges, for specific settlement services the borrower is likely to incur in connection with the mortgage transaction.

Government Mortgage: A mortgage loan that is insured or guaranteed by a federal government entity such as the Federal Housing Administration (FHA), the U.S. Department of Veterans Affairs (VA), or the Rural Housing Service (RHS).

Government National Mortgage Association (Fanny Mae): A government owned corporation within the U.S. Department of Housing and Urban Development (HUD) that guarantees securities backed by mortgages that are insured or guaranteed by other government agencies. Popularly known as “Fanny Mae.”

Gross Monthly Income: The income you earn in a month before taxes and other deductions. It also may include rental income, self-employed income, income from alimony, child support, public assistance payments, and retirement benefits.

Ground Rent: Payment for the use of land when title to a property is held as a leasehold estate (that is, the borrower does not actually own the property, but has a long term lease on it).

Growing Equity Mortgage (GEM):

A fixed rate mortgage in which the monthly payments increase according to an agreed upon schedule, with the extra funds applied to reduce the loan balance and loan term.

H

Hazard Insurance: Insurance coverage that compensates for physical damage to a property from fire, wind, vandalism, or other covered hazards or natural disasters.

Home Equity Conversion Mortgage (HECM): A special type of mortgage developed and insured by the Federal Housing Administration (FHA) that enables older home owners to convert the equity they have in their homes into cash, using a variety of payment options to address their specific financial needs. Sometimes called a “reverse mortgage.”

Home Equity Line of Credit (HELOC): A line of credit that allows you to borrow against your home equity. Equity is the amount your property is currently worth, minus the amount of any mortgage on your property. Unlike a home equity loan, HELOCs usually have adjustable interest rates. For most HELOCs, you will receive special checks or a credit card, and you can borrow money only for a specified time, from when you open your account.

Home Inspection: A professional inspection of a home to determine the condition of the property. The inspection should include an evaluation of the plumbing, heating and cooling systems, roof, wiring, foundation, and pest infestation.

Homeowner’s Insurance: A policy that protects you and the lender from fire or flood, which damages the structure of the house; a liability, such as an injury to a visitor to your home; or damage to your personal property, such as your furniture, clothes or appliances.

Homeowner’s Warranty (HOW): Insurance offered by a seller that covers certain home repairs and fixtures for a specified period of time.

Homeowners’ Association (HOA): An organization of homeowners residing within a particular area whose principal purpose is to ensure the provision and maintenance of community facilities and services for the common benefit of the residents.

Homestead #1 (regarding taxes): When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent, the property owner may be eligible to receive a homestead exemption that would decrease the property’s taxable value by as much as $50,000. The first $25,000 of this exemption applies to all taxing authorities. The second $25,000 excludes School Board taxes and applies to properties with assessed values greater than $50,000. You are entitled to a Homestead Exemption if, as of January 1st, you have made the property your permanent home or the permanent home of a person who is legally or naturally dependent on you. By law, January 1 of each year is the date on which permanent residence is determined. An application for exemption with the county property appraiser must be filed by March 1, subject to stringent late filing exceptions. See Fla. Stat. §196.011(8),

Homestead #2 (regarding creditor exemption): Under Article X, Section 4 of Florida’s Constitution a homestead property can be protected from a forced sale by creditors. However, there are four exceptions: tax liens due to property taxes owed, specific liens due to mortgages and other voluntary instruments, construction liens, and/or claims of any creditor who has a judgment pre-dating the establishment of the homestead.

Housing Expense Ratio: The percentage of your gross monthly income that goes toward paying for your housing expenses.

HUD-1 Settlement Statement: HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance.

HUD-1A: In transactions that do not include a seller, such as a refinance loan, the settlement agent may use the shortened HUD-1A form.

Hybrid Loan: An adjustable rate mortgage (ARM) that offers a fixed rate for an initial period, typically three to ten years, and then adjusts every six months, annually, or at another specified period, for the remainder of the term.

I

Income Property: Real estate developed or purchased to produce income, such as a rental unit.

Index: A number used to compute the interest rate for an adjustable rate mortgage (ARM). The index is generally a published number or percentage, such as the average interest rate or yield on U.S. Treasury bills. A margin is added to the index to determine the interest rate that will be charged on the ARM. This interest rate is subject to any caps on the maximum or minimum interest rate that may be charged on the mortgage, stated in the note.

Individual Retirement Account (IRA): A tax deferred plan that can help you build a retirement nest egg.

Inflation: An increase in prices.

Initial Interest Rate: The original interest rate for an adjustable rate mortgage (ARM). Sometimes known as the “start rate.”

Inquiry: A request for a copy of your credit report by a lender or other business, often when you fill out a credit application and/or request more credit. Too many inquiries on a credit report can hurt your credit score; however, most credit scores are not affected by multiple inquiries from auto or mortgage lenders within a short period of time.

Installment: The regular periodic payment that a borrower agrees to make to a lender.

Installment Debt: A loan that is repaid in accordance with a schedule of payments for a specified term (such as an automobile loan).

Interest. The cost you pay to borrow money. It is the payment you make to a lender for the money it has loaned to you. A charge for borrowing money; usually expressed as a percentage of the amount borrowed.

Interest Accrual Rate: The percentage rate at which interest accumulates or increases on a mortgage loan.

Interest Rate Cap: For an adjustable rate mortgage (ARM), a limitation on the amount the interest rate can change per adjustment or over the lifetime of the loan, as stated in the note.

Interest Rate Ceiling: For an adjustable rate mortgage (ARM), the maximum interest rate, as specified in the mortgage note.

Interest Rate Floor: For an adjustable rate mortgage (ARM), the minimum interest rate, as specified in the mortgage note.

Investment Property: A property purchased to generate rental income, tax benefits, or profitable resale rather than to serve as the borrower’s primary residence. Contrast with “second home.”

J

Johnson vs. Davis: The landmark 1985 Florida Supreme Court case that holds that where a seller of a home knows of facts materially affecting the value of the property which are not readily observable and are not known to the buyer, the seller is under a duty to disclose them to the buyer.

Joint Tenancy with Right of Survivorship (JTWROS): A form of real property ownership where two or more parties own equal interests. Upon the death of one of the parties, the entire interest passes to the surviving joint tenant(s) rather than to heirs of the deceased. It possesses five characteristics: (1) unity of possession (joint ownership and control); (2) unity of interest (the interests must be identical – i.e. each party has the same percentage interest as the others); (3) unity of title (the interests must have originated in the same instrument – i.e. they must take title on the same instrument); (4) unity of time (the interests must have commenced simultaneously – i.e. must take title at the same time); and (5) survivorship. See, BEAL BANK, SSB, v. ALMAND AND ASSOCIATES, 780 So.2d 45 (Fla. 2001). If a co-owner of property titled as joint tenants with right of survivorship breaks one of the unities creating that form of ownership, such as a conveyance to a third party, the property loses its survivorship status as to that portion and defaults as being held as tenancy in common. See, KOZACIK V. KOZACIK, 157 Fla. 597, 26 So. 2d 659 (1946).

Judgment: A decision made by a court of law. In judgments that require the repayment of a debt, the court may place a lien against the debtor’s real property as collateral for the judgment’s creditor.

Judgment Lien: A lien on the property of a debtor resulting from the decree of a court. See, Fla. Stat. §55.10

Jumbo Loan: A loan that exceeds Fannie Mae’s and Freddie Mac’s loan limits; also called a nonconforming loan. Freddie Mac and Fannie Mae loans are referred to as conforming loans.

Junior Mortgage: A loan that is subordinate to the primary loan or first lien mortgage loan, such as a second or third mortgage.

Judicial foreclosure: A type of foreclosure proceeding used in some states that is handled as a civil lawsuit and conducted entirely under the auspices of a court. Other states use non-judicial foreclosure.

K

Keogh Funds: A tax deferred retirement savings plan for small business owners or self-employed individuals who have earned income from their trade or business. Contributions to the Keogh plan are tax deductible.

L

Late Charge: A penalty imposed by the lender when a borrower fails to make a scheduled payment on time.

Latent defect: A hidden defect, one that is not readily discoverable by mere observation. In the famous case of Johnson v. Davis, it was held that sellers and their real estate agents must disclose known material latent defects concerning the property to prospective purchasers.

Lease Purchase Option: An option sometimes used by sellers to rent a property to a consumer, who has the option to buy the home within a specified period of time. Typically, part of each rental payment is put aside for the purpose of accumulating funds to pay the down payment and closing costs.

Lender’s Title Insurance Policy: Prior to bank lending Buyer/Borrower money to buy that property they want to make sure whomever sells you the property actually owns the property, that there aren’t any superior claims, outstanding judgments, liens, or other title defects that could cause the property to be ripped away. So as a condition of giving you that loan, Lenders will require a Lender’s Title Insurance Policy to protect themselves.

Letter of explanation: A written statement which explains the reason(s) why any derogatory or negative credit action such as late payments, collections, judgments, charge-offs or bankruptcy have occurred over time.

Liabilities: A person’s debts and other financial obligations.

Liability Insurance: Insurance coverage that protects property owners against claims of negligence, personal injury or property damage to another party.

LIBOR Index: An index used to deter mine interest rate changes for certain adjustable rate mortgage (ARM) plans, based on the average interest rate at which international banks lend to or borrow funds from the London Interbank Market.

Lien: A claim or charge on property for payment of a debt. With a mortgage, the lender has the right to take the title to your property if you don’t make the mortgage payments.

Lifetime Cap: For an adjustable rate mortgage (ARM), a limit on the amount that the interest rate or monthly payment can increase or decrease over the life of the loan.

Liquid Asset: A cash asset or an asset that is easily converted into cash.

Listing Agent: The real estate agent that represents the seller. Listing agents list homes for sale on the regional Multiple Listing Service (MLS).

Loan Origination: The process by which a loan is made, which may include taking a loan application, processing and underwriting the application, and closing the loan.

Loan Origination Fees: Fees paid to your mortgage lender or broker for processing the mortgage application. This fee is usually in the form of points. One point equals one percent of the mortgage amount.

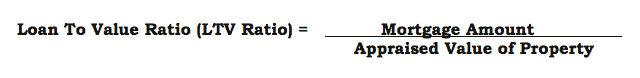

Loan To Value (LTV) Ratio: A lending risk assessment ratio that financial institutions and others lenders examine before approving a mortgage. Typically, assessments with high LTV ratios are generally seen as higher risk and, therefore, if the mortgage is approved, the loan generally costs the borrower more to borrow. Additionally, a loan with a high LTV ratio may require the borrower to purchase mortgage insurance to offset the risk to the lender. The LTV ratio is calculated as the amount of the mortgage lien divided by the appraised value of the property, expressed as a percentage. For example, a borrower taking on a $92,500 mortgage to purchase a home appraised at $100,000 would have an LTV ratio of 92.50% (92,500/100,000).

Lock In Rate: A written agreement guaranteeing a specific mortgage interest rate for a certain amount of time.

Low Down Payment Feature: A feature of some mortgages, usually fixed rate mortgages, that helps you buy a home with a low down payment.

M

Manufactured Housing: Homes that are built entirely in a factory in accordance with a federal building code administered by the U.S. Department of Housing and Urban Development (HUD). Manufactured homes may be single or multi-section and are transported from the factory to a site and installed. Homes that are permanently affixed to a foundation often may be classified as real property under applicable state law, and may be financed with a mortgage. Homes that are not permanently affixed to a foundation generally are classified as personal property, and are financed with a retail installment sales agreement.

Margin: A percentage added to the index for an adjustable rate mortgage (ARM) to establish the interest rate on each adjustment date.

Marketable Title: A title that is called a Marketable Title is one that corresponds to a particular piece of property that shows a chain of ownership that is clear and free from “clouds” or defects. Since a search of its history shows nothing likely to pop up (such as a undiscovered existing mortgage or unpaid tax bill) that may cause the new buyer of the property trouble in the future, a Marketable Title means it can be marketed for sale with no additional effort by either the seller or potential buyer. If a defect (or defects) are found in the title search, a title can become Insurable as opposed to Marketable. That means that rather than fixing the defect (which could be an expensive and time-consuming process), a title company may agree to insure against any problems that the discovered defect may cause in the future. Some defects never become a problem (or threaten either the ownership or value of the property) so the title company (in the business of risk management) would rather defer that risk than correct it.

Market Value: The current value of your home based on what a purchaser would pay. An appraisal is sometimes used to determine market value.

Maturity Date: The date on which a mortgage loan is scheduled to be paid in full, as stated in the note.

Merged Credit Report: A credit report issued by a credit reporting company that combines information from two or three major credit bureaus.

Modification: Any change to the terms of a mortgage loan, including changes to the interest rate, loan balance, or loan term.

Money Market Account: A type of investment in which funds are invested in short term securities.

Mortgage: A loan using your home as collateral. In some states the term mortgage is also used to describe the document you sign (to grant the lender a lien on your home). It also may be used to indicate the amount of money you borrow, with interest, to purchase your house. The amount of your mortgage often is the purchase price of the home minus your down payment.

Mortgage Broker: An individual or firm that brings borrowers and lenders together for the purpose of loan origination. A mortgage broker typically takes loan applications and may process loans. A mortgage broker also may close the loan.

Mortgage Insurance (MI): Insurance that protects lenders against losses caused by a borrower’s default on a mortgage loan. MI typically is required if the borrower’s down payment is less than 20 percent of the purchase price. See also “Private Mortgage Insurance”

Mortgage Insurance Premium (MIP): The amount paid by a borrower for mortgage insurance, either to a government agency such as the Federal Housing Administration (FHA) or to a private mortgage insurance (PMI) company.

Mortgage Lender: The lender providing funds for a mortgage. Lenders also manage the credit and financial information review, the property and the loan application process through closing.

Mortgage Life Insurance: A type of insurance that will pay off a mortgage if the borrower dies while the loan is outstanding; a form of credit life insurance.

Mortgage Rate: The interest rate you pay to borrow the money to buy your house.

Mortgagee: The institution or individual to whom a mortgage is given.

Mortgagor: The owner of real estate who pledges property as security for the repayment of a debt; the borrower.

Multifamily Mortgage: A mortgage loan on a building with five or more dwelling units.

Multifamily Properties: Typically, buildings with five or more dwelling units.

Multiple Listing Service (MLS): A clearinghouse through which member real estate brokerage firms regularly and systematically exchange information on listings of real estate properties and share commissions with members who locate purchasers. The MLS for an area is usually operated by the local, private real estate association as a joint venture among its members designed to foster real estate brokerage services.

Municipal Lien Search: A report that shows open and expired building permits that have not been closed, outstanding property taxes, municipal lien/assessments that have been imposed, utility department balances, code enforcement violations and liens that have been imposed.

Mutual Funds: A fund that pools the money of its investors to buy a variety of securities.

N

Negative Amortization: An increase in the balance of a loan caused by adding unpaid interest to the loan balance; this occurs when the payment does not cover the interest due.

Net Monthly Income: Your take home pay after taxes. It is the amount of money that you actually receive in your paycheck.

Net Worth: The value of a company or individual’s assets, including cash, less total liabilities.

Non Liquid Asset: An asset that cannot easily be converted into cash.

Note: A written promise to pay a specified amount under the agreed upon conditions.

Note Rate: The interest rate stated on a mortgage note, or other loan agreement.

O

Offer: A formal bid from the home buyer to the home seller to purchase a home.

Open House: When the seller’s real estate agent opens the seller’s house to the public.

Original Principal Balance: The total amount of principal owed on a mortgage before any payments are made.

Origination Fee: A fee paid to a lender or broker to cover the administrative costs of processing a loan application. The origination fee typically is stated in the form of points. One point is one percent of the mortgage amount.

Owner Financing: A transaction in which the property seller provides all or part of the financing for the buyer’s purchase of the property.

Owner Occupied Property: A property that serves as the borrower’s primary residence.

Owner’s Title Insurance Policy: Covers the buyer both legally and financially and insures you will not be liable for any title flaw that arose from the property’s history before you purchased it. The Owner’s Title Insurance Policy will stay in effect as long as you or your heirs own the property. FTIC will be there to pay valid claims and cover the costs of defending any attack on your title, now or in the future.

P

Partial Payment: A payment that is less than the scheduled monthly payment on a mortgage loan.

Payment Change Date: The date on which a new monthly payment amount takes effect, for example, on an adjustable rate mortgage (ARM) loan.

Payment Cap: For an adjustable rate mortgage (ARM) or other variable rate loan, a limit on the amount that payments can increase or decrease during any one adjustment period.

Personal Property: Any property that is not real property.

PITI: An acronym for the four primary components of a monthly mortgage payment: principle, interest, taxes, and insurance (PITI).

PITI Reserves: A cash amount that a borrower has available after making a down payment and paying closing costs for the purchase of a home. The principal, interest, taxes, and insurance (PITI) reserves must equal the amount that the borrower would have to pay for PITI for a predefined number of months.

Planned Unit Development (PUD): A real estate project in which individuals hold title to a residential lot and home while the common facilities are owned and maintained by a homeowners’ association for the benefit and use of the individual PUD unit owners.

Paid Outside of Closing (POC): Paid outside of closing. Sometimes the lender requests this money before settlement.

Point: One percent of the amount of the mortgage loan. For example, if a loan is made for $50,000, one point equals $500.

Polybutylene (PB): Plastic piping manufactured between 1978 and mid-1995, installed in up to 10 million homes in the Unites States during that period. Production ceased in mid-1996 after polybutylene pipes were discovered to have ruptured causing property damage.

Power of Attorney: A legal document that authorizes another person to act on one’s behalf. A power of attorney can grant complete authority or can be limited to certain acts and/or certain periods of time.

Pre-Approval: A process by which a lender provides a prospective borrower with an indication of how much money he or she will be eligible to borrow when applying for a mortgage loan. This process typically includes a review of the applicant’s credit history and may involve the review and verification of income and assets to close.

Pre-Approval Letter: A letter from a mortgage lender indicating that you qualify for a mortgage of a specific amount. It also shows a home seller that you’re a serious buyer.

Pre-Qualification: A preliminary assessment by a lender of the amount it will lend to a potential home buyer. The process of determining how much money a prospective home buyer may be eligible to borrow before he or she applies for a loan.

Pre-Qualification Letter: A letter from a mortgage lender that states that you’re prequalified to buy a home, but does not commit the lender to a particular mortgage amount.

Predatory Lending: Abusive lending practices that include making mortgage loans to people who do not have the income to repay them or repeatedly refinancing loans, charging high points and fees each time and “packing” credit insurance onto a loan.

Prepayment: Any amount paid to reduce the principal balance of a loan before the scheduled due date.

Prepayment Penalty: A fee that a borrower may be required to pay to the lender, in the early years of a mortgage loan, for repaying the loan in full or prepaying a substantial amount to reduce the unpaid principle balance.

Principal: The amount of money borrowed or the amount of the loan that has not yet been repaid to the lender. This does not include the interest you will pay to borrow that money. The principal balance (sometimes called the outstanding or unpaid principal balance) is the amount owed on the loan minus the amount you’ve repaid.

Private Mortgage Insurance (PMI): Insurance for conventional mortgage loans that protects the lender from loss in the event of default by the borrower. See, “Mortgage Insurance”

Promissory Note: A written promise to repay a specified amount over a specified period of time.

Purchase and Sale Agreement: A document that details the price and conditions for a transaction. In connection with the sale of a residential property, the agreement typically would include: information about the property to be sold, sale price, down payment, earnest money deposit, financing, closing date, occupancy date, length of time the offer is valid, and any special contingencies.

Purchase Money Mortgage: A mortgage loan that enables a borrower to acquire a property.

Q

Qualifying Guidelines: Criteria used to determine eligibility for a loan.

Qualifying Ratios: Calculations that are used in determining the loan amount that a borrower qualifies for, typically a comparison of the borrower’s total monthly income to monthly debt payments and other recurring monthly obligations.

Quality Control: A system of safeguards to ensure that loans are originated, underwritten and serviced according to the lender’s standards and, if applicable, the standards of the investor, governmental agency, or mortgage insurer.

Quit Claim Deed: A deed that conveys only that right, title, or interest that the grantor has, or may have, and does not warrant that the grantor actually has any interest in the property.The grantor under a quit-claim deed releases whatever interest he may have to the grantee.

R

Radon: A toxic gas found in the soil beneath a house that can contribute to cancer and other illnesses.

Rate Cap: The limit on the amount an interest rate on an adjustable rate mortgage (ARM) can increase or decrease during an adjustment period.

Rate Lock: An agreement in which an interest rate is “locked in” or guaranteed for a specified period of time prior to closing. See also, “Lock in Rate.”

Ratified Sales Contract: A contract that shows both you and the seller of the house have agreed to your offer. This offer may include sales contingencies, such as obtaining a mortgage of a certain type and rate, getting an acceptable inspection, making repairs, closing by a certain date, etc.

Real Estate Professional: An individual who provides services in buying and selling homes. The real estate professional is paid a percentage of the home sale price by the seller. Unless you’ve specifically contracted with a buyer’s agent, the real estate professional represents the interest of the seller. Real estate professionals may be able to refer you to local lenders or mortgage brokers, but are generally not involved in the lending process.

Real Estate Settlement Procedures Act (RESPA): A federal law that requires lenders to provide home mortgage borrowers with information about transaction related costs prior to settlement, as well as information during the life of the loan regarding servicing and escrow accounts. RESPA also prohibits kickbacks and unearned fees in the mortgage loan business.

Real Property: Land and anything permanently affixed thereto — including buildings, fences, trees, and minerals.

Recorder: The public official who keeps records of transactions that affect real property in the area. Sometimes known as a “Registrar of Deeds” or “County Clerk.”

Recording: The filing of a lien or other legal documents in the appropriate public record.

Refinance: Getting a new mortgage with all or some portion of the proceeds used to pay off the prior mortgage.

Rehabilitation Mortgage: A mortgage loan made to cover the costs of repairing, improving, and sometimes acquiring an existing property.

Reissue Rate. Reduced rate of title insurance premium applicable in cases where the owner of the land has been previously insured in an owner’s policy by the insurer within a certain time.

Remaining Term: The original number of payments due on the loan minus the number of payments that have been made.

Repayment Plan: An arrangement by which a borrower agrees to make additional payments to pay down past due amounts while still making regularly scheduled payments.

Replacement Cost: The cost to replace damaged personal property without a deduction for depreciation.

Rescission: The cancellation or annulment of a transaction or contract by operation of law or by mutual consent. Borrowers have a right to cancel certain mortgage refinance and home equity transactions within three business days after closing, or for up to three years in certain instances.

Revolving Debt: Credit that is extended by a creditor under a plan in which (1) the creditor contemplates repeated transactions; (2) the creditor may impose a finance charge from time to time on an outstanding unpaid balance; and (3) the amount of credit that may be extended to the consumer during the term of the plan is generally made available to the extent that any outstanding balance is repaid.

Right of First Refusal (ROFR): A provision in an agreement that requires the owner of a property to give another party the first opportunity to purchase or lease the property before he or she offers it for sale or lease to others.

Rural Housing Service (RHS): An agency within the U.S. Department of Agriculture (USDA), which operates a range of programs to help rural communities and individuals by providing loan and grants for housing and community facilities. The agency also works with private lenders to guarantee loans for the purchase or construction of single family housing.

S

Securities: A financial form that shows the holder owns a share or shares of a company (stock) or has loaned money to a company or government organization (bond).

Sale/Leaseback: A transaction in which the buyer leases the property back to the seller for a specified period of time.

Second Mortgage: A mortgage that has a lien position subordinate to the first mortgage.

Secondary Mortgage Market: The market in which mortgage loan and mortgage backed securities are bought and sold.

Secured Loan: A loan that is backed by property such as a house, car, jewelry, etc.

Security: The property that will be given or pledged as collateral for a loan.

Securities: Financial forms that shows the holder owns a share or shares of a company (stocks) or has loaned money to a company or government organization (bonds).

Seller Take Back: An agreement in which the seller of a property provides financing to the buyer for the home purchase. See also, “Owner Financing.”

Servicer: A firm that performs servicing functions, including collecting mortgage payments, paying the borrower’s taxes and insurance and generally managing borrower escrow accounts.

Servicing: The tasks a lender performs to protect the mortgage investment, including the collection of mortgage payments, escrow administration, and delinquency management.

Settlement: The process of completing a loan transaction at which time the mortgage documents are signed and then recorded, funds are disbursed, and the property is transferred to the buyer (if applicable). Also called closing or escrow in different jurisdictions. See also, “Closing”

Settlement Statement: A document that lists all closing costs on a consumer mortgage transaction.

Short Sale: A real estate transaction in which the proceeds of a home sale are not sufficient to cover the amount that is owed. A mortgage lender must approve the sale, which can save time and money compares with foreclosure.

Soft Second Loan: A second mortgage whose payment is forgiven or is deferred until resale of the property.

Service members Civil Relief Act: A federal law that restricts the enforcement of civilian debts against certain military personnel who may not be able to pay because of active military service. It also provides other protections to certain military personnel.

Special Warranty Deed: A deed in which the grantor limits the title warranty given to the grantee to anyone claiming by, from, through, or under him, the grantor. The grantor does not warrant against title defects arising from conditions that existed before he owned the property.

Subordinate Financing: Any mortgage or other lien with lower priority than the first mortgage.

Survey: A precise measurement of a property by a licensed surveyor, showing legal boundaries of a property and the dimensions and location of improvements.

Sweat Equity: A borrower’s contribution to the down payment for the purchase of a property in the form of labor or services rather than cash.

T

Taxes and Insurance: Funds collected as part of the borrower’s monthly payment and held in escrow for the payment of the borrower’s, or funds paid by the borrower for, state and local property taxes and insurance premiums.

Tenants by the Entireties: A legally recognized form of ownership in real and personal property. It possesses six characteristics: (1) unity of possession (joint ownership and control); (2) unity of interest (the interests must be identical – i.e. each party has the same percentage interest as the others); (3) unity of title (the interests must have originated in the same instrument – i.e. they must take title on the same instrument); (4) unity of time (the interests must have commenced simultaneously – i.e. must take title at the same time); (5) survivorship; and (6) unity of marriage (the parties must be married at the time the property became titled in their joint names). When property is held as a tenancy by the entireties, only the creditors of both the husband and wife, jointly, may attach the tenancy by the entireties property; the property is not divisible on behalf of one spouse alone, and therefore it cannot be reached to satisfy the obligation of only one spouse. See, BEAL BANK, SSB, v. ALMAND AND ASSOCIATES, 780 So.2d 45 (Fla. 2001)

Tenants in Common: You cannot be a tenant in common by yourself. It requires only one (1) unity which is called unity of possession (i.e. joint ownership and control). Each person in the co-tenancy has the right to possess the property. The parties can own the property in whatever percentages they want. Any party can sell their interest to anyone without notice to the other owners.

Termite Inspection: An inspection to determine whether a property has termite infestation or termite damage. In many parts of the country, a home must be inspected for termites before it can be sold.

Third-Party Origination: A process by which a lender uses another party to completely or partially originate, process, underwrite, close, fund, or package a mortgage loan. See also, “Mortgage Broker.”

Title: The right to, and the ownership of, property. A title or deed is sometimes used as proof of ownership of land.

Title Insurance: Insures owners of real property, or lenders using real property as collateral, against loss arising out of defective or invalid titles and the existence of other liens or other legal claims against titles to real property.

Title Insurance Policy (Lender’s Policy): Prior to bank lending Buyer/Borrower money to buy that property they want to make sure whomever sells you the property actually owns the property, that there aren’t any superior claims, outstanding judgments, liens, or other title defects that could cause the property to be ripped away. So as a condition of giving you that loan, Lenders will require a Lender’s Title Insurance Policy to protect themselves.

Title Insurance Policy (Owner’s Policy): Covers the buyer both legally and financially and insures you will not be liable for any title flaw that arose from the property’s history before you purchased it. The Owner’s Title Insurance Policy will stay in effect as long as you or your heirs own the property. FTIC will be there to pay valid claims and cover the costs of defending any attack on your title, now or in the future.

Title Search: FTIC scours all available public records for prior ownership making sure the title has passed correctly to each new owner, liens, utility assessments, taxes, judgments, mortgages, HELOCs, and anything else recorded about the property that may affect the new buyer’s superior and exclusive ownership of the property. The title search will reveal problems that might arise so they may be dealt with immediately, title defects cured, and the title cleared and cleaned before you purchase.

Trade Equity: Real estate or assets given to the seller as part of the down payment for the property.

Transfer Tax: State or local tax payable when title to property passes from one owner to another.

Treasury Index: An index that is used to determine interest rate changes for certain adjustable rate mortgage (ARM) plans. It is based on the results of auctions by the U.S. Treasury of Treasury bills and securities.

Truth In Lending Act (TILA): A federal law that requires disclosure of a truth in lending statement for consumer credit. The statement includes a summary of the total cost of credit, such as the annual percentage rate (APR) and other specifics of the credit.

Two to Four Family Property: A residential property that provides living space (dwelling units) for two to four families, although ownership of the structure is evidenced by a single deed; a loan secured by such a property is considered to be a single family mortgage.

U

Underwriting: The process used to determine loan approval. It involves evaluating the property and the borrower’s credit and ability to pay the mortgage.

Uniform Residential Loan Application: A standard mortgage application you will have to complete. The form requests your income, assets, liabilities, and a description of the property you plan to buy, among other things. Unsecured Loan: A loan that is not backed by collateral.

V

Variance: Permission granted by a zoning authority to a property owner to allow for a specified violation of the zoning requirements.Variances are generally granted when compliance is impossible without rendering the property virtually unusable.

Veterans Affairs (U.S. Department of Veterans Affairs): A federal government agency that provides benefits to veterans and their dependents, including health care, educational assistance, financial assistance, and guaranteed home loans.

VA Guaranteed Loan: A mortgage loan that is guaranteed by the U.S. Department of Veterans Affairs (VA).

W

Walk-through: A common clause in a sales contract that allows the buyer to examine the property being purchased at a specified time immediately before the closing, for example, within the 24 hours before closing.

Warranties: Written guarantees of the quality of a product and the promise to repair or replace defective parts free of charge.

Warranty Deed: A deed conveying the seller’s interest in real property to the buyer. The seller, also known as the grantor, certifies that the title on property being conveyed is free and clear from defects, liens and encumbrances. If a third party claims is not exempted specifically, the buyer (the grantee) may sue the seller for damages caused by the defective title.</ >