In a hot market with low inventory, meaning there is a glut of available properties for buyers to purchase, when something comes on the market; you have to be lighting-fast and come out with guns blazing a strong offer!! Sellers are receiving multiple offers at-and-above asking price, the market is highly competitive, and you need your offer to stand out. So how do you get to yes? Here are some ideas categorized by the: (1) Kindness Approach; and (2) Economically Strategic Approach; on how to get your buyers’ offers accepted:

I. KINDNESS APPROACH:

1. This sounds hokey but I am starting with this as my number one (#1). Call and build a rapport with the listing agent and ask what terms are most important for the seller. I’ve heard about a listing agent receiving seven (7) offers one weekend but only heard from two (2) before or after receiving their offers.

2. Present the offer in person or (nowadays) virtually via zoom. Let them know it will only take a few minutes, and you are bringing them a very nice offer that you know the seller and they will be excited to see! It will only take no more than 5 minutes of their time ?.

3. Video the buyers (in front of the house) as to why they love the house.

4. Pay very close attention to seller’s personal collections and family pictures. After touring the house, buyer notices a Miami Heat poster in the kid’s room and a vacation picture at Disney. Buyer sends Disney tickets and a signed Heat Jersey.

5. Look up the Sellers. Find out what sellers are involved in and make $500.00 payment to charity of their choice.

6. Picture drawn by the kids of the house.

7. Hand signed letter from the heart, identify what you love, honored if chosen, and a promise to take care of it.

“I had the pleasure of touring your home and fell in love with the possibility of one day living here. I think it would be the perfect home to raise my children in, and they were excited to have a place that we can finally call home. I want the best for my children. I would like to move to ______ so I can surround them with diversity, culture, and education they deserve. I would love more than anything to have a stable home for them to always come home to. Please consider accepting my offer. Thank you for your kind consideration, /s/ Signature.

8. Uber eats personally delivers the offer.

II. ECONOMICALLY STRATEGIC APPROACH:

9. Nonrefundable deposit up to $1,000.00 to be immediately released to Seller, but credited to buyer if deal closes.

10. Put down a higher (e.g. double) earnest money deposit.

11. Show proof of funds (whether cash buyer or not).

12. Shorten closing date to 2 weeks.

13. Shorten closing date to 2 weeks BUT, add Post-Occupancy Agreement for Seller to stay at $0.00.

14. Shorten closing date to 2 weeks BUT, for every day thereafter buyer pays non-refundable extension fee of $______/day to be released from buyer’s deposit to seller, and which, if the property closes, is either: [_] in addition to the sales price; or [_] goes towards the sales price. If the property does not close within ____ days from the effective date, then allow either the seller or buyer to cancel but preserving seller’s obligation to pay the extension fee.

15. Pre-Approval Letters from buyer’s lender and indicating that buyer already has provided all of their check stubs, bank statements, tax returns to get the process started. Be proactive and show you may be able to close sooner than the standard 30-45 days.

16. Shorten inspection period.

17. Limited inspection rights. Notwithstanding buyer’s inspection rights, buyer waives the first $4,000.00 of inspection issues.

18. Waiving inspection entirely (extremely dangerous and not recommended unless gutting/demolishing the structure or buyer previously inspected).

19. Buyer pays seller’s prorations (e.g. taxes, HOA maintenance).

20. Buyer pays maintenance, landscaping, pool, and utilities from time of acceptance until closing.

21. Pay seller’s moving costs (with a cap).

22. Pay typical seller costs (with a cap) like:

(1) Doc Stamps + surtax on the deed;

(2) Seller’s Settlement Fee (e.g. to prepare their closing documents charged by their attorney or title company)

(3) HOA estoppel fees (if any);

(4) Title search (if SELLER’S Box is Checked or the Miami-Dade/Broward Regional Provision is Checked under Article 9),

(5) Municipal lien search (if SELLER’S Box is Checked or the Miami-Dade/Broward Regional Provision is Checked under Article 9),

(6) Owner’s title policy (if SELLER’S Box under Article 9)

23. Buyer pays commissions.

24. Cooperating broker (buyer’s sales agent) gives back 0.50% commission. Buyer separately agrees to reimburse Cooperating Broker 0.5%

25. If does not appraise, Buyer will pay the difference.

26. If the appraised value comes in below the contract price, the buyer agrees to pay $____ above the appraised value, not to exceed the contract price.

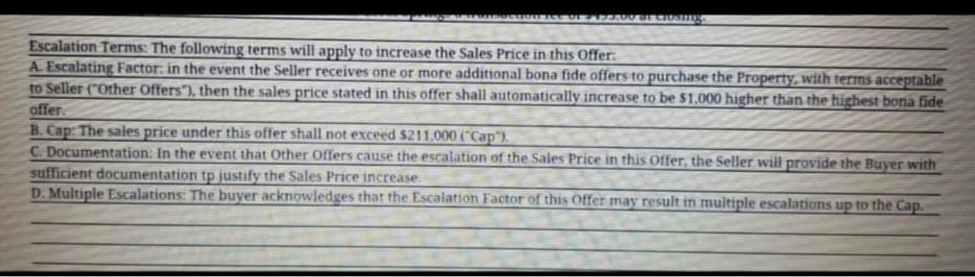

27. Escalation Clauses allow buyers to get another bite-at-the-apple and insures they are the highest bidder. The problem with giving a “Highest and Best,” “Final Offer,” “Take it or Leave it!” is that it leaves no room to negotiate. These can be quite useful in multiple offer scenarios. An escalation clause states that the buyer will pay a certain amount of money above the highest offer the seller receives. It generally includes a ceiling cap to make sure the buyer doesn’t agree to pay more money than they can afford. Now whether the no cap matters or not, may not make a difference if a buyer can simply cancel under the inspection period anyway.

Advantages: (1) It’s an attention grabber; (2) Seller could cross out the escalation clause and counter with buyer’s highest bid (See disadvantages); but who cares? The Buyer got what it was willing to spend anyway; (3) Seller may perceive the buyer as the most desirous to have the home; (4) If you think a listing agent is lying (I know it never happens) about having multiple offers. No Buyer’s remorse after losing deal thinking, “I wonder what would have happened if I just had the opportunity to offer $5,000 more?” At today’s 30 year fixed mortgage interest rates, a $10,000 increased would only amount to a little over $40.00 month. Accord., BankRate.com.

Disadvantages: (1) Upsetting a seller into thinking you’re playing games. If you can offer +$5,000 then just include that in your hard offer; (2) It’s only an offer so Seller could cross out Buyer’s escalation clause and counter with your highest bid [in fact – expect this]. (3) Seller may reject and say just give me your highest and best offer; (4) Some sellers don’t like it because the buyer isn’t putting their best foot forward and are not competing fairly (I only heard one example of this); (5) Frustrating and offending the Seller with gamesmanship – “Hey I am offering X but I am really willing to pay up to Y.”; (6) In some states like TX they are not allowed so check with your local ethics Board, FREC, and attorney.

Examples:

Re/Max Form (online)

Dwell Real Estate Form (online)

28. Kick-Out-Clause / Right-of-First Refusal. What a terrible term! I prefer Right-of-First-Refusal. When a seller receives a weak or low offer or one full of contingencies with terms less optimal than seller hoped for, this is an attractive alternative to bridge the gap and keep things moving. The way it works is, if another buyer comes along and makes an offer, the original buyer is given 24-72 hours to either meet or beat the new offer or receive their deposit back. Form Simplicity has two (2) forms which serve as examples: (1) CR-5x_X. Kick Out Clause; and (2) CRSP16.E.backup kickout addendum. * Note this concept is different from a back-up-offer which would allow a 2nd offer to put down a deposit and then move into 1st position if the original offer is terminated and falls through.

Another scenario is if the Seller insists their Fair Market Value is $600,000, but your research shows it is overpriced, and a fair estimate would be $500,000. Make an offer with a 60 day kick out clause. This essentially says I am so confident my offer is fair that I am willing to bet you won’t find a better deal out there.

DISCLAIMER: Topics discussed are general concepts, not intended to constitute legal advice, accuracy, nor completeness, and may not be relied upon as such; consult an attorney. FTIC is a national award winning title insurance company known for its white glove customer service and “No Junk Fee Guarantee.” ®