§1031 in a Nutshell. Assume an investor wants to sell a property for a $200,000 profit. The profit is subject to taxation. To put it in numbers, federal income tax brackets range from 10% for the lowest earners to 37% for the highest earners. So, a total tax bracket of approximately 35%, could result in a capital gains tax bill of $200,000 X 35% = $70,000. But, with some proper guidance, what if instead of just selling the $200,000 property, the seller did an exchange? The seller who exchanges their investment property by selling their “relinquished property” and who rolls their $200,000 profit into buying a “replacement property” could potentially pay no capital gains tax whatsoever (i.e. $0.00), leaving the entire $200,000 to reinvest, if the transaction was set up right. In the real estate industry, this sale and timely reporting and re-purchasing is called a “Like-Kind-Exchange” or “1031 Exchange.”

This article addresses:

| I. | Basic Accounting Terms |

| II. | Residential Property Gains |

| III. | §1031 Exchange – The Deferrable Tax Exception |

| IV. | Is the Property “Like-Kind” Property? |

| V. | Does the property “Qualify?” |

| VI. | Contractual Clauses To Notify New Buyer & New Seller Of Intent To Perform A §1031 Exchange |

| VII. | Strict Timeline For Completing §1031 Exchanges |

| VIII. | How Will You Exchange the Two Properties? |

| IX. | How Much Tax is Deferrable? Am I Doing This Right? Do the “Napkin Test” to determine if there is “Boot” (* You Don’t want a Partial 1031 exchange *) |

| X. | Reporting |

§1031’s are no brainer for investors and realtors too. Not only is this advantageous for the Seller resulting in huge tax savings, but it is also a no brainer for realtors, who stand to earn a double commission; first through the sale of the Relinquished Property, and second through the purchase of the Replacement Property, – i.e. resulting in an exchange of properties.

First get your accounting terminology correct. This article is slightly more advanced but will be a good reference point to refer back. Internal Revenue Code §1031 is part of the tax code, so sound intelligent by using accounting lingo. Your kid may say, “I have a boo-boo;” you say “bruise;” but the doctor says, “contusion or hematoma.” Who would you rather sound like? Tax terms used by professionals are bolded and hyperlinked below, so commit to learning them.

I. BASIC ACCOUNTING TERMS

Start with Basics. Gain or Loss From Sales and Exchanges. When property is sold it usually results in either a Gain or Loss being Realized. A sale is a transfer of property for money or a mortgage, note, or other promise to pay money. A Gain (i.e. the profit) is the amount you Realize (i.e. receive) from a sale or exchange of property that is more than its Adjusted Basis (i.e. cost). Inversely, a Loss occurs when your property’s adjusted basis (i.e. cost) is more than the amount you realize (i.e. received) on the sale or exchange. The Basis can be complicated to figure out but it usually starts with the cost you paid for the property (see IRS Pub 551 if you got the property by gift/inheritance). That Basis (i.e. your cost) is then adjusted by increasing it (i.e. increasing the cost) to include costs of any improvements having a useful life of more than one (1) year. Decreases to Basis (i.e. reductions to your cost) include depreciation and casualty losses.

| Amount realized is more than the adjusted basis. e.g. Adjusted basis =$50,000, Sells for $75,000, Gain is $25,000 | GAIN |

| Adjusted basis is more than the amount realized. e.g. Adjusted basis =$50,000, Sells for $35,000, Loss is $15,000 | LOSS |

II. RESIDENTIAL PROPERTY GAINS

Taxation of Personal Residence vs. Investment Property. Taxation on income generated from the sale of personal residence is very different from the taxation of income on investment property. If the taxpayer resided in the personal residence for two (2) of the last five (5) years, and their sale results in a Gain then: (1) $250,000 of a single (unmarried) seller’s Gain; or (2) $500,000 for married couples, will be disregarded/excluded/ignored. Widowers are treated differently. This residential exemption from paying taxes on gains may be used once every two (2) years. See, 26 U.S. Code §121 – Exclusion of gain from sale of principal residence.

III. §1031 EXCHANGE – THE DEFERRABLE TAX EXCEPTION

Taxation of Investment Property. If seller sells investment property that appreciates in value, then the seller would have to pay Capital Gains Taxes; unless, with a little bit of planning, that seller’s investment property qualifies for preferential tax treatment under Internal Revenue Code Section §1031 as a like-kind exchange. Section 1031(a)(1) states:

Nonrecognition of gain or loss from exchanges solely in kind: In general. No gain or loss shall be recognized on the exchange of real property held for productive use in a trade or business or for investment if such real property is exchanged solely for real property of like kind which is to be held either for productive use in a trade or business or for investment.

Elements of a §1031 Property. Stated another way, to be a §1031 like-kind exchange, the property relinquished and the property received as its replacement must be both of the following: (1) “Like-kind property”; and (2) “Qualifying” (i.e. not subject to some exception).

IV. IS THE PROPERTY “LIKE-KIND” PROPERTY?

Like-Kind does not mean Exactly. Under §1031 there must be an exchange of “like-kind property.” Investors often mistakenly believe they must purchase a replacement property exactly like their relinquished property. But most are surprised to learn a wide variety of properties can be considered “like-kind.” “Like-kind” does not refer to the type of property. Instead, it addresses the intended use of the property i.e. that both properties be “real property held for productive use in a trade or business or for investment.” Like-kind properties are properties of the same nature or character, even if they differ in grade or quality.

For example, any of the following can be considered “like-kind” property exchanges: a duplex for a fourplex, bare land for improved property, a rental house for a retail center or an apartment building for an office building. Investors do not have to exchange for exactly the same type of property as relinquished.

Personal Property exchanged for Real Estate – NO. “An exchange of personal property for real property does not qualify as a like-kind exchange.”

City Property exchanged for Farm – YES. “An exchange of city property for farm property … is a like-kind exchange.”

Improved exchanged for Farm – YES. “… improved property for unimproved property, is a like-kind exchange.”

Real Estate for 30 Year exchanged for Real Estate Lease. – YES. “The exchange of real estate you own for a real estate lease that runs 30 years or longer is a like-kind exchange. However, not all exchanges of interests in real property qualify.”

Foreign Real Property – NO. Foreign real property is real property not located in a state or the District of Columbia. “Real property located in the United States and real property located outside the United States are not property of a like kind.” If you exchange foreign real property for property located in the United States, your gain or loss on the exchange is recognized.

V. DOES THE PROPERTY “QUALIFY?”

Assuming the properties to be exchanged meet the definition of “Like-Kind-Properties” do they also “Qualify” for §1031 tax deferral treatment? Section 1031’s nonrecognition rules for like-kind exchanges apply only to exchanges of “real property held for productive use in a trade or business or for investment if such real property is exchanged solely for real property of like kind….” Qualifying property examples include: buildings, land, and rental.

Which Properties Do NOT Qualify? Like-kind exchanges do not apply to the certain exchanges of property.

Real property held primarily for sale – Does NOT Qualify. “This subsection shall not apply to any exchange of real property held primarily for sale.”

Business Assets for Business Assets – Does NOT Qualify. “An exchange of the assets of a business for the assets of a similar business cannot be treated as an exchange of one property for another property.”

Personal or intangible property – Does NOT Qualify? An exchange of personal property for real property does not qualify as a like-kind exchange. However, “incidental property” is disregarded, see infra.

Disregard incidental property – Does Qualify. Do not treat property incidental to a larger item of property as separate from the larger item when you identify replacement property. Property is incidental if it meets both the following tests. (1) It is typically transferred with the larger item; and (2) The total fair market value of all the incidental property is not more than 15% of the total fair market value of the larger item of property.

For example, furniture, laundry machines, and other miscellaneous items of personal property will not be treated as separate property from an apartment building with a fair market value of $1,000,000, if the total fair market value of the furniture, laundry machines, and other personal property does not exceed $150,000.

Unrented vacation homes – Does NOT Qualify. In Moore v. Commissioner of Internal Revenue, the taxpayers exchanged one lakeside vacation home for another. Neither home was ever rented. Both were used by the taxpayers only for personal purposes. The taxpayers claimed that the exchange of the homes was a like-kind exchange under § 1031 because the properties were expected to appreciate in value and thus were held for investment. The Tax Court held, however, that the properties were held for personal use and that the “mere hope or expectation that property may be sold at a gain cannot establish an investment intent if the taxpayer uses the property as a residence.”

Exclusively Personal Residences – Does NOT Qualify. In Starker v. United States, the Ninth Circuit held that a personal residence of a taxpayer was not eligible for exchange under § 1031, explaining that “[it] has long been the rule that use of property solely as a personal residence is antithetical to its being held for investment.”

Rental Residences + Occasionally Used Personally – MAY QUALIFY. Many taxpayers hold Dwelling Units to produce rental income, but they also use those properties occasionally for their own personal purposes. A Dwelling Unit is defined as real property improved with a house, apartment, condominium, or similar improvement that provides basic living accommodations including sleeping space, bathroom and cooking facilities. In the interest of sound tax administration, owners have a safe harbor under which their Dwelling Unit will qualify under §1031 even though they occasionally use the Dwelling Unit for their own personal purposes. The IRS will not challenge whether a Dwelling Unit qualifies under §1031 if certain requirements are met. See, Revenue Procedure 2008-16 §4, 2008-10 I.R.B. 547 The following questions will help determine whether the property qualifies.[1]

| WITH REGARDS TO THE RELINQUISHED PROPERTY: |

| Own for 2 yrs. Will you have owned the property you intend to relinquish for 24 months before the exchange? | YES. |

| Year 1 – Rent 14+ days. During the 1st 12 month period, did you rent the property you intend to relinquish for 14+ days at fair rental value? | YES. |

| Year 2 – Rent 14+ days. During the 2nd 12 month period, did you rent the property you intend to relinquish for 14+ days at fair rental value? | YES. |

| Year 1 – Your personal use. How many days was the property you intend to relinquish rented in the 1st 12 month period? | Less than the greater of 14 days or 10 percent of the number of days during the 12-month period that it was rented. |

| Year 2 – Your personal use. How many days was the property you intend to relinquish rented in the 2nd 12 month period? | Less than the greater of 14 days or 10 percent of the number of days during the 12-month period that it was rented. |

VI. CONTRACTUAL CLAUSES TO NOTIFY NEW BUYER & NEW SELLER OF INTENT TO PERFORM A §1031 EXCHANGE

Clauses Seller should add to Purchase and Sale Agreements. When the Buyer purchases a Seller’s property the seller is supposed to receive the proceeds of the sale. However, in a §1031 tax-deferred exchange, the proceeds will not go to the Seller, but instead will go to the Seller’s Qualified Intermediary (known as a “QI”), which will then use those proceeds to purchase the Replacement Property. You don’t want to catch the buyer off guard that there will be a QI involved. Therefore, in the beginning, include language in the Purchase and Sales Agreement, stating Seller’s intent to perform a §1031 tax-deferred exchange. Some suggested language by some two different QIs (Starker Services, Inc., and Asset Preservation, Inc.) are:

When Selling the Relinquished Property Option #1

“Buyer is aware that Seller intends to perform an IRC §1031 tax–deferred exchange. Seller requests Buyer’s cooperation in such exchange and agrees to hold Buyer harmless from any and all claims, liabilities, costs, or delays in time resulting from such an exchange. Buyer agrees to an assignment of this contract to a Qualified Intermediary, by Seller.”

When Selling the Relinquished Property Option #2

“It is the intent of the Seller to perform an IRC §1031 tax-deferred exchange by trading the property herein with a QI. Buyer agrees to execute an Assignment Agreement at the request of Seller at no additional cost or liability to Buyer.”

When Buying the Replacement Property Option #1

“It is the intent of the Buyer to perform an IRC §1031 tax-deferred exchange by trading the property herein with a QI, Seller agrees to execute an Assignment Agreement at the request of Buyer at no additional cost or liability to Seller.”

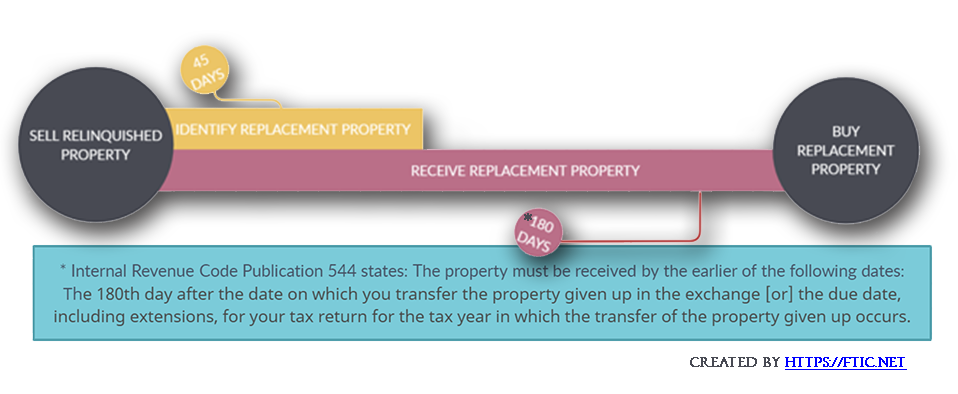

VII. STRICT TIMELINE FOR COMPLETING §1031 EXCHANGES

There is a limited time to select and purchase a Replacement Property so don’t place yourself in a time crunch. Exchangers have been known toget stuck with a Hobson’s Choice – Lose the favorable tax treatment and pay tons of capital gains tax, or close on a Replacement Propertythat the Exchanger otherwise would not have bought. Exchangers who run out of time, may also find themselves having little to no negotiating power after discovering defects during a due diligence inspection. Section 1031(a)(3) of the IRC sets two deadlines: an Identification deadline, and an Exchange deadline.

A. 45 Day “Identification” Deadline. “You must identify the [Replacement] property to be received within 45 days after the date you transfer the property given up in the exchange. This period of time is called the identification period. Any property received during the identification period is considered to have been identified.” In other words, the potential Replacement Property must be identified within 45 days of the sale of the Relinquished Property.

- Specific Requirements on How To Identify The Replacement Property. “You must identify the replacement property in a [1] signed written document and [2] deliver it to the person obligated to transfer the replacement property or any other person involved in the exchange other than you or a disqualified person. … [3] You must clearly describe the replacement property in the written document. For example, use the legal description or street address for real property …. In the same manner, you can cancel an identification of replacement property at any time before the end of the identification period.”

- How Many Properties can you Identify? Safely the answer is “three (3) properties regardless of their fair market value.”[2] You can identify more but then it gets complicated.[3]

- Who do You Identify the Property to? Qualified Intermediary (QI). 1031 Exchanges are preformed through third-parties called Qualified Intermediaries who essentially stand-in-your shoes and act as your surrogate. A qualified intermediary is a person whom You enter into a “written exchange agreement.”

- What does a Written Exchange Agreement with a QI entail? “The written exchange agreement must expressly limit your rights to receive, pledge, borrow, or otherwise obtain the benefits of money or unlike property held by the qualified intermediary.” The Written Exchange Agreement requires the QI to do the following for you:

- Acquire your Relinquished Property, and Transfer your Relinquished Property,

- How? Typically You would assign the QI your rights as the Seller under your Purchase and Sale Agreement to sell your Property, You sign the Deed, the QI transfers your signed deed to your Relinquished Property to the new Buyer.

- Acquire the Replacement Property, and Transfers the Replacement Property to you.

- How? Typically the QI enters into an agreement with the owner of the Replacement Property for the transfer of that property and, pursuant to that agreement, the Replacement Property is transferred to You (that is, by direct deed to you).

- Who may be a Qualified Intermediary (QI) and who is Disqualified? Persons who are disqualified from serving as QI’s include: “your employee, attorney, accountant, investment banker or broker, or real estate agent or broker within the 2-year period ending on the date of the transfer of the first of the relinquished properties….” On the other hand, Routine financial, title insurance, escrow, or trust services by a financial institution, title insurance company, or escrow company, and Services with respect to exchanges of property intended to qualify for nonrecognition of gain or loss as like-kind exchanges may serve as QIs.

B. *180 Day “Exchange” Deadline. Additionally, the closing of the purchase must occur within 180 days of the sale of the Relinquished Property. “The property must be received by the earlier of the following dates: (1) The 180th day after the date on which you transfer the property given up in the ex-change; [*or] (2) The due date, including extensions, for your tax return for the tax year in which the transfer of the property given up occurs. This period of time is called the exchange period.”

VIII. How Will You Exchange the Two Properties?

There are four (4) different types of 1031 Exchanges. The illustration above is the first and most common; it is called a Delayed Exchange.

Simultaneous Exchange, is when the sale of the Relinquished Property and the purchase of the Replacement Property happen at the same time.

Reverse Exchange is the opposite of a Delayed Exchange. Ideally, an investor will be able to sell the Relinquished Property first, and then use that money to close on a Replacement Property. But sometimes investors may need to buy the Replacement Property first, without selling their Relinquished Property. This can be accomplished through a reverse exchange. In it, the Replacement Property is purchased before the Relinquished Property is sold. The same timing rules apply, but in reverse. The Relinquished Property must be identified within 45 calendar days and sold with 180 calendar days.

“A reverse exchange is somewhat more complex than a deferred exchange. It involves the acquisition of replacement property through an ‘Exchange Accommodation Titleholder’ [EAT], with whom it is parked for no more than 180 days. During this parking period the taxpayer disposes of its relinquished property to close the exchange.” IRS Fact Sheet 2008-18, February 2008, See also, IRC Rev. Proc. 2000–37 for more detail.

Construction Exchange a/k/a Improvement Exchange Is utilized when repairs, construction or maintenance needs to be completed on the Replacement Property before the Buyer takes ownership of the Replacement Property. The IRS specifically prohibits using §1031 proceeds from the Relinquished Property to directly pay for repairs, maintenance, or new construction. So how do investors make improvements to Replacement Properties without directly violating the rules. The short version is the If you want to build or improve your replacement property then it must be purchased and held, temporarily, by a holding company known as an Exchange Accommodation Titleholder (EAT). The EAT stays on title during the building period. The EAT names you “construction manager,” you oversee the improvements (work with contractors, inspect work, collect invoices, etc). The construction Funds are drawn, at your direction, from the exchange account. The EAT makes the payments. Once the construction is complete or the 180-day exchange period is over, whichever is first, the EAT transfers title of the property to you and the exchange is finished. However, usually a Delayed Exchange will suffice and the Exchanger will take ownership to the property and perform the repairs. The procedures to safely accomplish construction 1031 exchanges are set forth in IRC Rev. Proc. 2000–37.

IX. How Much Tax is Deferrable? Am I Doing This Right? Do the “Napkin Test” to determine if there is “Boot” (* You Don’t want a Partial 1031 exchange *)

Boot is bad. You don’t want Boot. Performing a partial 1031 exchange results in creating Boot. So let’s figure out if your Replacement Property is going to result in you having to pay taxable gains or not.

The term “Boot” is not used in either the IRC nor the Regulations, but is the term commonly used to describe the money (or fair market value of “other property” received by the taxpayer) in an exchange and which is not tax deferrable. A partial 1031 exchange may produce two different types of boot: (1) Cash Boot or (2) Mortgage Boot.

A. “The Napkin Test” a/k/a “The Even Up Rule” is used to determine whether there is “Boot.” The Napkin test is simply a matter of determining if the Exchanger is trading across (i.e. $0.00) or up in value. To avoid “Boot” an exchanger must trade either “across” or “up” in both Equity and Mortgage (this will be repeated several times).

Napkin Test #1 – No Boot.

Purchase price Increased and Mortgage Increased

| A Relinquished Property | B Replacement Property | Up / Across / Down ? | Boot | |

| Value | $1,500,000 | $2,250,000 | UP | |

| Mortgage | $1,000,000 | $1,700,000 | UP | |

| Equity | $ 500,000 | $ 500,000 | ACROSS |

* To avoid “Boot” an exchanger must trade either “across” or “up” in both equity and mortgage. * “Boot” exists if either: equity or mortgage are Down.

In the example above, the Exchanger is trading up in Value, across in Equity and up in Mortgage; therefore, the Exchanger has no taxable boot. To avoid a taxable gain, always trade your Properties and Mortgage either “across” or “up;” never trade them down (the “even or up rule”). In the scenario above, the Seller’s equity position of $500,000 never changed when he replaced property A with Property B.

Napkin Test #2 – Boot.

Purchase price Increased and Mortgage Increased

| A Relinquished Property | B Replacement Property | Up / Across / Down ? | Boot | |

| Value | $1,500,000 | $2,000,000 | UP | |

| Mortgage | $1,000,000 | $1,700,000 | UP | |

| Equity | $ 500,000 | $ 300,000 | DOWN | $200,000 |

* To avoid “Boot” an exchanger must trade either “across” or “up” in both equity and mortgage. * “Boot” exists if either: equity or mortgage are Down.

Trading down always results in boot received, either cash, debt reduction, or both. In the example above, the Seller made $500,000 but rather than reinvest his $500,00 gains he only reinvested $300,000 in gains, thereby receiving $200,000 in cash boot when he replaced the property A with Property B.

B. Cash Boot. If you receive cash from a sale and do not fully reinvest the proceeds in the new property, this results in Cash Boot. When the value of the new property (i.e. replacement property) is less than the value of the old property (i.e. relinquished property) it results in Cash Boot. For example in scenario #1(A), if you sold a property for $250,000, and bought a replacement property for $200,000, the $50,000 in Gain is considered Cash Boot. This makes the exchange a partial 1031 exchange. You need to reinvest 100% of the $50,000 Gain (see Example #1B)) from the like-kind exchange in order to defer all taxes.

CASH TRANSACTION EXAMPLE #1(A) – BOOT

Purchase price Decreased

| A Relinquished Property | B Replacement Property | Up / Across / Down ? | Boot | |

| Value | $250,000 | $200,000 | DOWN | $50,000 |

CASH TRANSACTION EXAMPLE #1(B) – NO BOOT

Purchase price Increased

| A Relinquished Property | B Replacement Property | Up / Across / Down ? | Boot | |

| Value | $200,000 | $250,000 | UP | $0.00 |

C. Mortgage Boot. If the new mortgage on the Replacement Property is less than the old mortgage you paid off on the Relinquished Property then this results in Mortgage Boot. “Mortgage boot” results when an Exchangor reduces the amount of their loan or debt by exchanging properties. If the old loan was $1,000,000 on the Relinquished Property and the new loan on the Replacement Property is $900,000, there is $100,000 worth of mortgage boot, which may be taxable. Another example. If you loan $100,000 to a friend and only require him to pay back $70,000, then your friend will have received $30,000 of relief of indebtedness income which he will have to pay tax upon.

To avoid Boot, not only must the Replacement Property be of equal or greater value, but additionally, the amount of equity to be reinvested must also be equal to or greater than the equity from the Replacement Property. If the mortgage balance on the Replacement Property is not equal to or greater than the mortgage balance from the Relinquished Property, then the difference is considered to be “mortgage boot” and taxable.

FINANCED TRANSACTION EXAMPLE #2(A) – CASH BOOT

Purchase price remains the same and Mortgage increases

| Up / Across / Down ? | A Relinquished Property | B Replacement Property | Up / Across / Down ? | Boot |

| Value | $250,000 | $250,000 | ACROSS | |

| Mortgage | $100,000 | $170,000 | UP | |

| Equity | $150,000 | $ 80,000 | DOWN | $70,000 |

* To avoid “Boot” an exchanger must trade either “across” or “up” in both equity and mortgage. * “Boot” exists if either: equity or mortgage are Down.

FINANCED TRANSACTION EXAMPLE #2(B) – CASH BOOT

Purchase price increases and Mortgage increases

| A Relinquished Property | B Replacement Property | Up / Across / Down ? | Boot | |

| Value | $250,000 | $500,000 | UP | |

| Mortgage | $100,000 | $450,000 | UP | |

| Equity | $150,000 | $ 50,000 | DOWN | $100,000 |

* To avoid “Boot” an exchanger must trade either “across” or “up” in both equity and mortgage. * “Boot” exists if either: equity or mortgage are Down.

D. You think you know boot but you don’t – Common Misconception. The above Example #2(A) and #2(B) will help you visualize a common misconception about Boot. It is commonly believed that so long as a taxpayer buys Replacement Property equal to or greater in value than the net sale price of the Relinquished Property and takes on new mortgages more than the old mortgages, then there is no net Boot received; however, this isn’t always true! This is why you need the Napkin Test. For example, the taxpayer will be in receipt of net taxable cash Boot if the taxpayer sells Relinquished Property valued at $250,000.00 with existing mortgages of $100,000.00 and buys Replacement Property valued at $250,000.00 with $170,000.00 new mortgages. In this example, the taxpayer cashed out $70,000.00 in equity and is in receipt of net taxable cash Boot. The taxpayer over-financed the acquisition of the replacement property, which resulted in the receipt of net taxable cash Boot in the amount of $70,000.00.

FINANCED TRANSACTION EXAMPLE #2(C) – MORTGAGE BOOT

Purchase price stays the same and Mortgage Decreases

| A Relinquished Property | B Replacement Property | Up / Across / Down ? | Boot | |

| Value | $250,000 | $250,000 | ACROSS | |

| Mortgage | $100,000 | $ 80,000 | DOWN | $20,000 |

| Equity | $150,000 | $170,000 | UP |

* To avoid “Boot” an exchanger must trade either “across” or “up” in both equity and mortgage. * “Boot” exists if either: equity or mortgage are Down.

FINANCED TRANSACTION EXAMPLE #2(D) – MORTGAGE BOOT

Purchase price Increases and Mortgage Decreases

| A Relinquished Property | B Replacement Property | Up / Across / Down ? | Boot | |

| Value | $250,000 | $500,000 | UP | |

| Mortgage | $100,000 | $ 50,000 | DOWN | $50,000 |

| Equity | $150,000 | $450,000 | UP |

* To avoid “Boot” an exchanger must trade either “across” or “up” in both equity and mortgage. * “Boot” exists if either: equity or mortgage are Down.

Another common misconceptions is what I liken to the poker mentality when players only play with their winnings. One misconception is that a Seller can receive net cash in an exchange in the amount of the taxpayer’s initial capital investment in the acquisition of the relinquished property (i.e. I invested $100,000, so when I sell and buy a new property I can take out my original $100,000 = MISCONCEPTION). A second misconception is that a taxpayer need only replace the profit in the relinquished property and not its value net of exchange expenses (i.e. I will make a $100,000 profit, so when I sell and buy a new property I only need to play with my winnings of $100,000 = MISCONCEPTION). In all of these cases, the taxpayer would be in receipt of taxable Boot either as Net Cash Boot received or Net Mortgage Boot received, or both. That is why it is important to run a Napkin Test.

E. Rules of Thumb for Avoiding Boot

If the Seller buys a new Replacement Property equal (=) or greater (>) in value to the net sale price of the old Relinquished Property and spends all of the old Relinquished Property proceeds on buying the new Replacement Property, then the Exchange will be fully tax deferred. If the taxpayer follows this rule, then there is no cash Boot received and the taxpayer either took on new mortgages in excess of the old mortgages (no mortgage Boot received) or the taxpayer gave cash Boot to offset any mortgage Boot received.

X. REPORTING

To report a like-kind exchange, taxpayers must file Form 8824, Like-Kind Exchanges, with their tax return for the year they transfer property as part of a like-kind exchange. This form helps taxpayers figure the amount of gain deferred as a result of the like-kind exchange, as well as the basis of the like-kind property received. Form 8824 also helps taxpayers compute the amount of gain they must report if cash or property that isn’t of a like-kind is involved in the exchange.

DISCLAIMER: Topics discussed are general concepts, not intended to constitute legal advice, accuracy, nor completeness, and may not be relied upon as such; consult an attorney or accountant. The author is neither an attorney nor an accountant. FTIC is a national award winning title insurance company known for its white glove customer service and “No Junk Fee Guarantee.” ®

[1] SECTION 4. APPLICATION

.01 In general. The Service will not challenge whether a dwelling unit as defined in section 3.02 of this revenue procedure qualifies under § 1031 as property held for productive use in a trade or business or for investment if the qualifying use standards in section 4.02 of this revenue procedure are met for the dwelling unit.

.02 Qualifying use standards.

(1) Relinquished property. A dwelling unit that a taxpayer intends to be relinquished property in a § 1031 exchange qualifies as property held for productive use in a trade or business or for investment if:

(a) The dwelling unit is owned by the taxpayer for at least 24 months immediately before the exchange (the “qualifying use period”); and

(b) Within the qualifying use period, in each of the two 12-month periods immediately preceding the exchange,

(i) The taxpayer rents the dwelling unit to another person or persons at a fair rental for 14 days or more, and

(ii) The period of the taxpayer’s personal use of the dwelling unit does not exceed the greater of 14 days or 10 percent of the number of days during the 12-month period that the dwelling unit is rented at a fair rental.

For this purpose, the first 12-month period immediately preceding the exchange ends on the day before the exchange takes place (and begins 12 months prior to that day) and the second 12-month period ends on the day before the first 12-month period begins (and begins 12 months prior to that day).

(2) Replacement property. A dwelling unit that a taxpayer intends to be replacement property in a § 1031 exchange qualifies as property held for productive use in a trade or business or for investment if:

(a) The dwelling unit is owned by the taxpayer for at least 24 months immediately after the exchange (the “qualifying use period”); and

(b) Within the qualifying use period, in each of the two 12-month periods immediately after the exchange,

(i) The taxpayer rents the dwelling unit to another person or persons at a fair rental for 14 days or more, and

(ii) The period of the taxpayer’s personal use of the dwelling unit does not exceed the greater of 14 days or 10 percent of the number of days during the 12-month period that the dwelling unit is rented at a fair rental.

For this purpose, the first 12-month period immediately after the exchange begins on the day after the exchange takes place and the second 12-month period begins on the day after the first 12-month period ends.

[2] Fair market value. Fair market value is the price at which the property would change hands between a buyer and a seller when both have reasonable knowledge of all the necessary facts and neither is being forced to buy or sell. If parties with adverse interests place a value on property in an arm’s-length transaction, that is strong evidence of fair market value. If there is a stated price for services, this price is treated as the fair market value unless there is evidence to the contrary.

[3] “You can identify more than one re-placement property. However, regardless of the number of properties you give up, the maximum number of replacement properties you can identify is: Three properties regardless of their fair market value; or Any number of properties whose total fair market value at the end of the identification period is not more than double the total fair market value, on the date of transfer, of all properties you give up.”

If, as of the end of the identification period, you have identified more properties than permit-ted under this rule, the only property that will be considered identified is: Any replacement property you received before the end of the identification period, and Any replacement property identified before the end of the identification period and received before the end of the exchange period, but only if the fair market value of the property is at least 95% of the total fair market value of all identified replacement properties. Fair market value is determined on the earlier of the date you received the property or the last day of the exchange period. See Receipt requirement, later.