How to Read Seller’s Closing Disclosure (i.e. Seller’s Closing Costs)

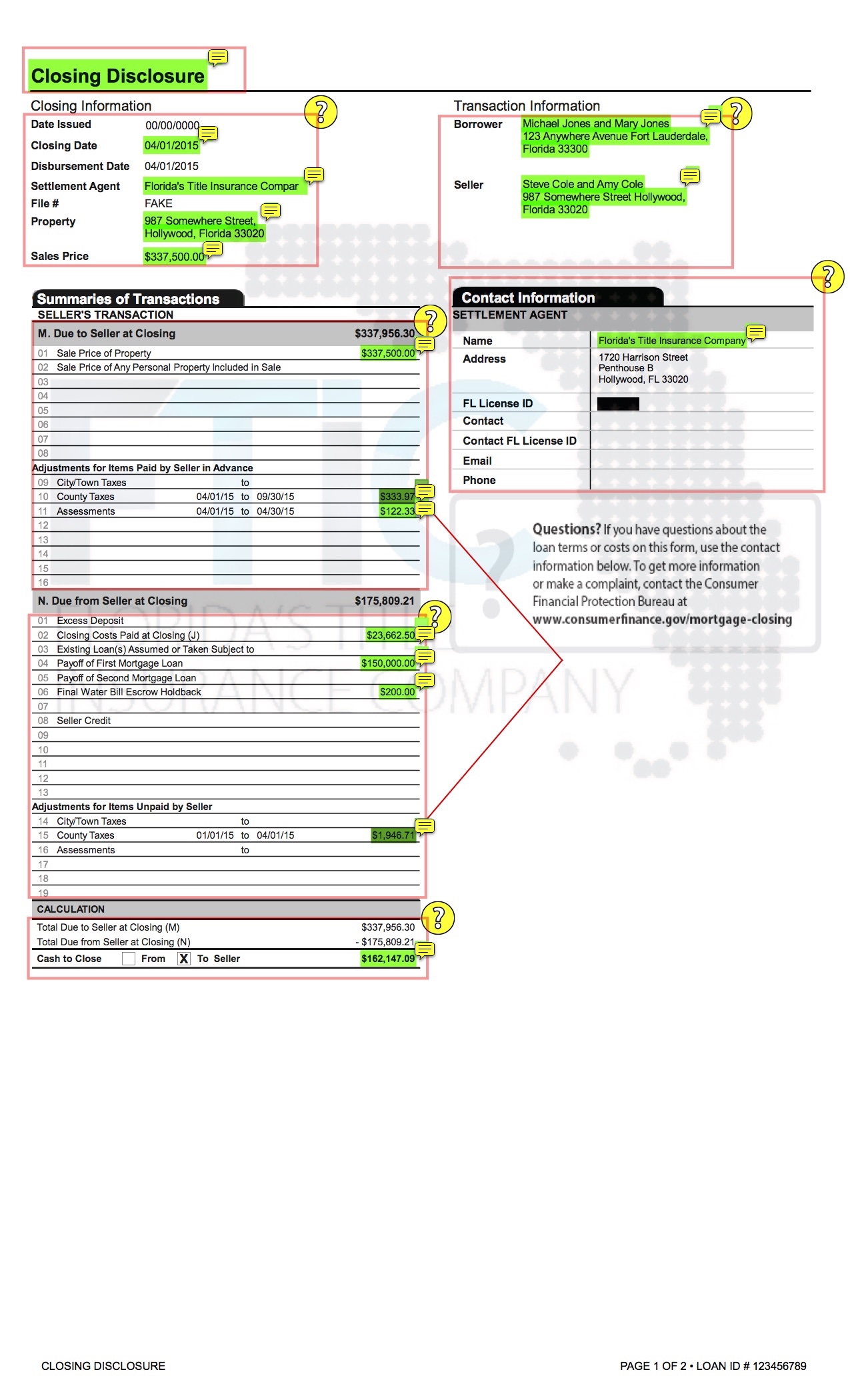

When a mortgage loan is involved the Seller receives a Closing Disclosure (see below). Due to privacy concerns the Seller receives a different Closing Disclosure than the Buyer. While the Buyer’s Closing Disclosure is five (5) pages, the Seller’s Closing Disclosure is only two (2) pages long. The purpose of the Seller’s Closing Disclosure is to show the purchase price and itemize expenses. The Seller’s Closing Disclosure shows the purchase price and then a line item breakdown of every cost paid by the seller in two columns of whether it was paid before or at closing.

Interactive Seller’s Closing Disclosure

(hover over highlighted terms for explanations)

There are two Closing Disclosures when purchasing/selling a property. One is signed by the Buyer (5 pages) and one is signed by the Seller (2 pages). This is one is for the Seller.

Basic Who what whens: identifies the closing date, that we are the title company, the property address, and the purchase price.

Identifies Buyer/Borrower and Seller

Name of Buyer of the property. The term Borrower is used when the Buyer is borrowing money to purchase the property.

Date usually set in the contract as to when ownership of the property will be transferred. The deed and all other required documents are signed, lender funds to disburse, and money is transferred by us as your title company.

Name of the Sellers of the Property.

This identifies us as the one who is doing your closing.

Address of property being purchased.

Purchase price of the property.

Our Contact information

Divides Seller's information into 3 parts:

(1) How much seller gets (+)

(2) How much seller's pays (-)

(3) Totals Seller's net proceeds (=) This identifies us as the one doing your closing. Purchase price of property. There are 2 categories of County Taxes: These are NON-Ad-valorem taxes (e.g. special assessments, such as drainage assessments, garbage, sheriff, voter-approved special purpose assessments for lighting or security).

* In Broward these are fixed from 10/01/year-09/30/year and are pre-paid in advance by the Seller. Therefore the Seller gets a credit for Seller's proportionate share of what the Seller pre-paid. This property is located within a Home Owner's Association (HOA). FTIC obtained an estoppel from the HOA and saw that Seller already pre-paid the HOA's monthly assessment for the entire month of April (even though the property is being sold 04/01). Therefore, Seller is receiving a credit for having pre-paid the HOA fee for the Buyer. Divides Seller's information into 3 parts:

(1) How much seller gets (+)

(2) How much seller's pays (-)

(3) Totals Seller's net proceeds (=) Summary of all the costs being paid by Seller to sell the property. They are itemized on the next page as: (1) transfer taxes, (2) real estate commissions; (3) HOA estoppel fee; (4) Our fee - called a settlement fee. When Seller originally bought this property Seller took out a loan. Now that Seller is selling the property that loan needs to be fully paid off in order to clear title. Therefore, prior to Buyer purchasing this property Sellers' old loan will be paid off. Electric bills are billed by the power company to the individual but water bills are tied to the property. To insure the Buyer that the final water bill is paid after closing, FTIC looks at Seller's last water bill and holds back an amount in relation thereto from Seller's proceeds. Upon confirmation the next There are 2 categories of County Taxes: These are AD-valorem taxes (i.e. latin term meaning 'according to worth.' This is often referred to as “property taxes,” are taxes levied on the assessed value of the property). ** These fees are fixed for the time period of 01/01/year-12/31/year but are not billed by the county until 11/01/year. Because this amount is will not be billed until November (i.e. after the property has already been sold to Buyer), FTIC reviews the prior year's taxes and pro-rates the taxes being charged so that Seller pays for the period (01/01-04/01) that Seller still owned the property. This amount is then credited to the Buyer and will be seen on Buyer's Closing Disclosure. Divides Seller's information into 3 parts:

(1) How much seller gets (+)

(2) How much seller's pays (-)

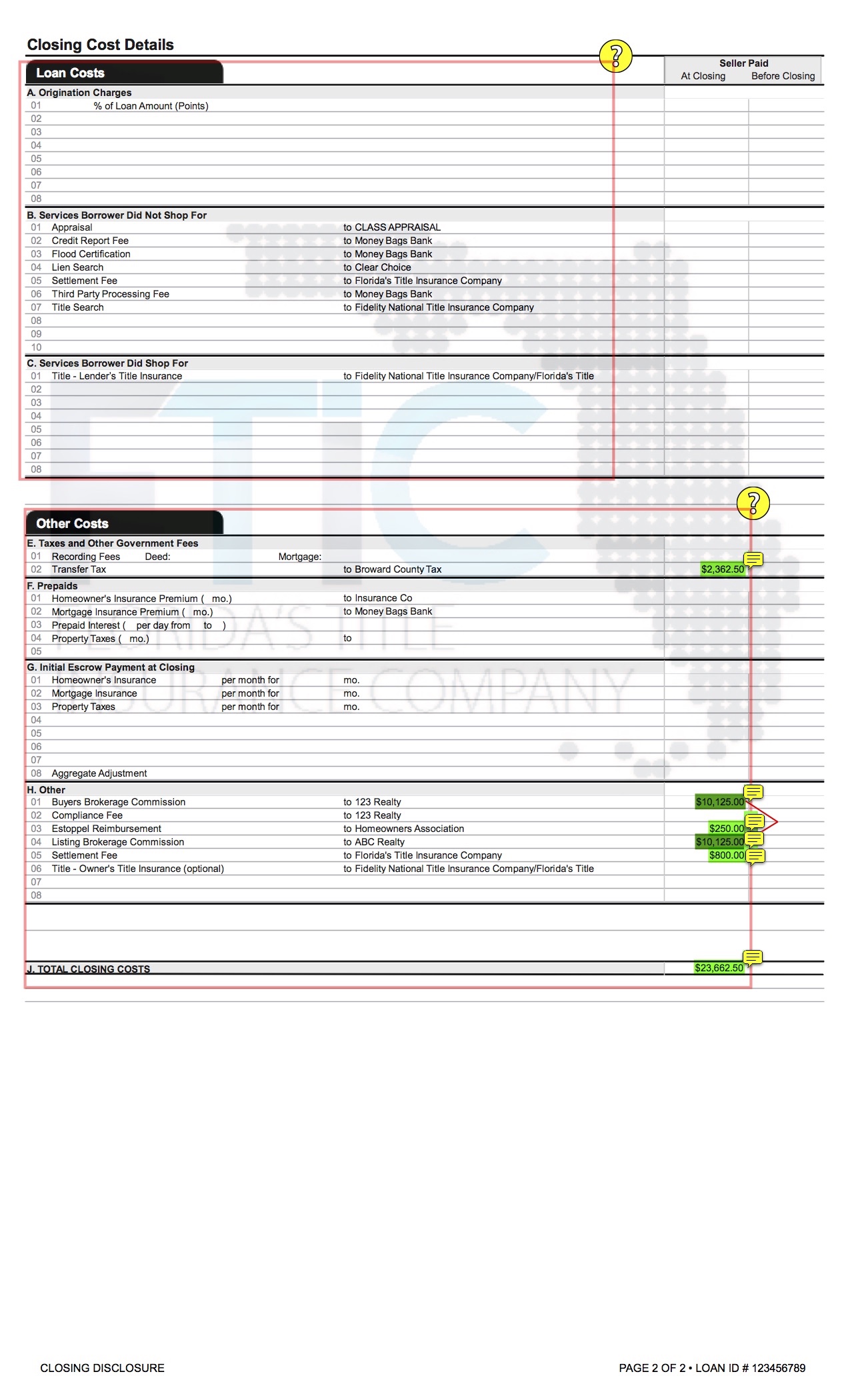

(3) Totals Seller's net proceeds (=) Total amount Seller nets from selling the property after adding (+) and subtracting (-) the above two boxes. No dollar amounts listed because these particular costs were all paid by Buyers. Sometimes Sellers agree to pay these fees for the Buyers as an additional inducement to buyers buying the property. Itemizes Seller's costs to sell the property. * Documentary stamp tax on Deeds (Seller Expense) (this is not a recording fee). In all Florida counties except Miami-Dade, the tax rate imposed on Deeds (e.g., warranty, special warranty, quit claim, trustee's deed, life estate deed, and even transfers of property between spouses) are subject to tax is $0.70 on each $100.00 or portion thereof of the total consideration. But in Miami-Dade County the tax rate is $0.60 cents on each $100 or portion thereof. Miami-Dade County also has a surtax of $0.45 cents on each $100 or portion thereof however single-family dwellings are exempt from the surtax. For example, a Broward County property that sells for $337,500 would = $2,362.50 in documentary stamp taxes (3375 is the number of taxable units representing each $100 or portion thereof of the consideration of $337,500 multiplied by (x) $0.70 = $2,362.50). See, Fla. Stat. §201.02(1)(a), §201.031 Seller pays the real estate commissions to both the selling realtor (known as the listing agent) and the Buyer's real estate agent. The amount of the commission paid will be identified in the "Listing Agreement" signed by the Seller when they hired the realtor (or the on-line MLS). Estoppel Fee charged by Seller's HOA. Seller pays the real estate commissions to both the selling realtor (known as the listing agent) and the Buyer's real estate agent. The amount of the commission paid will be identified in the "Listing Agreement" signed by the Seller when they hired the realtor (or the on-line MLS). Fee paid to FTIC for escrowing and performing the closing. This amount also appears on page 1. It is the total breakdown of the "closing" costs (-) exclusively related to Seller selling the property. There are other costs on page 1 shown, but those are not included here because those seller expenses would have been incurred by Seller regardless of whether the property was sold or not.

(1) How much seller gets (+)

(2) How much seller's pays (-)

(3) Totals Seller's net proceeds (=) This identifies us as the one doing your closing. Purchase price of property. There are 2 categories of County Taxes: These are NON-Ad-valorem taxes (e.g. special assessments, such as drainage assessments, garbage, sheriff, voter-approved special purpose assessments for lighting or security).

* In Broward these are fixed from 10/01/year-09/30/year and are pre-paid in advance by the Seller. Therefore the Seller gets a credit for Seller's proportionate share of what the Seller pre-paid. This property is located within a Home Owner's Association (HOA). FTIC obtained an estoppel from the HOA and saw that Seller already pre-paid the HOA's monthly assessment for the entire month of April (even though the property is being sold 04/01). Therefore, Seller is receiving a credit for having pre-paid the HOA fee for the Buyer. Divides Seller's information into 3 parts:

(1) How much seller gets (+)

(2) How much seller's pays (-)

(3) Totals Seller's net proceeds (=) Summary of all the costs being paid by Seller to sell the property. They are itemized on the next page as: (1) transfer taxes, (2) real estate commissions; (3) HOA estoppel fee; (4) Our fee - called a settlement fee. When Seller originally bought this property Seller took out a loan. Now that Seller is selling the property that loan needs to be fully paid off in order to clear title. Therefore, prior to Buyer purchasing this property Sellers' old loan will be paid off. Electric bills are billed by the power company to the individual but water bills are tied to the property. To insure the Buyer that the final water bill is paid after closing, FTIC looks at Seller's last water bill and holds back an amount in relation thereto from Seller's proceeds. Upon confirmation the next There are 2 categories of County Taxes: These are AD-valorem taxes (i.e. latin term meaning 'according to worth.' This is often referred to as “property taxes,” are taxes levied on the assessed value of the property). ** These fees are fixed for the time period of 01/01/year-12/31/year but are not billed by the county until 11/01/year. Because this amount is will not be billed until November (i.e. after the property has already been sold to Buyer), FTIC reviews the prior year's taxes and pro-rates the taxes being charged so that Seller pays for the period (01/01-04/01) that Seller still owned the property. This amount is then credited to the Buyer and will be seen on Buyer's Closing Disclosure. Divides Seller's information into 3 parts:

(1) How much seller gets (+)

(2) How much seller's pays (-)

(3) Totals Seller's net proceeds (=) Total amount Seller nets from selling the property after adding (+) and subtracting (-) the above two boxes. No dollar amounts listed because these particular costs were all paid by Buyers. Sometimes Sellers agree to pay these fees for the Buyers as an additional inducement to buyers buying the property. Itemizes Seller's costs to sell the property. * Documentary stamp tax on Deeds (Seller Expense) (this is not a recording fee). In all Florida counties except Miami-Dade, the tax rate imposed on Deeds (e.g., warranty, special warranty, quit claim, trustee's deed, life estate deed, and even transfers of property between spouses) are subject to tax is $0.70 on each $100.00 or portion thereof of the total consideration. But in Miami-Dade County the tax rate is $0.60 cents on each $100 or portion thereof. Miami-Dade County also has a surtax of $0.45 cents on each $100 or portion thereof however single-family dwellings are exempt from the surtax. For example, a Broward County property that sells for $337,500 would = $2,362.50 in documentary stamp taxes (3375 is the number of taxable units representing each $100 or portion thereof of the consideration of $337,500 multiplied by (x) $0.70 = $2,362.50). See, Fla. Stat. §201.02(1)(a), §201.031 Seller pays the real estate commissions to both the selling realtor (known as the listing agent) and the Buyer's real estate agent. The amount of the commission paid will be identified in the "Listing Agreement" signed by the Seller when they hired the realtor (or the on-line MLS). Estoppel Fee charged by Seller's HOA. Seller pays the real estate commissions to both the selling realtor (known as the listing agent) and the Buyer's real estate agent. The amount of the commission paid will be identified in the "Listing Agreement" signed by the Seller when they hired the realtor (or the on-line MLS). Fee paid to FTIC for escrowing and performing the closing. This amount also appears on page 1. It is the total breakdown of the "closing" costs (-) exclusively related to Seller selling the property. There are other costs on page 1 shown, but those are not included here because those seller expenses would have been incurred by Seller regardless of whether the property was sold or not.