What is a Title Commitment and how do I read it? After a title search (see above) is done looking for defects in the property’s chain of history that might lead to future problems, a “Title Commitment” is issued informing that the title company has committed to insuring the property. The buyer has several days to talk to their title company or their agent if they have questions or they find anything unacceptable on the title commitment. The Title Commitment is divided into two (2) sections:

Schedule A is like the cover page. It lists the lists the: (1) Effective date of the insurance policy; (2a) Dollar Amount of the Policy; (2b) Names of the insureds (e.g. New Owner and/or Lender); (3) Name of the Seller of the Property; and (4) identification of the land being insured.

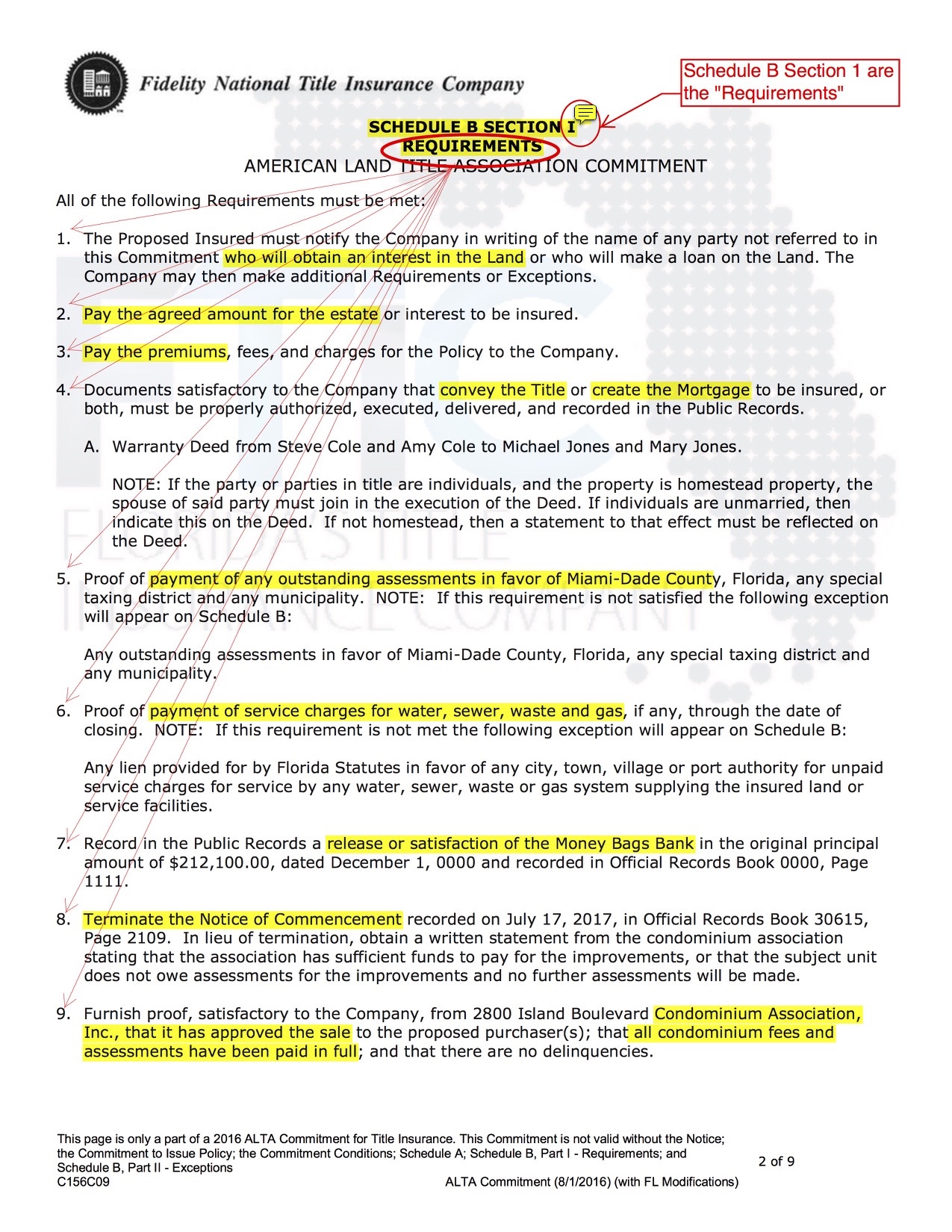

Schedule B -1 includes the Requirements. The Requirements are what must be done before the title insurance can be issued and property can close. If any of the Requirements can’t be met, there may be a delay or cancellation of the sale. Some of the Requirements may be recording of a new deed, releases of various liens, tax payments, copy of trust paperwork, or proof of identify, payoff of mortgages, liens, judgments, Home Equity Lines (HELOC).

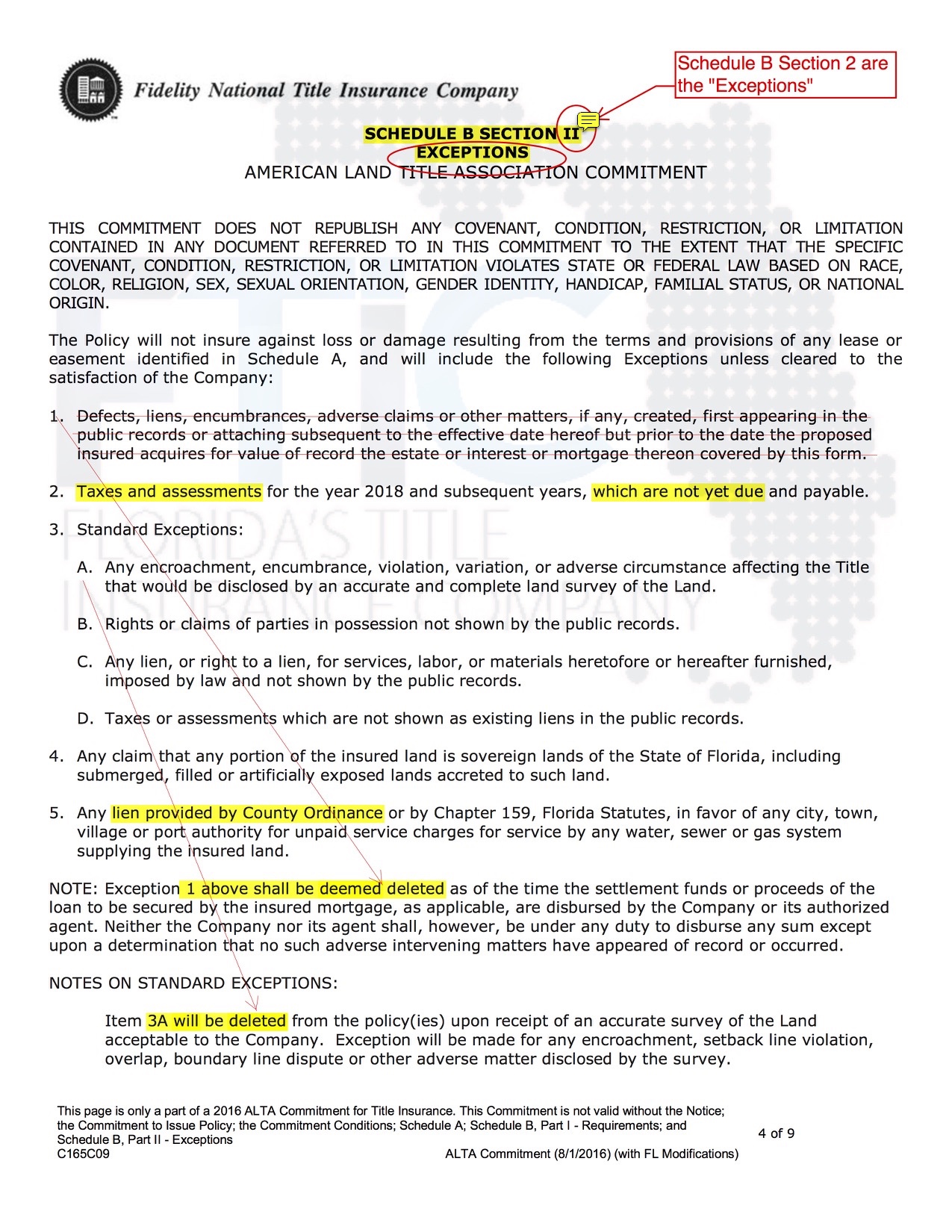

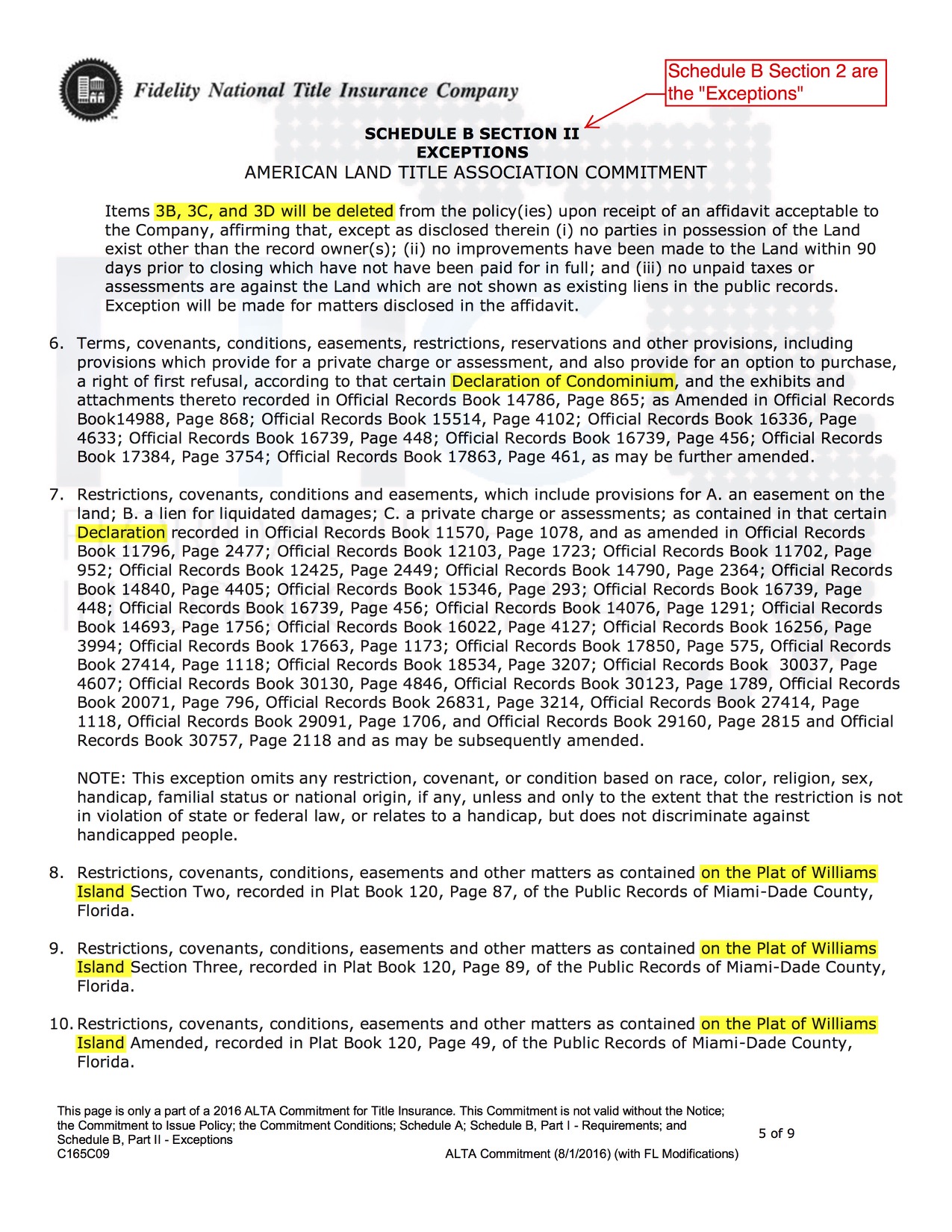

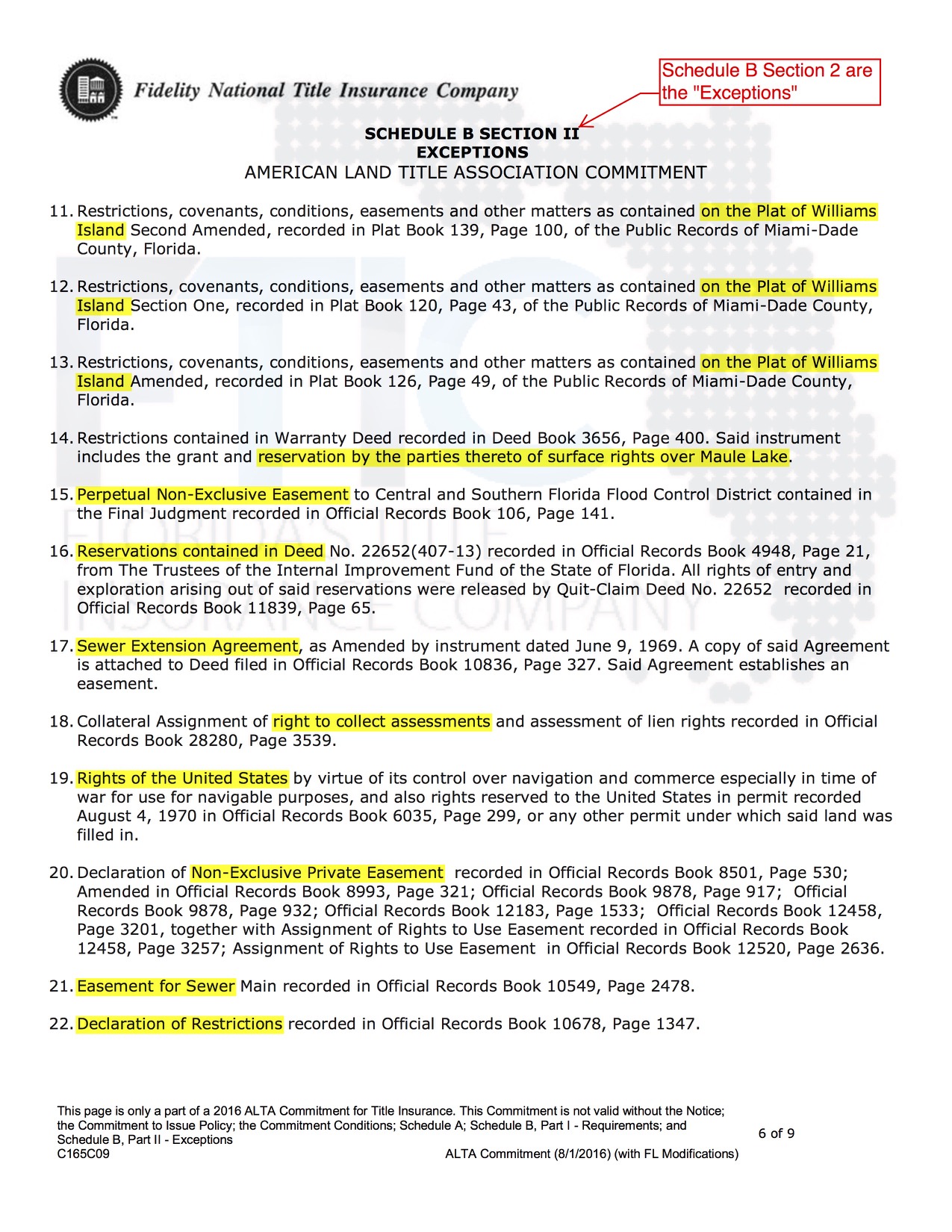

Schedule B-2 includes the Exceptions. Exceptions are what the title company will not cover against (including certain exceptions that are standard, like water or mineral rights.) If the problem is listed in Schedule B, the title insurance policy will not cover against it (nor pay attorney or court fees regarding the problem.) If the buyer protests some Exception, the title company may be convinced to insure over it (with an endorsement) or obtain a release, or other document to eliminate the exception. Some examples of Exceptions are interests in the land that can only be found at inspection, easements, and tax assessments for new construction. The buyer, however, should read the Exceptions section carefully as there may be a limited time to make any objections before the title insurance is issued and the closing is completed.

After the Closing, the title insurance policy is issued.

Fidelity National Title: We here at FTIC write our title insurance through and are backed by Fidelity National Title which is a Fortune 500 Company.

Schedule A: Title Commitments are broken down into three (3) parts:

(1) Schedule A,

(2) Schedule B-1 (Requirements); and

(3) Schedule B-2 (Exceptions).

* Schedule A is short and generally shows identifying information.

Title Commitment: This is an offer to insure title at a future date. The Title Commitment reflects the current status of title, sets forth the requirements (in Schedule B-1) that must be completed before the property can be insured, lists the exceptions (Schedule B-2) for which insurance coverage is excluded, and commits to insure title by issuing what is called a final Title Policy based on stated conditions.

Commitment Date: This will be the same date as the closing.

Proposed Insured: Only a proposed insured who is identified, and no other person, may make a claim under this commitment. The Buyers are identified as the insureds. This is called an "Owner's Policy." When a lender is involved they typically require their own additional "Lender's Policy" be issued in their name and they are shown as an additional insured. This deal was an all cash deal with no financing (i.e. no loan).

Amount of Insurance: The dollar amount of the insurance policy. Because this is an Owner's Policy for the buyers of the property the amount is set at the Buyers' purchase price. Had this been a Lender's Policy then the amount of the policy would have been for the amount of the lender's loan (typically loans are about 20% less than 100% of the purchase price).

Estate or Interest in Land: This is shown as Fee Simple which is the greatest form of ownership recognized by law, entitling the owner to unrestricted powers to dispose of the property.

Title to the Fee Simple estate: The Sellers of the Property.

The Land: Identifies the legal description of the property being insured (when it is long it is attached as an exhibit).

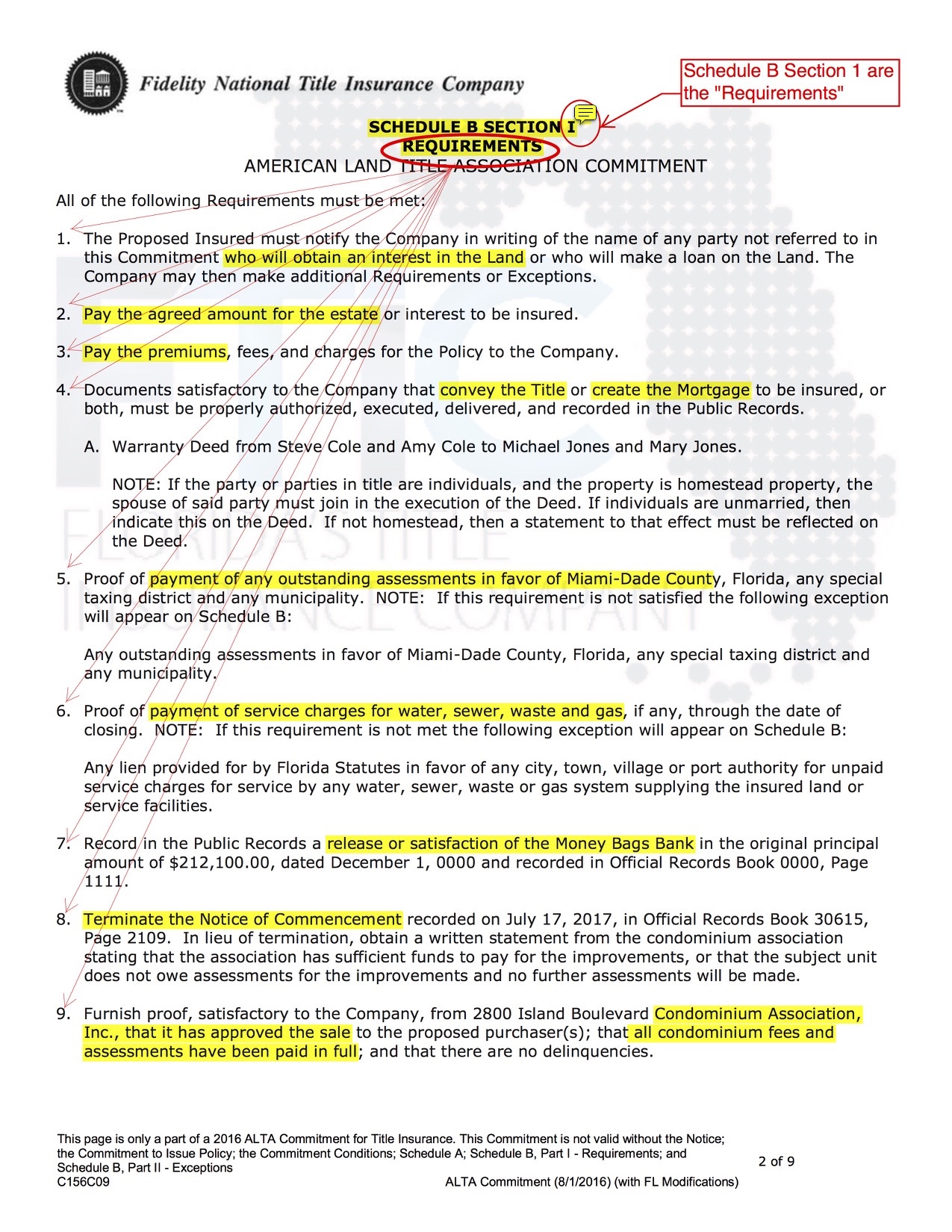

Schedule B-1 (Requirements): Title Commitments are broken down into three (3) parts:

(1) Schedule A,

(2) Schedule B-1 (Requirements); and

(3) Schedule B-2 (Exceptions).

* Schedule B-1 are all the "requirements" that FTIC as your title company needs to complete in order to issue clear title:

1. Identify Name of owners and lenders.

2. Pay Seller the purchase price.

3. Pay the insurance premium

4. Sign Deed + Sign Mortgage + Record both

5. Pay off County Assessments

6. Pay off water, sewer, waste, and gas

7. Pay off outstanding mortgage

8. Terminate Contractor’s Notice of Commencement

9. Obtain Condo Approval + Pay off Condo Ass’n fees

10. Pay off Master Ass’n fees

11. Affidavit

12. Pay off taxes

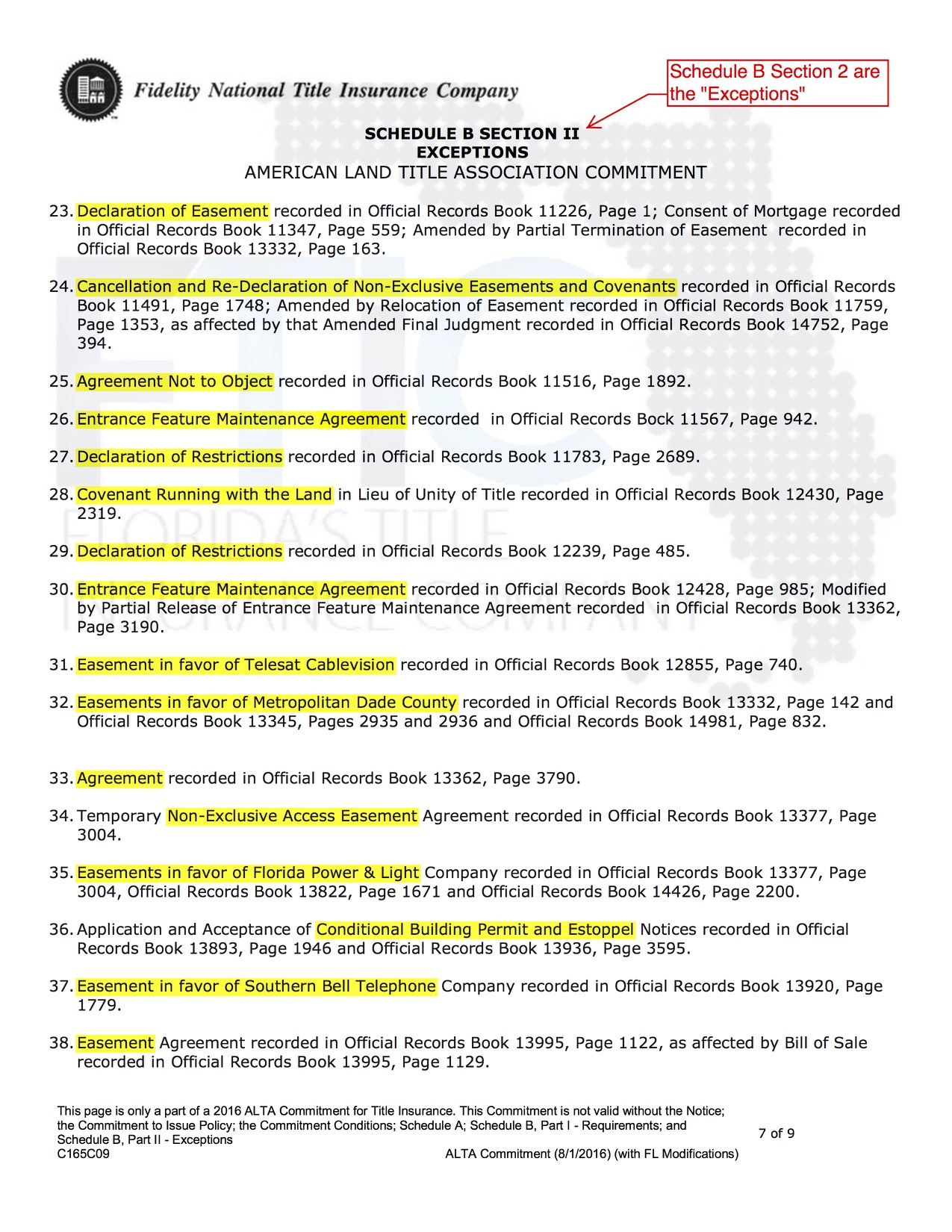

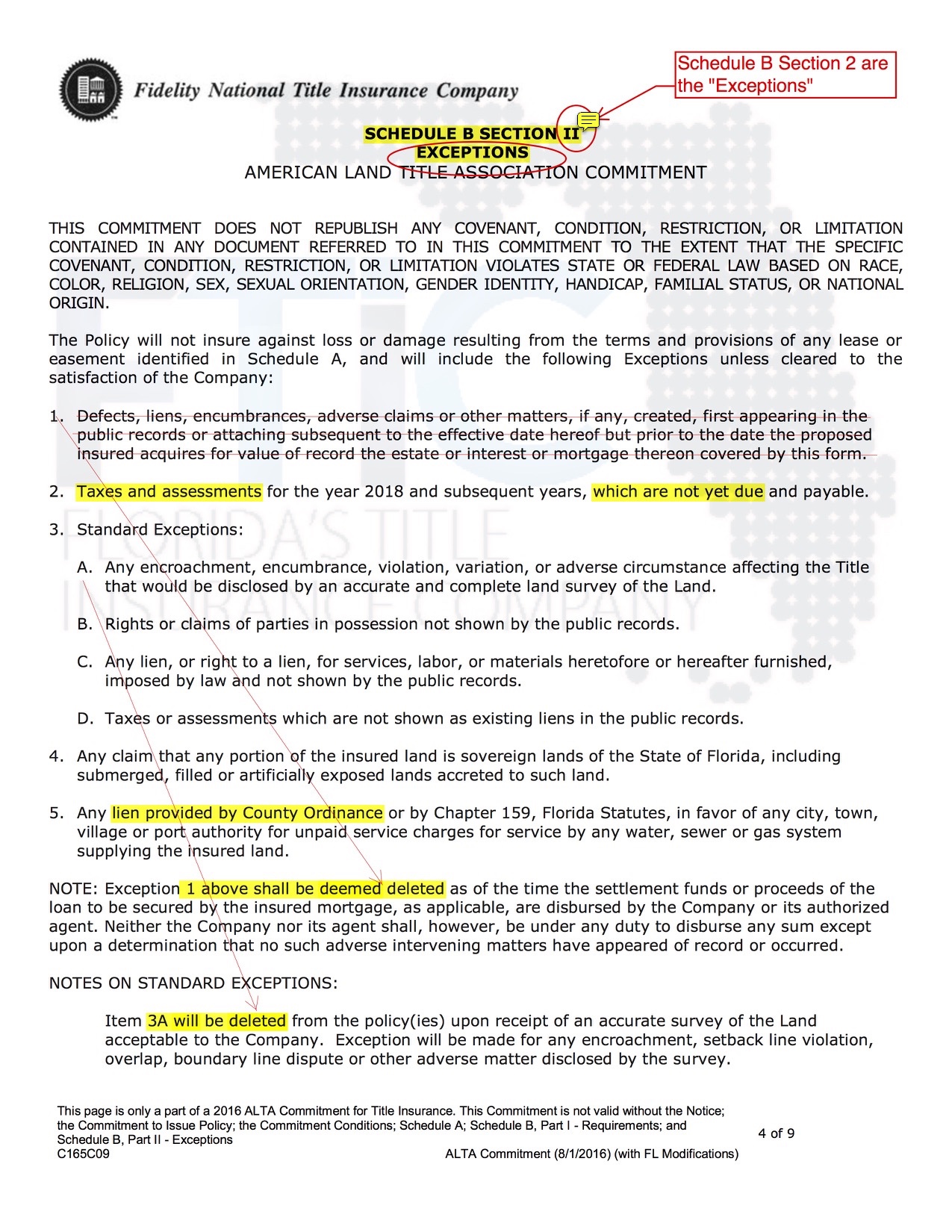

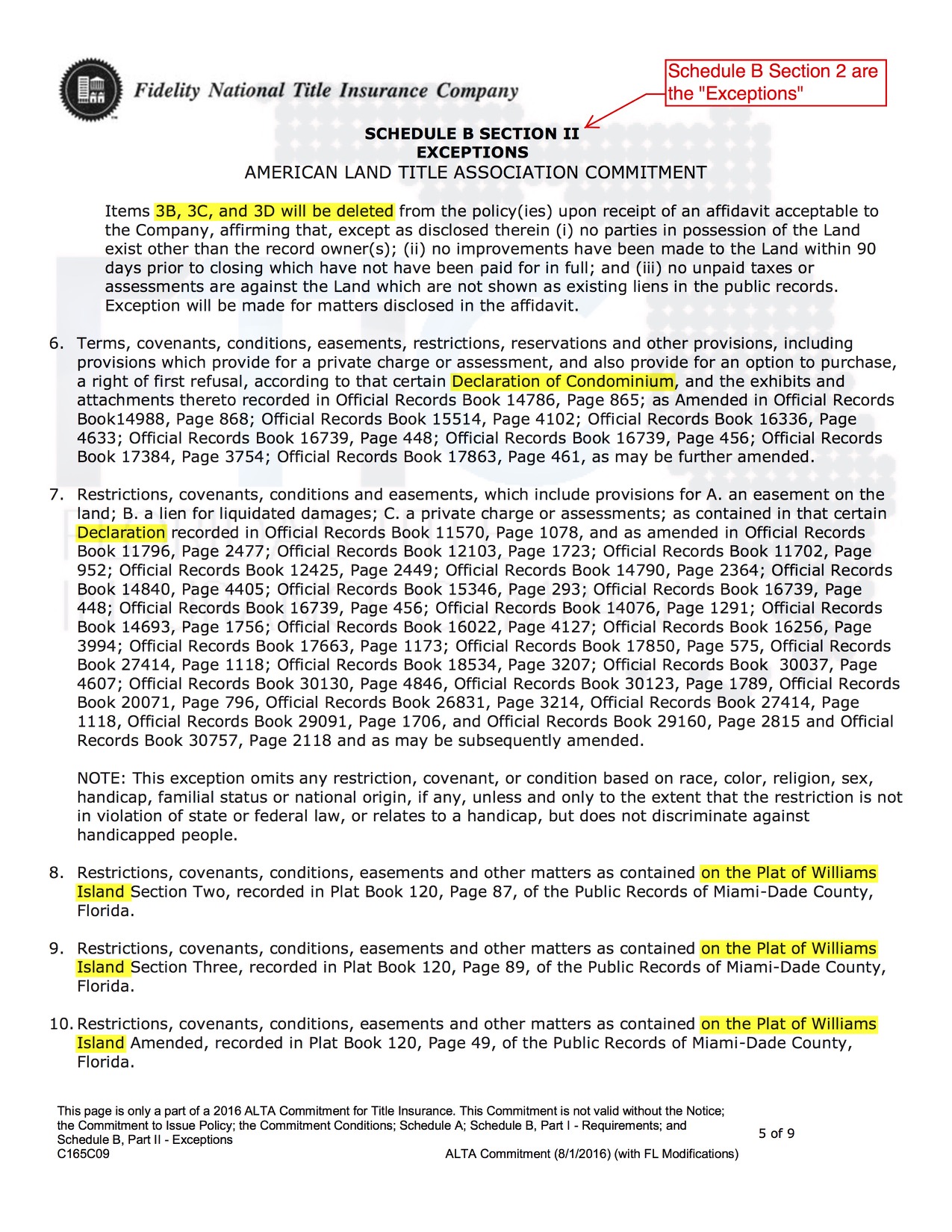

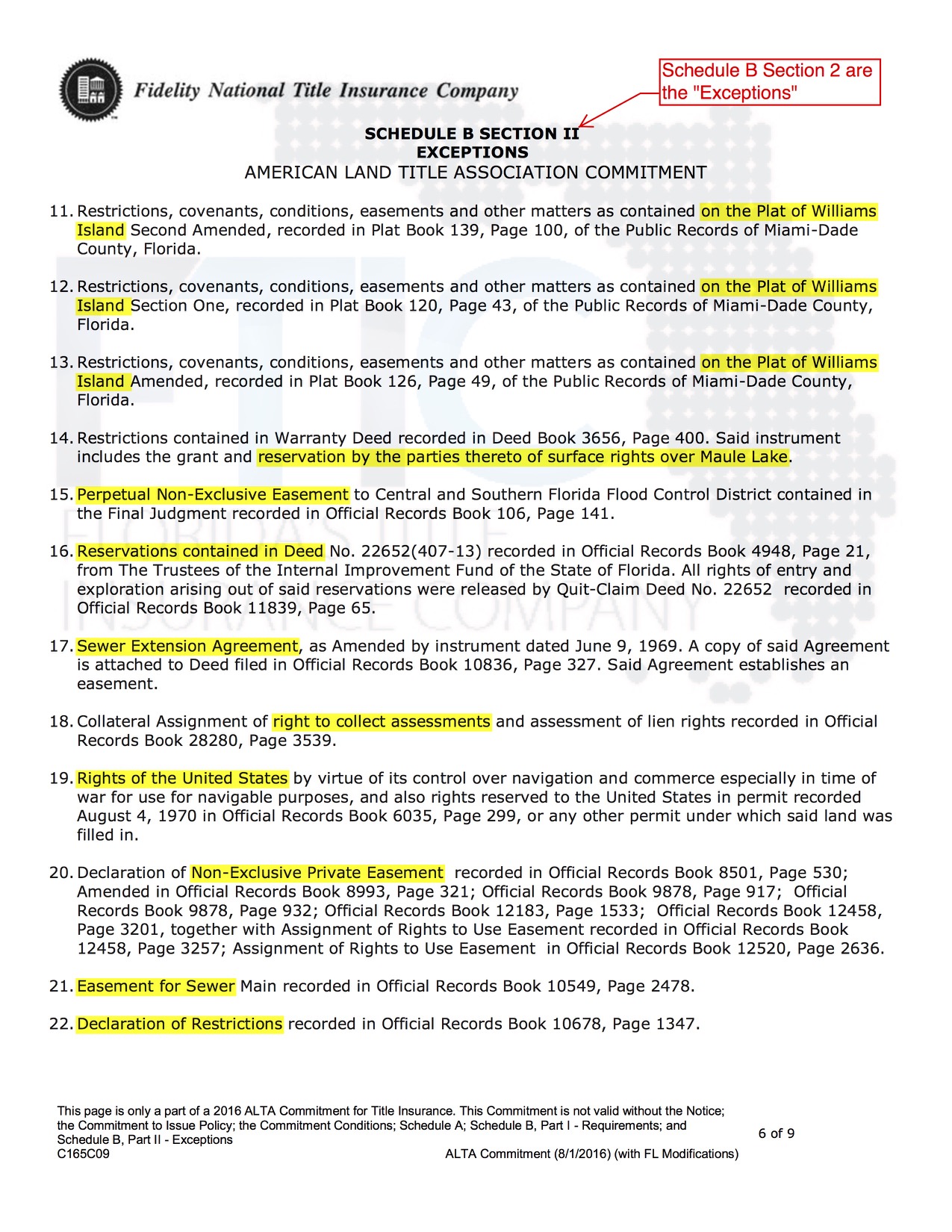

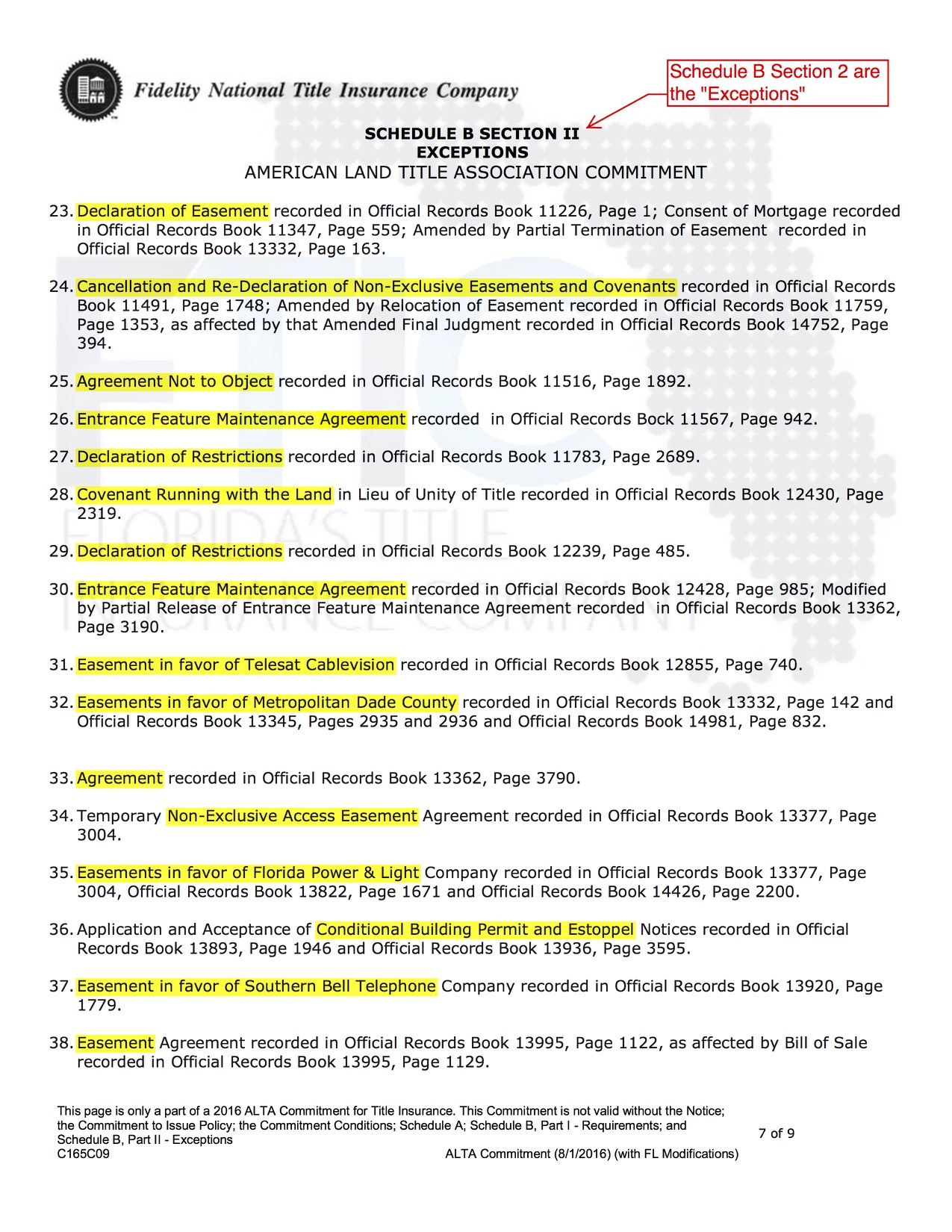

Schedule B-2 (Exceptions): Title Commitments are broken down into three (3) parts:

(1) Schedule A,

(2) Schedule B-1 (Requirements); and

(3) Schedule B-2 (Exceptions).

* Schedule B-2 are what the title company will not cover meaning the title insurance policy will not cover against the particular issue (nor pay attorney or court fees regarding the problem.) But remember, a title commitment is only a pre-liminary. Once the requirements listed on Schedule B-1 are performed, some of the important exceptions will be removed from Schedule B-2 and coverage will eventually be provided once the deal closes. Once the requirements are fulfilled, the exceptions will be deleted and will be shown in either what is called a "Marked up Title Commitment" or the final Title Policy.

In this particular commitment there are many exceptions relating to the property being subject to all sorts of condominium rights, easements or rights of way from FP&L and the cable companies; taxes which are not yet due; liens for unpaid water, sewer and gas (that is why a separate municipal lien search is performed); navigable water rights, etc...

test test