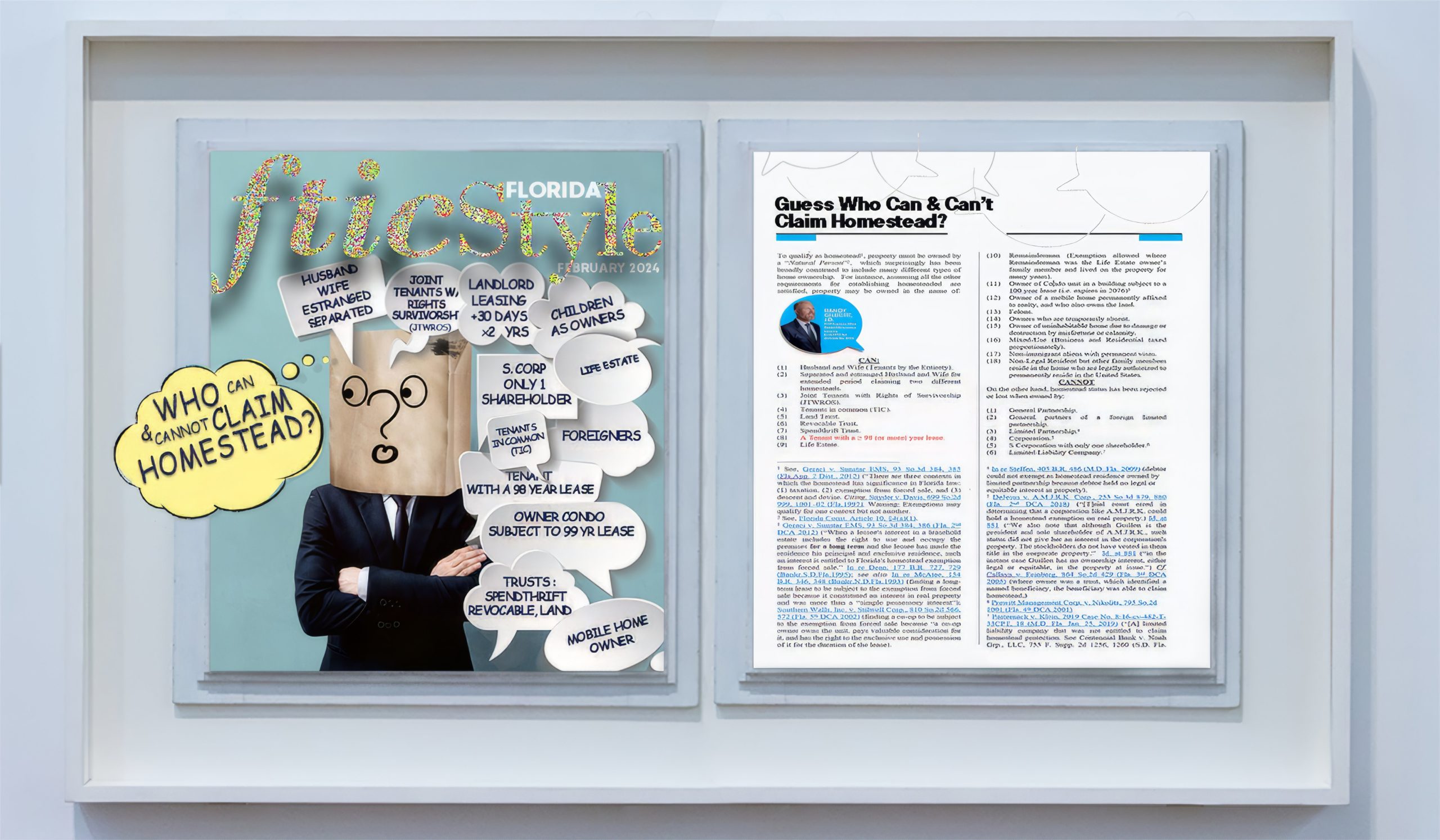

To qualify as homestead[1], property must be owned by a “Natural Person”[2], which surprisingly has been broadly construed to include many different types of home ownership.[3] For instance, assuming all the other requirements[4] for establishing homesteaded are satisfied, property may be owned in the name of:

CAN:

- Husband and Wife (Tenants by the Entirety).[5]

- Separated and estranged Husband and Wife for extended period claiming two different homesteads.[6]

- Joint Tenants with Rights of Survivorship (JTWROS). [7]

- Tenants in common (TIC). [8]

- Land Trust.[9]

- Revocable Trust.[10]

- Spendthrift Trust.[11]

- A Tenant with a ≥ 98 (or more) year lease.[12]

- Life Estate.[13]

- Remainderman (Narrow exemption allowed where Remainderman was the Life Estate owner’s family member and lived on the property for many years).[14]

- Owner of Condo unit in a building subject to a 100 year lease (i.e. expires in 2076)[15]

- Owner of a mobile home permanently affixed to realty, and who also owns the land.[16]

- Felons.[17]

- Owners who are temporarily absent.[18]

- Owner of uninhabitable home due to damage or destruction by misfortune or calamity.[19]

- Mixed-Use (Business and Residential taxed proportionately).[20]

- Non-immigrant aliens with permanent visas.[21]

- Non-Legal Resident but other family members reside in the home who are legally authorized to permanently reside in the United States.[22]

CANNOT

On the other hand, homestead status has been rejected or lost when owned by:

- General Partnership.[23]

- General partners of a foreign limited partnership.[24]

- Limited Partnership.[25]

- Corporation.[26]

- S Corporation with only one shareholder.[27]

- Limited Liability Company.[28]

- Landlord/Homeowner leasing all or substantially all of a dwelling for more than 30 days per calendar year for 2 consecutive years.[29]

- Tenant with a year-to-year lease.[30]

- Remainderman[31]

- Unmarried Minor with permanent home away from his parents. [32]

- Multiple-Home Owner.[33]

- Non-Legal residents. [34]

- Non-immigrant aliens on temporary visas.[35]

DISCLAIMER: Topics discussed are general concepts, not intended to constitute legal advice, accuracy, nor completeness, and may not be relied upon as such; consult an attorney or accountant. The author Randy Gilbert, J.D. is neither an attorney nor an accountant. FTIC is a national award winning title insurance company known for its white glove customer service and “No Junk Fee Guarantee.”

[1] See, Geraci v. Sunstar EMS, 93 So.3d 384, 385 (Fla.App. 2 Dist., 2012) (“There are three contexts in which the homestead has significance in Florida law: (1) taxation, (2) exemption from forced sale, and (3) descent and devise. Citing, Snyder v. Davis, 699 So.2d 999, 1001–02 (Fla.1997). Warning: Exemptions may qualify for one context but not another.

[2] See, Florida Const. Article 10, §4(a)(1).

[3] See, Aronson v. Aronson, 81 So.3d 515, 519 (Fla. 3rd DCA 2012) (“The estate owned need not be fee simple, but may be any type of interest in the property, legal or equitable, so long as the interest is a possessory interest. See Hill v. First Nat’l Bank of Marianna, 75 So. 614 (Fla. 1917) (tenancy in common); Smith v. Unkefer, 515 So.2d 757 (Fla. 2nd DCA 1987) (life estate); Heiman v. Capital Bank, 438 So.2d 932 (Fla. 3rd DCA 1983) (equitable interest); but see Aetna Ins. Co. v. LaGasse, 223 So.2d 727 (Fla. 1969) (remainder interest does not qualify [where there was no present right to possession and lien attached prior to homestead attaching].”) Cf. In re Williams, Infra.

[4] See, Aronson v. Aronson, 81 So.3d 515 (Fla. 3rd DCA 2012) (“Three requirements must be satisfied for real property to be impressed with the characteristics of homestead property under article X, section 4 of the Florida Constitution: (1) the property must be owned by a “natural person”; (2) the owner must have made, or intend to make the real property his or her permanent residence or that of his family; and (3) the property must meet the size and contiguity requirements of article X, section 4(a)(1) of the Florida Constitution [i.e. 160 acres of contiguous land and improvements thereon if located outside a municipality, or ½ acre of contiguous land if within a municipality].”)

[5] Florida Const. Article 7 §6(a) (“The real estate may be held by legal or equitable title, by the entireties, jointly, in common, as a condominium, or indirectly by stock ownership or membership representing the owner’s or member’s proprietary interest in a corporation owning a fee or a leasehold initially in excess of ninety-eight years.”); Fla. Stat. §196.031(1)(a) (“Such title may be held by the entireties, jointly, or in common with others, and the exemption may be apportioned among such of the owners as reside thereon, as their respective interests appear.”)

[6] Colwell v. Royal International Trading Corp., 226 B.R. 714 (S.D. FL 1998) (overruling creditor objection to separate homestead exemptions claimed by a separated and estranged husband and wife for an extended period of time in different residences deeded to them in their individual capacities were each entitled to claim separate homestead exemption).

[7] Id., See also, Callava v. Feinberg, 864 So.2d 429, 431 (Fla. 3rd DCA 2003) (“[T]he individual claiming homestead exemption need not hold fee simple title to the property.”)

[8] See FN 5.

[9] See, Attorney General Opinion 2008-44, and Fla. Stat. §689.071(8)(h) (“The principal residence of a beneficiary shall be entitled to the homestead tax exemption even if the homestead is held by a trustee in a land trust, provided the beneficiary qualifies for the homestead exemption under chapter 196.”)

[10] Cutler v. Cutler, 994 So.2d 341, 343 (Fla. 3rd DCA 2008)(“This court, and other district courts of appeal as well, have confirmed that property held in trust may be impressed, legally speaking, with the character of homestead.”) In re Edwards, 356 B.R. 807, 810–11 (Bkrtcy.M.D.Fla.,2006) summarizing (“The Florida Appellate Court ruled in Engelke v. Estate of Engelke, 921 So.2d 693, 696 (Fla. 4th DCA 2004) a revocable trust was constitutionally protected homestead property and could not be used to pay claims and expenses of the grantor’s estate. The grantor of the trust retained an ownership interest in the property since the trust was revocable. The trust, due to its revocable nature, was owned by a ‘natural person’ within the meaning of the Florida homestead exemption. The revocable trust only held title to the property, while the grantor retained ownership.”); Rule 12D-7.011, Fla. Admin. (“The beneficiary of a passive or active trust has equitable title to real property if he is entitled to the use and occupancy of such property under the terms of the trust; therefore, he has sufficient title to claim homestead exemption. AGO 90-70. Homestead tax exemption may not be based upon residence of a beneficiary under a trust instrument which vests no present possessory right in such beneficiary.”)

[11] See, HCA Gulf Coast Hospital v. Estate of Downing, 594 So. 2d 774 (Fla. 1st DCA 1992)

[12] Florida Statute §196.041(1), entitled homestead exemptions,(“… lessees owning the leasehold interest in a bona fide lease having an original term of 98 years or more in a residential parcel … for the purpose of homestead exemptions from ad valorem taxes and no other purpose, shall be deemed to have legal or beneficial and equitable title to said property.”)

[13] Southern Walls, Inc. v. Stilwell Corp., 810 So.2d 566, 570 (Fla. 5th DCA 2002) citing, Hill v. First Nat’l Bank, 73 Fla. 1092, 75 So. 614 (1917) (“life estate interest is sufficient beneficial interest in property to qualify for homestead exemption.”) See also, Fla. Stat. §196.041(2) (“A person who otherwise qualifies by the required residence for the homestead tax exemption provided in s. 196.031 shall be entitled to such exemption where the person’s possessory right in such real property is based upon an instrument granting to him or her a beneficial interest for life, such interest being hereby declared to be “equitable title to real estate,” as that term is employed in s. 6, Art. VII of the State Constitution; and such person shall be entitled to the homestead tax exemption irrespective of whether such interest was created prior or subsequent to the effective date of this act.”); Rule 12D-7.009(1), Fla. Admin. (“A life estate will support a claim for homestead exemption.”)

[14] In re Williams, 427 B.R. 541, 545 (Bankr. M.D. Fla. 2010). (“Pursuant to article X, section 4 of the Florida Constitution, property must also be the ‘the residence of the owner or the owner’s family’ in order to qualify as exempt homestead.”), distinguishing Aetna Ins. Co. v. LaGasse, 223 So.2d 727 (Fla. 1969) (remainder interest did not qualify where there was no present right to possession and lien attached prior to homestead attaching.)

[15] Geraci v. Sunstar EMS, 93 So.3d 384, 386 (Fla. 2nd DCA 2012) (“When a lessee’s interest in a leasehold estate includes the right to use and occupy the premises for a long term and the lessee has made the residence his principal and exclusive residence, such an interest is entitled to Florida’s homestead exemption from forced sale.” In re Dean, 177 B.R. 727, 729 (Bankr.S.D.Fla.1995); see also In re McAtee, 154 B.R. 346, 348 (Bankr.N.D.Fla.1993) (finding a long-term lease to be subject to the exemption from forced sale because it constituted an interest in real property and was more than a “simple possessory interest”); Southern Walls, Inc. v. Stilwell Corp., 810 So.2d 566, 572 (Fla. 5th DCA 2002) (finding a co-op to be subject to the exemption from forced sale because “a co-op owner owns the unit, pays valuable consideration for it, and has the right to the exclusive use and possession of it for the duration of the lease).

[16] Rule 12D-7.0135(1), Fla. Admin. (“(1) For purposes of qualifying for the homestead exemption, the mobile home must be determined to be permanently affixed to realty, as provided in rule Chapter 12D-6, F.A.C. Otherwise, the applicant must be found to be making his permanent residence on realty. (2) Where a mobile home owner utilizes a mobile home as a permanent residence and owns the land on which the mobile home is located, the owner may, upon proper application, qualify for a homestead exemption.)

[17] Rule 12D-7.014(1), Fla. Admin. (“Although loss of suffrage is one consequence of a felony conviction, the person so convicted is not thereby deprived of his right to obtain homestead exemption.”)

[18] Rule 12D-7.013(1),(3), Fla. Admin. (Temporary absence from the homestead for health, pleasure or business reasons would not deprive the property of its homestead character. (Lanier v. Lanier, 116 So. 867 (Fla. 1928)). “Temporary absence, regardless of the reason for such, will not deprive the property of its homestead character, providing an abiding intention to return is always present. This abiding intention to return is not to be determined from the words of the homesteader, but is a conclusion to be drawn from all the applicable facts. (City of Jacksonville v. Bailey, 30 So.2d 529 (Fla. 1947)”)

[19] Rule 12D-7.013(6) Fla. Admin. (“Homestead property that is uninhabitable due to damage or destruction by misfortune or calamity shall not be considered abandoned in accordance with the provisions of Section 196.031(6), F.S., where: (a) The property owner notifies the property appraiser of his or her intent to repair or rebuild the property, (b) The property owner notifies the property appraisers of his or her intent to occupy the property after the property is repaired or rebuilt, (c) The property owner does not claim homestead exemption elsewhere, and (d) The property owner commences the repair or rebuilding of the property within three (3) years after January 1 following the damage or destruction to the property.”)

[20] Rule 12D-7.013(5), Fla. Admin. (Property used as a residence and also used by the owner as a place of business does not lose its homestead character. The two uses should be separated with that portion used as a residence being granted the exemption and the remainder being taxed.”); Furst v. Rebholz, 361 So.3d 293 (Fla., 2023) (Granting homestead tax exemption to Landlord living on first floor of a single-family house, but not to the other 15% rented to the exclusive use of tenants.)

[21] See, FN 35.

[22] See, FN 35.

[23] Buchman v. Canard, 926 So. 2d 390, 392 (Fla. 3rd DCA 2005). (“Property acquired by a partnership is property of the partnership, not the individual partners. Thus, partnership property cannot constitute the homestead property of one partner prior to the dissolution of the partnership.”)

[24] Florida Attorney General Opinion 2005-52 (“general partners of a foreign limited partnership were not entitled to claim a homestead exemption on the residential property owned by the partnership. In reaching this conclusion, this office relied on earlier opinions of this office and the decision by the Fourth District Court of Appeal in Prewitt Management Corporation v. Nikolits, 795 So. 2d 1001, 1002 (Fla. 4th DCA 2001) in which the court held that a corporate entity of a type not enumerated under section 196.031 or section 196.041, Florida Statutes, which holds title to residential real property, is not qualified for the homestead tax exemption under Article VII, section 6 of the Florida Constitution.”)

[25] In re Steffen, 405 B.R. 486 (M.D. Fla. 2009) (debtor could not exempt as homestead residence owned by limited partnership because debtor held no legal or equitable interest in property).

[26] DeJesus v. A.M.J.R.K. Corp., 255 So.3d 879, 880 (Fla. 2nd DCA 2018) (“[T]rial court erred in determining that a corporation like A.M.J.R.K. could hold a homestead exemption on real property.) Id. at 881 (“We also note that although Guillen is the president and sole shareholder of A.M.J.R.K., such status did not give her an interest in the corporation’s property. The stockholders do not have vested in them title in the corporate property.” Id. at 881 (“in the instant case Guillen has no ownership interest, either legal or equitable, in the property at issue.”) Cf. Callava v. Feinberg, 864 So.2d 429 (Fla. 3rd DCA 2003) (where owner was a trust, which identified a named beneficiary, the beneficiary was able to claim homestead.)

[27] Prewitt Management Corp. v. Nikolits, 795 So.2d 1001 (Fla. 4th DCA 2001)

[28] Pasternack v. Klein, 2019 Case No. 8:16-cv-482-T-33CPT, 18 (M.D. Fla. Jan. 25, 2019) (“[A] limited liability company that was not entitled to claim homestead protection. See Centennial Bank v. Noah Grp., LLC, 755 F. Supp. 2d 1256, 1260 (S.D. Fla. 2010) (holding property titled in the name of a limited liability company was not entitled to homestead protection). At most, Klein owned an interest in a limited liability company that owned the property, which is insufficient under Florida law to obtain homestead protection.”)

[29] Haddock v. Carmody, 1 So.3d 1133 (Fla. 1st DCA 2009) (Homeowners lost homestead exemption under Fla. Stat. §196.061 when they rented the entire home, even though they still reserved two locked closets for personal storage which was a de minimis amount of space within the structure.); Fla. Stat. §196.061(1) (“The rental of all or substantially all of a dwelling previously claimed to be a homestead for tax purposes shall constitute the abandonment of such dwelling as a homestead, and the abandonment continues until the dwelling is physically occupied by the owner. However, such abandonment of the homestead after January 1 of any year does not affect the homestead exemption for tax purposes for that particular year unless the property is rented for more than 30 days per calendar year for 2 consecutive years.”)

[30] In re Tenorio, 107 B.R. 787, 788–89 (Bkrtcy.S.D.Fla.,1989) (One person cannot claim an exemption in another person’s property. In addition, a year to year lease such as the one at hand, evidences a lack of intent to make the property her permanent place of residence—a requirement of homestead property. … A debtor must have an ownership interest in the property being claimed as exempt. A year to year lease does not constitute the requisite ownership interest. In addition, leases of this type are typically classified as chattels real, and regarded as personal property—not real property.”)

[31] See, FN 14. See also, Rule 12D-7.010, Fla. Admin. “(1) A future estate, whether vested or contingent, will not support a claim for homestead exemption during the continuance of a prior estate. (Aetna Ins. Co. v. LaGasse, 223 So.2d 727 (Fla. 1969)). (2) If the remainderman is in possession of the property during a prior estate, he must be claiming such right to possession under the prior estate and not by virtue of his own title; it must be presumed that the right granted under the life estate is something less than real property and incapable of supporting a claim for homestead exemption.”

[32] Rule 12D-7.014(2), Fla. Admin. (“An unmarried minor whose disabilities of non-age have not been removed may not maintain a permanent home away from his parents such as to entitle him or her to homestead exemption.”)

[33] Rule 12D-7.012, Fla. Admin. (“(1) No residential unit shall be entitled to more than one homestead tax exemption. (2) No family unit shall be entitled to more than one homestead tax exemption. (3) No individual shall be entitled to more than one homestead tax exemption.”)

[34] See, FN 35.

[35] In re De Bauer, 628 B.R. 355, 358 (Bkrtcy. M.D.Fla., 2021) (Debtor cannot form an actual intent to live permanently in the Home. She is not a legal resident of the United States. Courts uniformly hold homeowners who lack permanent resident status in the United States cannot claim a homestead exemption under Florida law because they subjectively cannot formulate an intent to live here forever. … Non-immigrant aliens in the United States on temporary rather than permanent visas are incapable of formulating the requisite intent to establish permanent residence. … [BUT] A few courts have extended the right to claim Florida homestead protection, however, when the debtor has family members residing at the claimed homestead who are legally authorized to permanently reside in the United States.”); DeQuervain v. Desguin, 927 So.2d 232 (Fla. 2d DCA 2006) (Alien with temporary and not permanent visa did not establish requisite intent to become permanent residents for purposes of the homestead exemption, despite homeowners immigrating from Switzerland, residing legally in Florida, living and working in county for 5+ years, held Social Security numbers and drivers’ licenses, paid federal income tax, and filed Declaration of Domicile in Florida); Rule 12D-7.007, Fla. Admin. (1) For one to make a certain parcel of land his permanent home, he must reside thereon with a present intention of living there indefinitely and with no present intention of moving therefrom. (2) A property owner who, in good faith, makes real property in this state his permanent home is entitled to homestead tax exemption, notwithstanding he is not a citizen of the United States or of this State. (3) A person in this country under a temporary visa cannot meet the requirement of permanent residence or home and, therefore, cannot claim homestead exemption.