How to Read a Buyer’s Closing Disclosure

If you are getting a mortgage, then a Closing Disclosure is a five (5) page form that provides final details about the terms of your mortgage loan. The lender is required to give you the Closing Disclosure at least three (3) business days before you close. This three (3) day window allows you time to compare your final terms and costs to those estimated in the Loan Estimate which you originally received from your lender. An interactive sample to help you understand is below.

(hover over highlighted terms for explanations)

Your total monthly payment will typically be more than this amount due to taxes and insurance. See the Estimated Total Monthly Payment. Pre-payment Penalty:A feature on some mortgages/promissory notes. A pre-payment penalty means the lender can charge you a fee if you pay off your mortgage early. Balloon Mortgage: A mortgage with monthly payments often based on a 30 year amortization schedule, with the unpaid balance (i.e. the Balloon Payment) being due in a lump sum payment at the end of a specific period of time (usually 5 or 7 years). The mortgage may contain an option to “reset” the interest rate to the current market rate and to extend the due date if certain conditions are met. Payment Calculation: Sets the time period over which the loan is being calculated. Some loans have have ARMS (not like an octopus although it can feel like it). An adjustable rate mortgage (ARM) offers a fixed rate for an initial period, typically 3,5,7, or 10 years, and then adjusts every six months, annually, or at another specified period, for the remainder of the term. The one shown in this example is a Fixed Rate Loan over 30 years. Principal: Is the amount you are borrowing (excluding interest).

Interest: Is the amount your lender is charging you for borrowing their money. Estimated Escrow: Additional charges the Lender will be charging, such as property taxes and homeowners' insurance, that are bundled in your monthly payment, and which they hold and pay-on your behalf in order to secure themselves that these costs are actually being paid. Estimated Total Monthly Payment: The total payment you will make each month, including mortgage insurance and escrow, if applicable. Estimated Taxes, Insurance & Assessments: This box tries to give a realistic assessment of what the taxes, insurance and assessments will cost every month. This box is confusing because the Estimated Escrow above is included in this amount. BUT, if under the "IN ESCROW?" column it says "NO" then this means that there is an additional charge above the monthly Escrowed payment ($326.22 above) each month that you will need to pay separately. Closing Costs: Upfront costs you will be charged to get your loan and transfer ownership of the property. Cash to Close: Total amount you will have to pay at closing, in addition to any money you have already paid. Closing Disclosure: There are two Closing Disclosures when purchasing/selling a property. One is signed by the Buyer (5 pages) and one is signed by the Seller (2 pages). This is one is for the Seller. Borrower: Name of the Buyer of the property. The term Borrower is used when the Buyer is borrowing money to purchase the property. Loan Term: Sets the time period over which the loan is being calculated. Some loans have have ARMS (not like an octopus although it can feel like it). An adjustable rate mortgage (ARM) offers a fixed rate for an initial period, typically 3,5,7, or 10 years, and then adjusts every six months, annually, or at another specified period, for the remainder of the term. The one shown in this example is a Fixed Rate Loan over 30 years. Closing Date: Date usually set in the contract as to when ownership of the property will be transferred. The deed and all other required documents are signed, lender funds to disburse, and money is transferred by us as your title company. Seller: Name of the Sellers of the Property. Settlement Agent: This identifies us as the one who is doing your closing. Property: Address of property being purchased. Lender: Name of Lender (usually a bank) loaning the money to the Buyer/Borrower in order to purchase the property. Sales Price: Purchase price of the property. Loan Amount: Amount borrowed from the lender, excluding interest. Interest: The cost you pay the Lender to borrow their money usually expressed as a percentage (%) of the Loan Amount borrowed. Monthly Principal & Interest: Principal (the amount you will borrow) and interest (the lender's charge for lending you money) usually make up the main components of your monthly mortgage payment. Your total monthly payment will typically be more than this amount due to taxes and insurance. See the Estimated Total Monthly Payment. Pre-payment Penalty: A feature on some mortgages/promissory notes. A pre-payment penalty means the lender can charge you a fee if you pay off your mortgage early. Balloon Mortgage: A mortgage with monthly payments often based on a 30 year amortization schedule, with the unpaid balance (i.e. the Balloon Payment) being due in a lump sum payment at the end of a specific period of time (usually 5 or 7 years). The mortgage may contain an option to “reset” the interest rate to the current market rate and to extend the due date if certain conditions are met. Payment Calculation: Sets the time period over which the loan is being calculated. Some loans have have ARMS (not like an octopus although it can feel like it). An adjustable rate mortgage (ARM) offers a fixed rate for an initial period, typically 3,5,7, or 10 years, and then adjusts every six months, annually, or at another specified period, for the remainder of the term. The one shown in this example is a Fixed Rate Loan over 30 years. Principal: Is the amount you are borrowing (excluding interest).

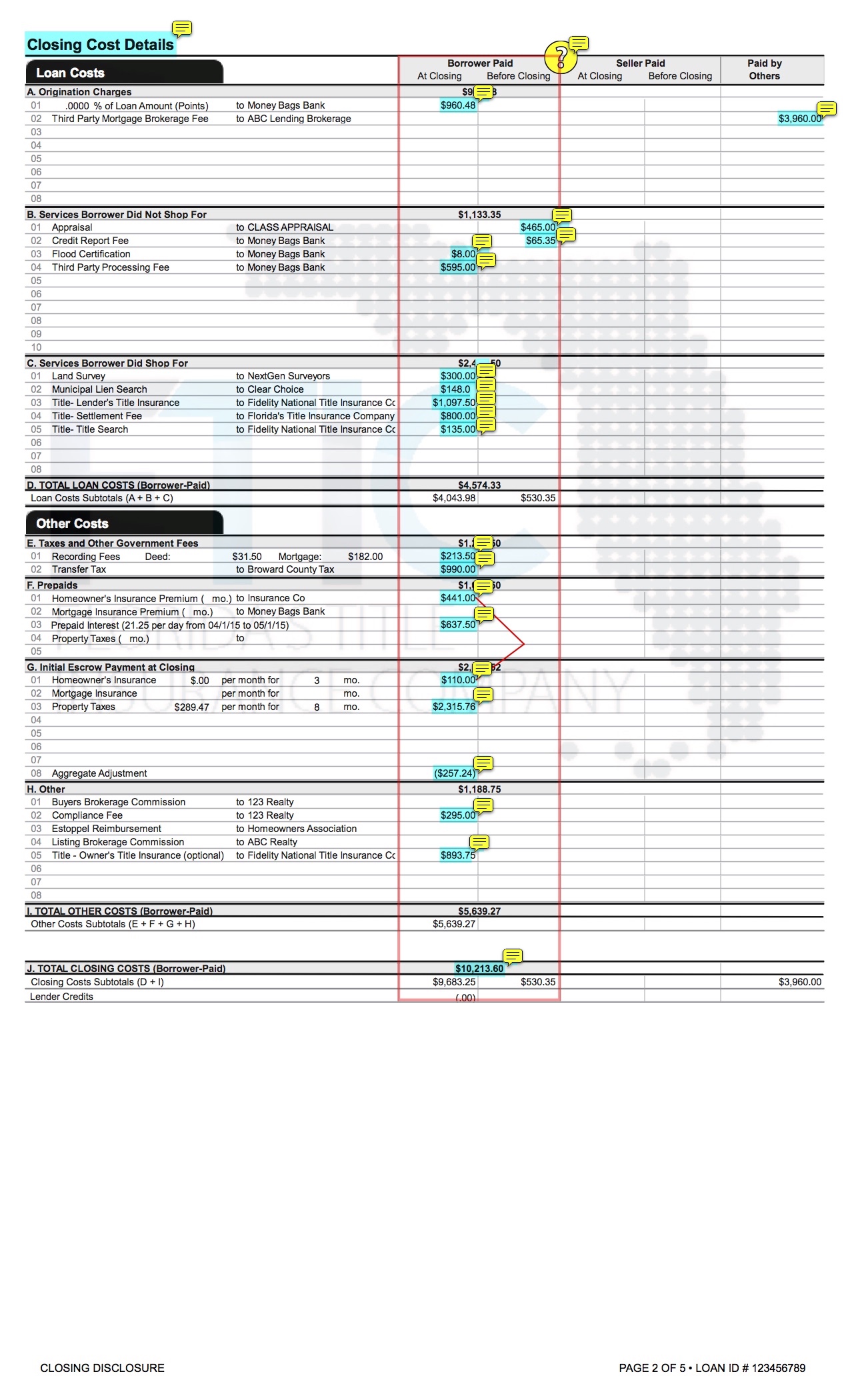

Interest: Is the amount your lender is charging you for borrowing their money. Estimated Escrow: Additional charges the Lender will be charging, such as property taxes and homeowners' insurance, that are bundled in your monthly payment, and which they hold and pay-on your behalf in order to secure themselves that these costs are actually being paid. Estimated Total Monthly Payment: The total payment you will make each month, including mortgage insurance and escrow, if applicable. Estimated Taxes, Insurance & Assessments: This box tries to give a realistic assessment of what the taxes, insurance and assessments will cost every month. This box is confusing because the Estimated Escrow above is included in this amount. BUT, if under the "IN ESCROW?" column it says "NO" then this means that there is an additional charge above the monthly Escrowed payment ($326.22 above) each month that you will need to pay separately. Closing Costs: Upfront costs you will be charged to get your loan and transfer ownership of the property. Cash to Close: Total amount you will have to pay at closing, in addition to any money you have already paid. Closing Cost Details: This page itemizes closing costs into three (3) columns:

(1) Borrower's Closing Costs;

(2) Seller's Closing Costs; and

(3) Costs paid by others (Lender, realtor, etc...) Borrower Paid column: This column lists the costs being charged to you the Buyer/Borrower. Origination fee: Up front charges by the lender for issuing you the loan. Some lenders charge a % of the loan amount some charge a flat fee. Mortgage Broker Fee: Amount being paid to Buyer/Borrower's Mortgage Broker for finding Buyer/ Borrower a lender. Because this fee is in the "Paid by Others" Column the mortgage broker fee is being paid by the Lender. Appraisal: As a condition to lending money, the lender first requires an analysis from an appraiser giving an estimate of the value of the property based on comparable properties. Credit Report: As a condition to lending money, the lender first requires information from credit bureaus to examine your use of credit, payment histories, defaults, and amount of debt. Flood Certificate: Usually provided with the survey, and identifies whether the property is located in a designated flood zone. If the property is in a flood zone, then the Flood insurance will likely be required by the lender. 3rd Party Processing Fee: fee paid to person assisting mortgage broker assemble loan documents and process the loan. Survey: Two dimensional (2-D) drawing showing the property's precise measurement, dimensions, and boundaries. Municipal lien search: A report that shows open and expired building permits that have not been closed, outstanding property taxes, municipal lien/assessments that have been imposed, utility department balances, code enforcement violations and liens that have been imposed. Lender’s Title Insurance Policy: Prior to bank lending Buyer/Borrower money to buy that property they want to make sure whomever sells you the property actually owns the property, that there aren’t any superior claims, outstanding judgments, liens, or other title defects that could cause the property to be ripped away. So as a condition of giving you that loan, Lenders will require a Lender’s Title Insurance Policy to protect themselves. Settlement Fee: Fee paid to FTIC for escrowing and performing the closing. Title Search: FTIC scours all available public records for prior ownership making sure the title has passed correctly to each new owner, liens, utility assessments, taxes, judgments, mortgages, HELOCs, and anything else recorded about the property that may affect the new buyer’s superior and exclusive ownership of the property. The title search will reveal problems that might arise so they may be dealt with immediately, title defects cured, and the title cleared and cleaned before you purchase ** Recording Fee (Buyer Expense) $10.00 for the First (1st) Page plus $8.50 for each additional page, plus $4.50 electronic submission fee. See, Fla. Stat. §28.24(12)(a,b,d,e), §24.222(3)(a). Made up of two taxes:

***Intangible tax (Buyer Expense) of $0.002 per one dollar $1.00 of notes secured by a mortgage. [$180,000.00 x $0.002 $360.00 Intangible Tax. See, Fla. Stat. §199.133.

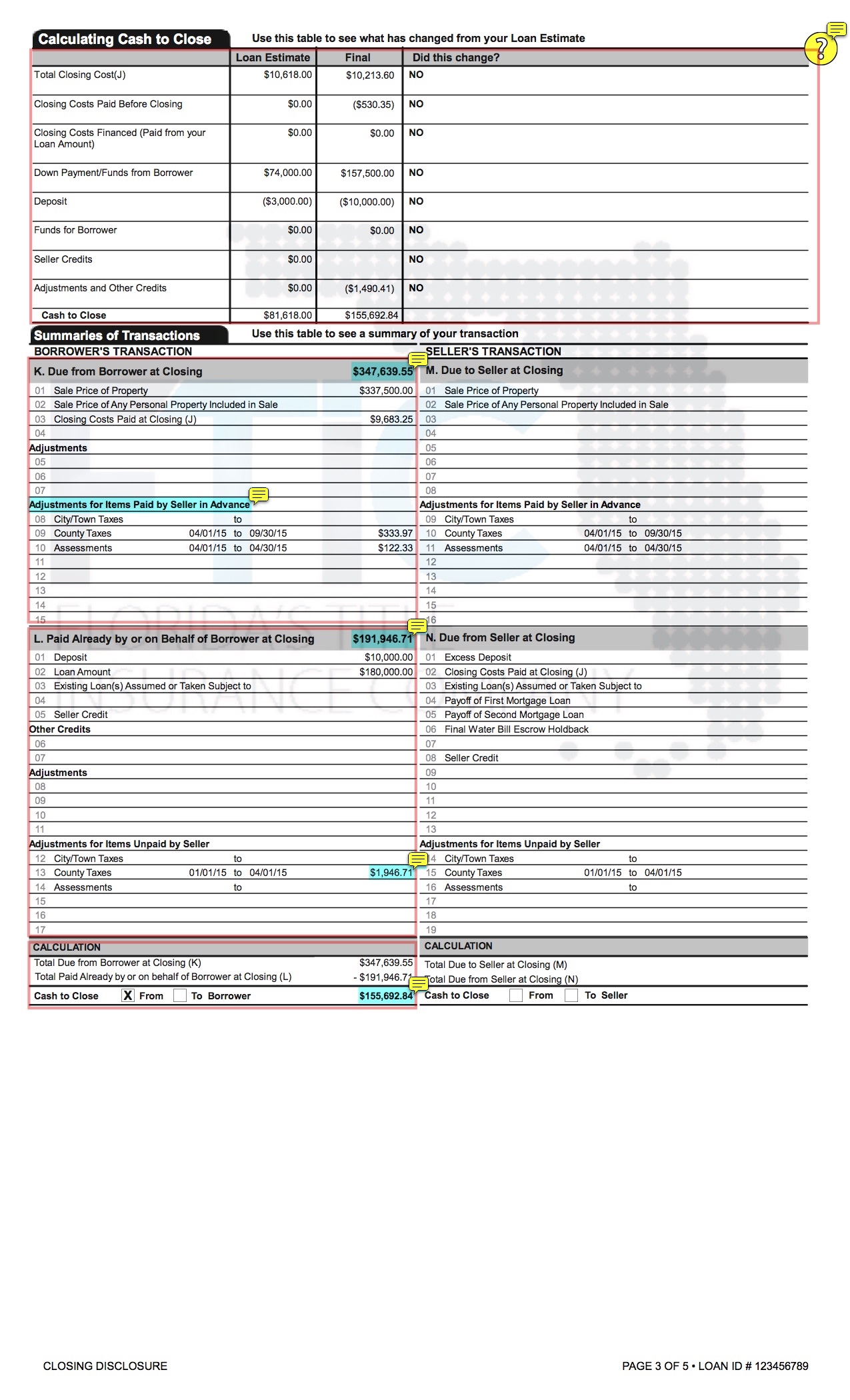

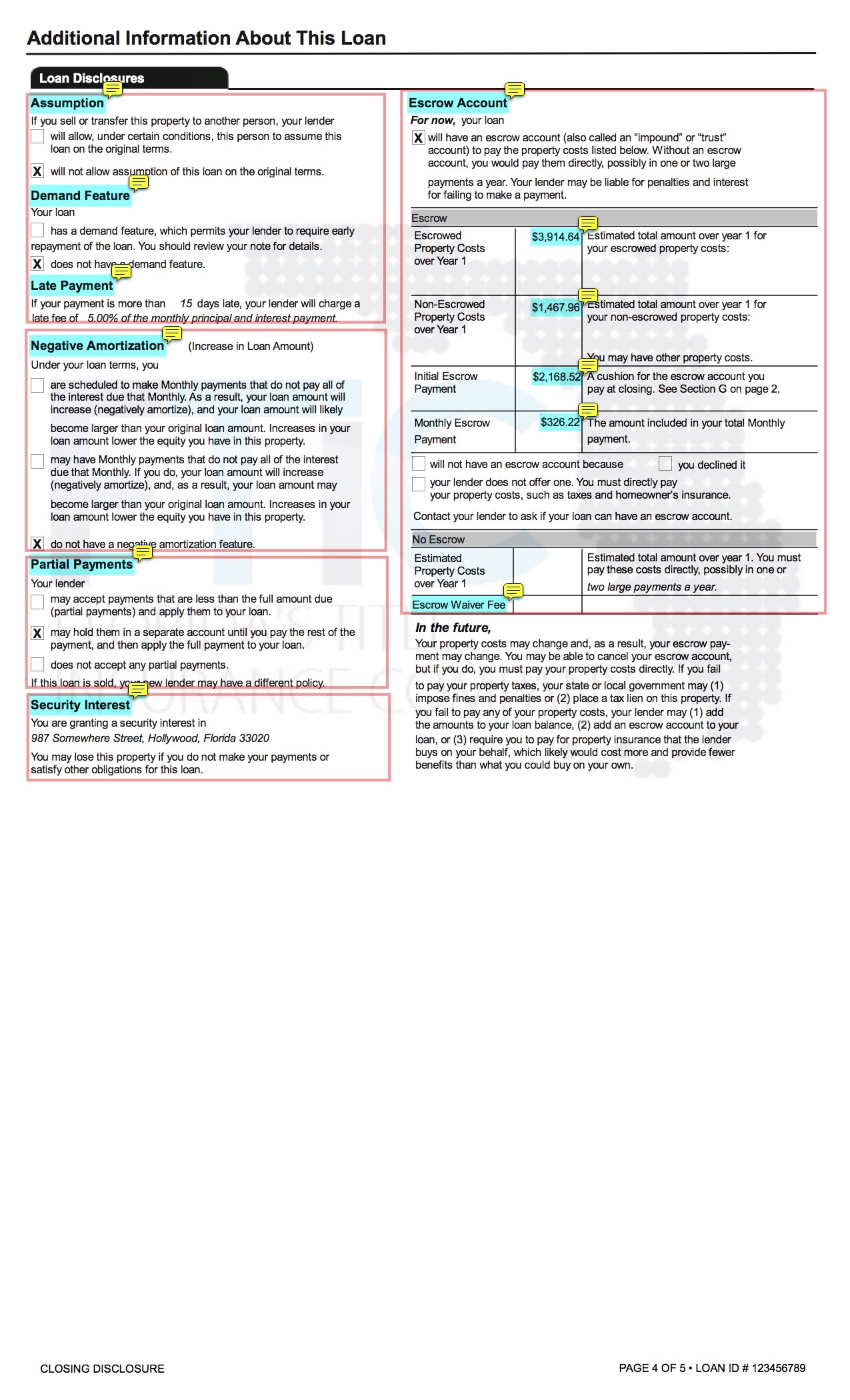

**** Documentary stamp tax on Mortgages (Buyer Expense), are taxed based on the full amount of the indebtedness regardless of whether it is contingent or absolute, at the rate of tax is $0.35 cents per $100 or portion thereof. There is no cap on the amount of tax due [1800x$0.35 cents = $630 Documentary Stamp Tax]. See, Fla. Stat. §201.08(1)(b). Homeowner's Insurance: As a condition of issuing the loan Lender required Buyer/Borrower to pre-pay an entire years homeowner's insurance in advance. Interest: As a condition of issuing the loan Lender required Buyer/Borrower to pre-pay the first month's interest on the $180,000.00 loan. Homeowner's Insurance: As a condition to issuing the loan Lender required Buyer/Borrower to pre-pay 3 months of homeowner's insurance in advance to Lender, and which Lender will hold in escrow. Property taxes: As a condition to issuing the loan Lender required Buyer/Borrower to pre-pay the estimated property taxes for the remainder of the year and which will be held in escrow by the Lender. Aggregate Adjustment: is a calculation to prevent lenders collecting more money for your escrow account than allowed under the Real Estate Settlement Procedures Act (RESPA). Under RESPA, lenders can’t keep more than one sixth (1/6) of your annual property tax and insurance payment amount in your escrow account at any one time and will credit money to prevent your escrow account from holding more funds than allowed. Fee Buyer/Borrower agreed to pay to its realtor. Owner’s Title Insurance Policy: Covers the buyer both legally and financially and insures you will not be liable for any title flaw that arose from the property’s history before you purchased it. The Owner’s Title Insurance Policy will stay in effect as long as you or your heirs own the property. FTIC will be there to pay valid claims and cover the costs of defending any attack on your title, now or in the future. Total Closing Costs: It is the total upfront expenses associated with both: (1) Processing and issuing your loan and (2) processing this real estate transaction in order to close. This is different from the actual amount of money you have to pay for the Property itself. Calculating Cash to close: Allows you to compare what the Lender originally provided in its Loan Estimate, versus the amount you are actually spending. Due from Borrower at Closing: Total amount charged to you at closing. It includes your house price + closing costs. (It does not include any credits or rebates that lower your closing costs if any which would be in Section L below). Adjustments for Items Paid by Seller in Advance: Costs that have been prepaid by the seller that you are now reimbursing the seller for. Paid Already by or on Behalf of Borrower at Closing: This section details how you will pay for the items in Section K. It includes the amount you are borrowing, the amount of your deposit, and any rebates or credits paid by the seller or third-party service providers. It does not include the amount you have to bring to closing—that’s below in “Cash to Close.” There are 2 categories of County Taxes: These are AD-valorem taxes (i.e. latin term meaning 'according to worth.' This is often referred to as “property taxes,” are taxes levied on the assessed value of the property). ** These fees are fixed for the time period of 01/01/year-12/31/year but are not billed by the county until 11/01/year. Because this amount will not be billed until November (i.e. after the property has already been sold to Buyer), FTIC reviews the prior year's taxes and pro-rates the taxes being charged so that Seller pays for the period (01/01-04/01) that Seller still owned the property. This amount is then credited (+) to the Buyer and deducted from the Seller and will be seen as a debit (-) on Seller's Closing Disclosure. Cash to Close: Assuming the lender has funded the loan, this is the remaining balance you will personally have to pay out-of-pocket at closing to purchase the property. You will typically need to pay this amount via wire transfer. Assumption/Transfer: Most mortgages provide that if you transfer the property without paying off the mortgage it will cause the mortgage to go into immediate default. Escrow Account: An account that the Lender establishes on behalf of a borrower to pay taxes, insurance premiums, or other charges when they are due.

Many homeowners pay their property taxes and homeowner’s insurance as part of their monthly payment. This arrangement is called an "escrow account."

This section tells you: whether you have an escrow account, what expenses are included in the escrow account, and the amounts. For example, homeowner’s association fees are often not included in the escrow account.

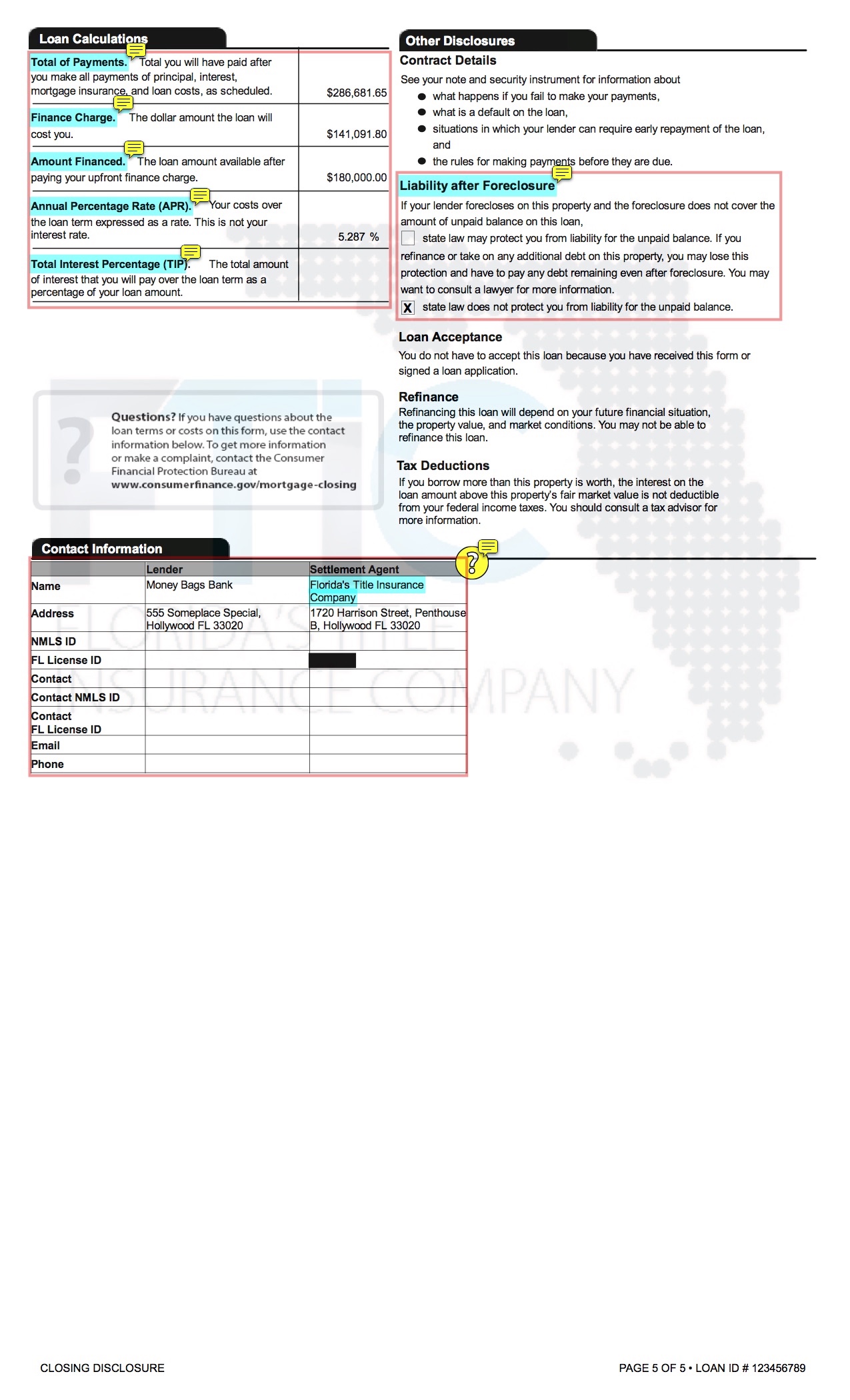

If your Closing Disclosure shows that you don’t have an escrow account, but you would prefer to pay your property taxes and homeowner’s insurance monthly instead of in one large lump sum, talk to the lender. Demand: States whether the lender can call the loan at any time it wants to and before the maturity date. Escrow payment x 12 months Late Payment: Most loans have a grace period found within the promossory note (e.g. 5,10,15 days) if the payment is not paid on time; and if paid after that grace period then a hefty late fees will be assessed and the lender may report your payment history to the credit bureaus. Although under ESCROW ACCOUNT box these are amounts that are NOT being escrowed. Let's you know some of your expected property costs each year which are not being escrowed. In this case it is the HOA fees. Deferred Interest Loan: A deferred interest loan, also known as a negative amortization loan, is a loan that lets you pay less than the entire interest owed for that month. The unpaid interest is then added to your loan amount to be paid off later, increasing the overall loan amount. Total of the numbers in ¶G Escrow payment x 1 month (also shown on page 1) Partial Payment: Explains how your lender will treat receipt of partial payments. Some accept them and apply it to reduce the loan amount, some do not accept partial payments, and some will just hold it and not apply the partial payment. Escrow Waiver Fee: Some Lenders charge an escrow waiver fee if you choose not to set up an escrow account to pay homeowner's insurance and property taxes but instead choose to pay these fees yourself directly. If you do not see an escrow account being set up by the Lender then check to see whether your Lender is charging you an escrow waiver fee. Security Interest: Identifies the property upon which the lender will place a mortgage so that if payments are not made, that property may be sold in a foreclosure and forced sale. Total of Payments: The total amount of money you will pay over the life of your loan, if you make all payments as scheduled. Finance Charge: (Loan Amount) x (Interest Rate) x (Years) will equal the total amount of interest that will be paid on the amount borrowed if it is not paid off before the maturity date, and all payments are made as scheduled. Amount Financed: Amount of your loan. Foreclosure: If the loan is not paid when due then (1) the property may be foreclosed upon and sold against your will, and if there are insufficient funds to pay off the loan after the property is sold then, (2) the lender may also continue to sue you personally for the balance owed (i.e. called a "deficiency") APR: The annual percentage rate (APR) shows the true cost of the loan on a yearly basis and is expressed as a percentage. The APR gives you more information about the actual cost of the loan, reflecting not only the interest rate but also any points, mortgage broker fees, and other charges that you pay to get the loan and for that reason is usually higher than your interest rate.

In comparison, the Interest Rate tells you how much interest you’ll pay based on your principal loan amount, it does not reflect fees or any other charges you may have to pay for the loan. Total Interest Percentage (TIP): This number helps you understand how much interest you will pay over the life of the loan and lets you make comparisons between loans. Contact information for: (1) Buyer/Borrower's lender and (2) us as your title insurance company.

* For Reverse Mortgages:You won’t receive a Loan Estimate or Closing Disclosure but instead will receive a Good Faith Estimate (GFE), an initial Truth-in-Lending Disclosure, and HUD-1 Settlement Statement.

** For a Home Equity Line of Credit (HELOC), manufactured housing loan not secured by real estate, or a loan through certain types of homebuyer assistance programs, you will not receive a GFE nor a Loan Estimate, but should receive a Truth-In-Lending Disclosure.