History behind the Lady Bird Deed – Myth Busted. “When you have a choice of printing the truth or the legend—print the legend.”[1]

Many still believe the origin of the “Lady Bird Deed” came from an ingeniously drafted deed first used by President Lyndon B. Johnson’s lawyers which allowed the President to retain full ownership and control of his real estate while alive, but triggered a transfer on death (n/k/a T.O.D.) clause to automatically pass real estate upon Lyndon B. Johnson’s death instantaneously to: (1) his wife “Lady Bird” Johnson, and then (2) upon her death to their children, without the delays or expense of a will, trust, court proceeding, or probate.

Wives of presidents are referred to as “The First Lady,” so is that where the term “Lady Bird Deed” came from? Nope. Claudia Alta “Lady Bird” Johnson was nicknamed at six (6) years old by her nanny, because she was said to be, “as pretty as a lady bird.”[2] So the famous “Lady Bird Deed” got its name from a six-year old’s nanny? Nope again.

A hunt for the original Lady Bird Deed revealed that neither the supervisory archivist, nor deputy director of The Lyndon B. Johnson Library, ever heard of a Lady Bird Deed. Moreover, the librarians’ follow-up with both the surviving members of the Johnson family, and more importantly the financial administrators of Mrs. Lady Bird Johnson’s estate, also dead-ended, as no one ever heard of a Lady Bird Deed.[3]

Comically, “the first Lady Bird deed was drafted by Florida attorney Jerome Ira Solkoff around 1982, nearly ten years after the death of President Johnson. In his elder law book and lecture materials, Solkoff used a fictitious cast of characters with the names Lyndon (husband), Lady Bird (wife), Lucie (daughter), and Lynda (daughter) in examples explaining the usefulness of this new type of deed. So as the-story-goes the nickname Lady Bird became associated with the deed.”[4] Jerome Ira Solkoff, Esq. reconfirmed the story.[5]

Today Lady Bird Deeds, which are more formally called enhanced life estates, are commonly used in Florida and throughout the United States. Nineteen (19) other states codified its use by adopting the Uniform Real Property Transfer on Death (TOD) Act and today there are talks in the Florida Bar’s RPPTL section (Real Property Probate and Trust Section) about possibly doing the same.

I. What is a Lady Bird Deed (a/k/a Enhanced Life Estate)? When property is owned, it is usually owned as fee simple absolute, meaning the grantee (i.e. recipient) receives 100% ownership and control of the property. But if an owner wanted to maintain ownership of their property for their entire life and leave it to their spouse and descendants without the need of a will, trust, or probate then the use of Life Estates is a great alternative.

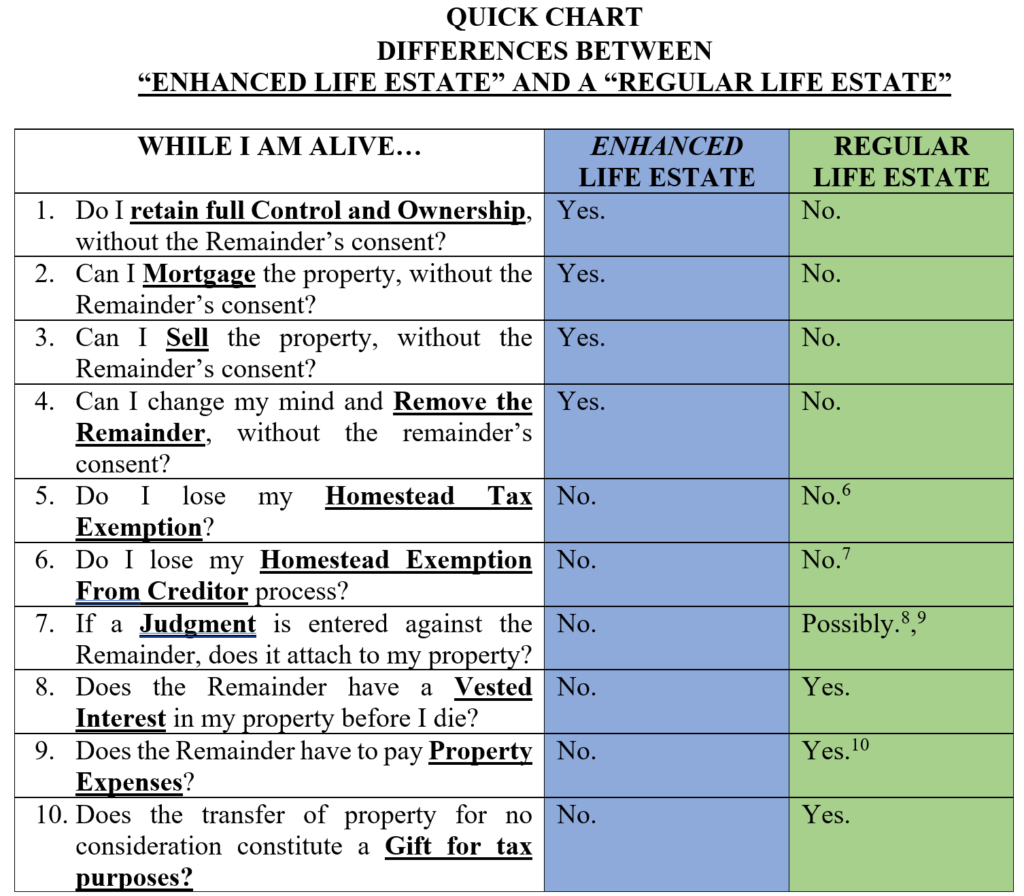

II. Advantages of Enhanced Life Estate. Using a Lady Bird Deed, you can grant yourself an enhanced life estate interest in your own property and simultaneously grant your beneficiaries, called remaindermen, the real property upon your death. A life estate obtained through a Lady Bird Deed is called an enhanced life estate. The life estate is said to be enhanced because during the enhanced life estate holder’s lifetime they have all the characteristics of full ownership without the burdens that come with a regular life estate.

Under an enhanced life estate, during the owner’s lifetime, the beneficiaries have no interest in the land, because the owner retains full power to remove the beneficiary, until the owner dies. Because no property interest vests in the beneficiary until the transferor’s death, the transferor retains complete control to amend, modify, or revoke the beneficiary’s designation during the transferor’s lifetime. Stated another way, the Lady Bird Deed does not transfer a current interest in the property to the beneficiary. Generally, all that is required to remove a remaindermen is the filing of a revocation of the lady bird deed prior to the grantor owner’s death. Because no property interest passes to the beneficiary until the death of the transferor, such revocation does not require the named beneficiary, or beneficiaries, to join. If a transferor wishes to modify the beneficiaries to a particular piece of real property, the transferor can simply execute and record a subsequent deed, which will supersede the previous transfer and become the effective deed.[11] Moreover, unlike a regular life estate, an enhanced life estate holder can still mortgage, encumber, sell, transfer, or modify, the real property without the remaindermen’s consent.

III. Example of Enhanced Life Estate. The example that made the Lady Bird Deed famous is:

Lyndon and Lady Bird, his wife, grantors, to Lyndon and Lady Bird, his wife, grantees, a life estate, without any liability for waste, with full power and authority in them to sell, convey, mortgage, lease and otherwise dispose of the property described below in fee simple, with or without consideration and without joinder by the remaindermen, and to keep absolutely any and all proceeds derived therefrom. Further, the grantors reserve the right to change remaindermen at any time without consent of remaindermen. Upon death of the life tenants, title shall be in Lucy and Lynda, joint tenants with rights of survivorship.[12]

IV. Regular Life Estates distinguished. The key advantages of the enhanced life estate is its combination of retained control for the transferor, simplicity, and revocability.Regular life estates however are irrevocable. When a regular life estate holder identifies the remaindermen in the deed, the remaindermen receive an immediate vested right in the real estate, regardless of when the regular life estate holder dies. Therefore, there is no removing the remaindermen without the remaindermen’s consent. Moreover, if a regular life estate holder wanted to mortgage, encumber, sell, or affect the real property to the detriment of the remainderman, they could not unless the regular life estate holder obtained the remainderman’s prior permission. An ordinary life tenant had no right to cut the timber for commercial purposes without the remaindermen’s consent.[13] Furthermore, because remaindermen receive an immediate vested interest, the remainderman’s interest in the real estate is subject to collection from creditors. A regular life estate holder cannot neglect the property allowing it to fall into disrepair or commit waste or fail to pay taxes and if it does then the remainder can have a receiver appointed over the property.[14] The remainder (future) interest holder must approve any improvements to the property, and has the right to inspect the property for waste or damage.[15]

In Florida, a tenant for life or a person vested with an ordinary life estate [i.e. not an enhanced life estate] is entitled to the use and enjoyment of his estate during its existence. The only restriction on the life tenant’s use and enjoyment is that he not permanently diminish or change the value of the future estate of the remainderman. This limitation places on the `ordinary life tenant’ the responsibility for all waste of whatever character. It is well settled that life tenants are bound in law to pay property taxes during their continuance of their estate. Failure to pay taxes constitutes waste. Therefore, it follows that the wife [ordinary life estate holder] would have the responsibility to pay all ordinary and necessary expenses that inure to a homeowner, including taxes, insurance, homeowner’s association fees, and general repairs for the upkeep and maintenance of the property, and not to dissipate or cause waste to the [remaindermen’s future] property.[16]

V. How long does a life estate last? Sounds silly I know, Typically, the owner of the life estate (called a life tenant) owns the property during their own lifetime and upon the death of the life tenant the remaindermen then become the new owner. However, a life estate may be measured by the life of another, which is called a life estate per autre vie – French “for the life of another.”

VI. Medicaid planning. Medical assistance (Medicaid) is a program funded jointly by the states and the federal government. It provides health coverage to pay for hospital stays, doctor bills, prescription drugs, and other health costs. In Florida, the Agency for Health Care Administration is responsible for Medicaid. To apply for Medicaid in Florida, an individual must provide a detailed list of all their assets to Florida’s Department of Children and Family Services or the Social Security Administration.

The Lady Bird Deed transfer has no effect on Medicaid eligibility.[17]

Furthermore, if you become a Medicaid recipient, then a Lady Bird Deed can be useful in avoiding Medicaid bills, by reducing or even eliminating the amount your estate would need to pay back to Medicaid. After a Medicaid recipient dies, Medicaid can seek repayment “Upon filing of a statement of claim in the probate proceeding” against the decedent’s estate.[18]

First, Medicaid only seeks reimbursement from assets within the probate estate. Real estate held as an enhanced life estate, will not be included in a probate estate, because it automatically transfers to the beneficiary (i.e. the remaindermen) upon death. So that property would not be included in the probate estate. Therefore, using a Lady Bird deed can allow heirs to inherit a property that might otherwise have been sold to pay a Medicaid reimbursement claim.

Secondly, a Florida Medicaid recipient’s homestead is exempt from Medicaid reimbursement.[19] Homesteaded property is disregarded.[20] So what we are really talking about trying to protect is non-homestead real estate in Florida (such as rental, vacation homes, or investment property) which may be subject to Medicaid repayment.

By keeping non-homesteaded real estate in a Lady Bird Deed, the property never becomes part of the deceased’s probate estate. The State will not be able to make a claim against any property with a valid Lady Bird Deed, because the property does not become part of the decedent’s estate. Instead, the property automatically transfers into the ownership of the beneficiary/remaindermen listed on the Lady Bird Deed.

DISCLAIMER: Topics discussed are general concepts, not intended to constitute legal advice, accuracy, nor completeness, and may not be relied upon as such; consult an attorney or accountant. The author is neither an attorney nor an accountant. FTIC is a national award winning title insurance company known for its white glove customer service and “No Junk Fee Guarantee.” ®

[1] 1962 John Ford film, “The Man Who Shot Liberty Valance” starring John Wayne and James Stewart.

[2] Obituary: Lady Bird Johnson BBC Online. July 12, 2007

[3] Kary C. Fran, The Search for the Lady Bird Deed 34 Mich. Prob. & Test. Plan. J. (Summer 2015).

[4] Gerry W. Beyer & Kerri M. Griffin, Lady Bird Deeds: A Primer for the Texas Practitioner, Estate Planning Developments For Texas Professionals, (Jan. 2011)

[5] Id. citing, 14 Fla. Prac., Elder Law § 9:53 “Lady Bird” life estate deeds—Life estate deed to convey future title to heirs (2014-15 ed.)

[6] Fla. Stat. §196.041(2) – Extent of homestead exemptions.— “A person who otherwise qualifies by the required residence for the homestead tax exemption provided in s. 196.031 shall be entitled to such exemption where the person’s possessory right in such real property is based upon an instrument granting to him or her a beneficial interest for life, such interest being hereby declared to be “equitable title to real estate….”

[7] “The homestead “ownership” requirement under the Florida Constitution does not restrict the type of property ownership; therefore, a life tenant can qualify for the homestead creditor exemption with his or her life estate. The Florida Supreme Court in Aetna Ins. Co. v. Lagasse, 223 So. 2d 727 (Fla. 1969), held that remainder interests, including vested remainders, were not able to qualify for the homestead creditor exemption, even if he or she lived on the property, because there was no ‘present right to possession.’ Thus, a life tenant can qualify for the homestead creditor exemption with a life estate, but the Florida Supreme Court has determined that a remainderman cannot qualify with a remainder interest.” See, Joseph M. Percopo, Esq., The Impact Of Co-Ownership On Florida Homestead, Vol. 86, No. 5 Pg. 32 (Florida Bar Journal May 2012).

[8] It is possible for a life estate holder to disclaim or renunciate a gift of the interest given. See, Weinstein v. Mackey, 408 So.2d 849 (Fla. 3d DCA 1982) (regarding renunciation of a life estate by a beneficiary); Richey v. Hurst, 798 So.2d 841 (Fla. 5th DCA 2001) (surviving spouse is given a life estate created under a trust and later disclaims that life estate even after the life estate has commenced); Kearley v. Crawford, 112 Fla. 43, 151 So. 2d 293 (Fla. 1933) (creditor unable to collect on judgment to force the sale of land left to son, when before judgment was rendered against him, debtor/son renounced his devise under a will, as well as his rights as an heir at law. “[E]lection to take under or against a will is a personal right of the legatee or devisee, and that it is one that cannot be controlled by his creditors”); Robert C. Meyer, Esq. Disclaimer Statute May Permit Judgment Debtors To Deliver Money To Friends Or Family With Nothing To Creditors, But Not Always In Florida Vol. 79, No. 4 Pg. 42 (Florida Bar Journal April 2005); Florida Statute §689.21 Disclaimer of interests in property passing under certain nontestamentary instruments or under certain powers of appointment.

[9] “When the life tenant qualifies for the homestead creditor exemption, the property is still protected from the life tenant’s creditors, but it is not safe from the remainderman’s creditors. For example, if Donna takes a life estate in blackacre while qualifying for the homestead creditor exemption and grants Ed and Frank equal remainder interests, Ed and Frank’s creditors can potentially take their remainder interests in blackacre. However, even if Ed or Frank’s creditors took their interest, there is little they could do with it until Donna died. Co-owners who share interests in time (life tenants and remainderman), unlike co-owners who share present interests, may not partition life estates. Therefore, a life tenant, such as Donna, could continue to reside on the property without worrying about the remaindermans’ creditors being able to force sale of the property. However, it is important to note that recently, two Florida bankruptcy cases held that a person with a vested remainder who lived on and made the property his or her residence could qualify for the homestead creditor exemption.”See, Joseph M. Percopo, Esq., The Impact Of Co-Ownership On Florida Homestead, Vol. 86, No. 5 Pg. 32 (Florida Bar Journal May 2012).

[10] Florida Statute §738.801 Apportionment of expenses; improvements.—

(1) For purposes of this section, the term:

(a) “Remainderman” means the holder of the remainder interests after the expiration of a tenant’s estate in property.

(b) “Tenant” means the holder of an estate for life or term of years in real property or personal property, or both.

(2) If a trust has not been created, expenses shall be apportioned between the tenant and remainderman as follows:

(a) The following expenses are allocated to and shall be paid by the tenant:

- All ordinary expenses incurred in connection with the administration, management, or preservation of the property, including interest, ordinary repairs, regularly recurring taxes assessed against the property, and expenses of a proceeding or other matter that concerns primarily the tenant’s estate or use of the property.

- . Recurring premiums on insurance covering the loss of the property or the loss of income from or use of the property.

- Any of the expenses described in subparagraph (b)3. which are attributable to the use of the property by the tenant.

(b) The following expenses are allocated to and shall be paid by the remainderman:

- Payments on the principal of a debt secured by the property, except to the extent the debt is for expenses allocated to the tenant.

- Expenses of a proceeding or other matter that concerns primarily the title to the property, other than title to the tenant’s estate.

- Except as provided in subparagraph (a)3., expenses related to environmental matters, including reclamation, assessing environmental conditions, remedying and removing environmental contamination, monitoring remedial activities and the release of substances, preventing future releases of substances, collecting amounts from persons liable or potentially liable for the costs of such activities, penalties imposed under environmental laws or regulations and other payments made to comply with those laws or regulations, statutory or common law claims by third parties, and defending claims based on environmental matters.

- Extraordinary repairs.

(c) If the tenant or remainderman incurred an expense for the benefit of his or her own estate without consent or agreement of the other, he or she must pay such expense in full.

(d) Except as provided in paragraph (c), the cost of, or special taxes or assessments for, an improvement representing an addition of value to property forming part of the principal shall be paid by the tenant if the improvement is not reasonably expected to outlast the estate of the tenant. In all other cases, only a part shall be paid by the tenant while the remainder shall be paid by the remainderman. The part payable by the tenant is ascertainable by taking that percentage of the total that is found by dividing the present value of the tenant’s estate by the present value of an estate of the same form as that of the tenant, except that it is limited for a period corresponding to the reasonably expected duration of the improvement. The computation of present values of the estates shall be made by using the rate defined in 26 U.S.C. s. 7520, then in effect and, in the case of an estate for life, the official mortality tables then in effect under 26 U.S.C. s. 7520. Other evidence of duration or expectancy may not be considered.

(3) This section does not apply to the extent it is inconsistent with the instrument creating the estates, the agreement of the parties, or the specific direction of the taxing or other statutes.

(4) The common law applicable to tenants and remaindermen supplements this section, except as modified by this section or other laws.

[11] Stephanie Emrick, Transfer on Death Deeds: It Is Time to Establish the Rules of the Game, 70 Fla. L. Rev. 469 (2018).

[12] 14 Fla. Prac., Elder Law § 9:53 “Lady Bird” life estate deeds—Life estate deed to convey future title to heirs (2020-2021 ed.)

[13] See, Sauls v. Crosby, 258 So. 2d 326, 327 (Fla. 1st D.C.A. 1972)

[14] Chapman v. Chapman, 526 So. 2d 131, 135 (Fla. 3d D.C.A. 1988) “Upon the failure of the life tenant to pay the taxes, the remainderman is entitled to have a receiver appointed to collect the rents and apply them to discharge the tax indebtedness.”

[15] Joseph M. Percopo, Esq., The Impact Of Co-Ownership On Florida Homestead, Vol. 86, No. 5 Pg. 32 (Florida Bar Journal May 2012).

[16] Schneberger v. Schneberger, 979 So. 2d 981 (Fla. 4th D.C.A. 2008)

[17] 1640.0613.01 Property Transferred and Life Estate Retained (MSSI) “If an individual retains life estate using a lady bird deed or life estate with powers, no transfer has occurred. The individual retains full ownership powers in the property and it is only upon their death that the property transfers ownership to the remainderman.”

[18] Florida Statute §409.9101 Recovery for payments made on behalf of Medicaid-eligible persons.

[19] 1640.0305.03 Life Estate Ownership (MSSI, SFP) ““The owner of an enhanced life estate (also known as a lady bird deed or life estate with powers) has the same rights as complete ownership, including the right to sell without the consent of the remainderman. Lady bird deeds and life estates with powers are counted the same as other real property an individual may own and it may be excluded if it qualifies as the individual’s homestead, including under intent to return when absent from the home.”

[20] “Florida Statute §409.9101(7) “No debt under this section shall be enforced against any property that is determined to be exempt from the claims of creditors under the constitution or laws of this state.”

Fascinating and well done. Thank you for the history and detailed analysis.

The origins of the Lady Bird Deed are a real twist. The common misconception is it originated with Lyndon B. Johnson’s wife. Mind-Blown!

Thank you for recognizing my husband, Jerome Ira Solkoff, Esq for his creation of the Lady Bird Deed as stated in your article. Jerome passed away several years ago and our son, Scott Solkoff, Esq. carries on the tradition of practicing law and making great strides in “you do well by doing good” for the community in southern Florida and across the country.

What a special treat and thank you for the response. Your husband was a genius! You are a very lucky lady and I am happy to know that Scott is carrying on the legacy.

Great information Randy; Didn’t know the part of the Medicaid of which could be a major factor for some families in their consideration to the life estate option.

Great information on the Lady Bird Deed. I have always believed in this product but like most, I was misguided on its origin. Thanks for clearing it up.

What a nice article for me to read and very thorough. I have a fun story you may appreciate. I was once contacted by a Professor/Historian who had been combing through the Johnson archives after looking everywhere else for the deed. It was an archivist who pointed him in the right direction. Even though his search did not take him where he thought it would, he was delighted to have solved his mystery. Thank you for a great article. I always like to see my Dad’s work continuing on even after his death.

Great information on Lady Bird Deeds, had no idea about the history and this is a great comparison between life estates and enhanced life estates. Thanks for the good work!

Hi Randy,

Seriously, wow! Forgot how well you write and how deeply you inform. Great tips, as always.

Hi Randy,

I just arrived at this article through Google Search. This is one of the best articles on commenting. I enjoyed it a lot. Carry on writing such useful stuff.

Thank you and bye for now.

Jeeny Brown

Hi Randy,

Thank you for writing this! I love it so much!!!

Lots of good advice here! Thanks for sharing. All your hard work is much appreciated.

This is probably the best, most concise step-by-step guide I’ve ever seen. Look forward to your next article.

What a fantastic article. This is so chock of useful information I can’t wait to dig deep and start utilizing the resources you have given to me.

I’ve been working with Florida’s Title Insurance Company on a couple of RE closings. And I can say with strong confidence that they always make the process easy and smooth for my clients.

Hi Randy,

I like the way you’ve explained all advantages of a Lady Bird Deed. I’ve been an owner of several rental properties for years, and never knew that “non-homestead real estate in Florida (such as rental, vacation homes, or investment property) may be subject to Medicaid repayment”.

Thanks for the great job you do.

I just moved to Florida and trying to get my real estate license. Now I can explain and advice my clients who’s going to buy rental properties on deeds. And “Moreover, unlike a regular life estate, an enhanced life estate holder can still mortgage, encumber, sell, transfer, or modify, the real property without the remaindermen’s consent”.

That’s awesome! Thanks again.

Just wanted to drop a line and say that you are doing a wonderful job writing such informative articles.

Looking forward to seeing what you write next for your column.

Best,

Tony

I am very glad the author wrote this article. It is a well-written, needed, and useful summary of the Lady Bird Deed.

Very well explained.

I had no idea the origin of the Lady Bird deeds, but not anymore thanks to yoo!

Such an interesting story

I wanted to take the time to thank you for this amazing article “Giving the Bird. Lady-Bird Deeds”. I like your style of writing. You do your research on facts, and give examples how it works in practice.

Thank you for writing this! I love it so much!!!

Your introduction really grabbed my attention. I wanted to keep reading. I love it how you focused on the importance of giving a little bit of history, advantages and examples of the Lady Bird Deed.

Can the Lady Bird Deed be used for title on investment property?

Mind blowing article, thank you for taking the time to clarify.

Clear and concise, thanks for the explanation.

Very interesting and informative; thank you for the advise.

This article is full of advise as well as information. A must read.

What an interesting piece of history. Thank you for the clarification.

Great advise, thanks

Great clarification. Thanks for the piece of history too.

Great article!

Very intereting

Perfectly written article.

I did not know something like this existed.

Interesting information

Great article.

Well written!|

Great read

Fantastic read

Loved this article….great information.

A must read

Great article.

Clear and concise.

Very good article.

Excellent article

Great points

Very good explanation.

Good points and content

Very helpful information here.

Well said!

Great content

A must read!

Fantastic article, thank you!

Great article

Fantastic content

Great information and piece of history

Best article I have read in a long time.

This article is filled with good advise. Thank you.

What a pleasant read.

Great post

Thanks for sharing

Excellent article

Good points filled with great advise.

Fantastic post.

Great advise

Great article

Best article I have read in a long time.

This was a great read

Excellent read

Great article

Great content

What a pleasant read.

Well written article

Great read

Excellent read

Thank you for the wonderful article

Great article

Excellent article

Great read

Very informative.

Fantastic article

Very interesting article.

I really like reading your articles. Keep up the great work!

https://www.philadelphia.edu.jo/library/directors-message-library

I have read so many posts about the blogger lovers however this post is really a good piece of writing, keep it up

It is perfect time to make some plans for the future and it is time to be happy. I’ve read this post and if I could I desire to suggest you some interesting things or suggestions. Perhaps you could write next articles referring to this article. I want to read more things about it!